Trade War Fears Continue to Weigh Despite Recent Gains

US futures are back in negative territory ahead of the open on Wednesday, as stocks continue to fluctuate against the backdrop of a potential trade war.

The moves this morning have also been exacerbated by an escalation in tensions between the US and Russia, with Donald Trump claiming on Twitter that missiles are coming to Syria despite a warning they will be shot down. The threat is a response to the chemical weapons attack in Syria which the US claims was carried out by the Assad regime, which is backed by Russia and Iran.

While the latest round of threats are an indication of a further deterioration in the relationship between the US and Russia – as Trump claimed himself on Twitter in saying they’re the worst they’ve ever been – investors are taking it quite well. There has been a clear response but with futures off only 1%, it has been a relatively soft reaction.

Investors are also awaiting the release of the FOMC minutes from the March meeting, at which the central bank raised interest rates by 25 basis points a released new economic forecasts containing upward revisions to rate, inflation and growth forecasts. The change was largely attributable to tax reform which was passed at the end of 2017 but many expected the Fed to go further and forecast a fourth hike this year rather than next.

EUR/USD – Euro Edges Higher, Markets Eye US Inflation, Fed Minutes

US Inflation Seen Ticking Higher After PPI Beat

While it wasn’t far from doing so, traders will be curious about how likely that is to change in June, especially if inflationary pressures grow in the meantime, as we’re expecting from the CPI releases today. Yesterday’s PPI release showed an uptick in March to 3% which is expected to be reflected in today’s data, with CPI seen rising to 2.4% from 2.2% and core CPI to 2.1% from 1.8%, compared to a year ago.

While this may not be the Fed’s preferred measure of inflation, it is released a few weeks earlier and so gives us the earliest indication of price pressures in the previous month. Anything above expectations could lift expectations ahead of the June meeting and lift yields on US debt in the process. The 10-year continues to trade well below 3%, with the trade conflict with China being the latest development to weigh on it.

Syria Risks Offset Trade Truce

Safe Havens Sought in Risk Averse Trade

Aside from the safe haven flows that US Treasuries naturally attract, a full blown trade war would likely have negative implications for the country and therefore impact the pace at which the Fed can raise interest rates, which may explain why the yield on the 10-year is still struggling to break 3%.

With stock markets in Europe trading in the red and US futures on course to do the same, we’re seeing some typically risk averse trading on Wednesday. As is typically the case, this is favouring save havens such as Gold and the yen, with the former close to 1% higher and trading near the top end of its range this year. The yen is making gains against the dollar, euro and pound, with the latter having also been negatively impacted by the manufacturing and industrial production figures this morning, all of which were shy of expectations.

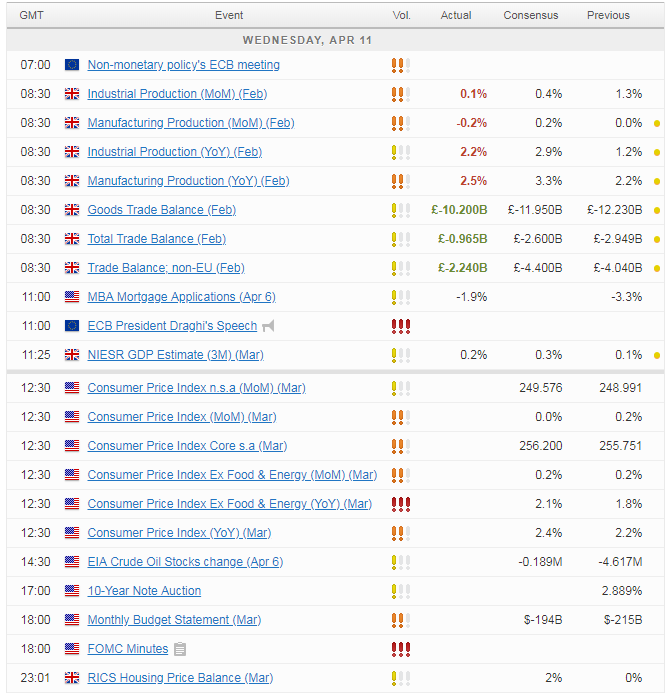

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.