Optimism Builds Ahead of Earnings Season

It’s been a strong start to the year for equity markets and that looks set to continue on Friday, with the Dow seen adding to its gains after flying through 25,000 on Thursday.

Any concerns about a post-tax reform pull-back in equity markets have quickly been quashed, with indices in the US posting decent gains in the first week of the year as investors anticipate another good earnings season. We’ve seen very good earnings growth from companies in the US and Europe in recent quarters and I think the optimism that we’re seeing at the start of the year is potentially being driven by expectations of a similarly positive fourth quarter.

U.S Dollar Seeks Guidance From NFP

Can US Jobs Report Offer Reprieve For Battered Greenback

That isn’t helping to lift the dollar which has sold off heavily over the last few weeks despite optimism over tax reform. It’s possible that the difference in fortune for the dollar and US stocks is partly a reflection of who investors believe stands to gain from the reforms and how significant an economic – and therefore inflationary – impact they’ll have.

Of course there are other factors at play including the impact that a flattening of the yield curve is having on interest rate expectations and the changing tightening prospects of other central banks. For the dollar’s fortunes to change I think we’ll need to see signs that inflation is heading towards target because what we’re seeing right now is Fed chat fatigue. We’ve been promised higher inflation and wage growth for some time and investors are increasingly not buying it.

US Dollar Index Daily Chart

Source – Thomson Reuters Eikon

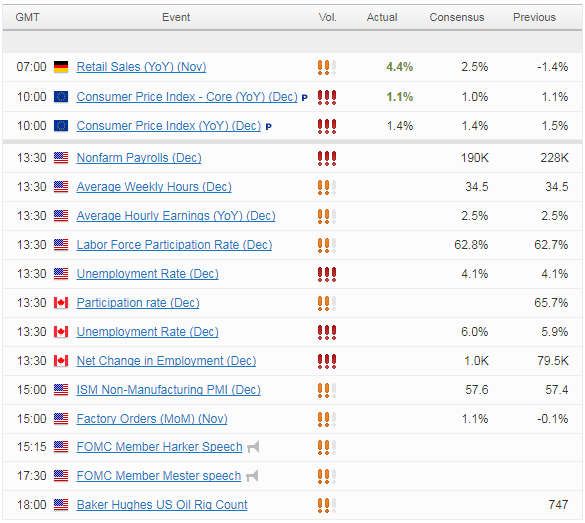

Even some policy makers are starting to question why nothing has not materialised and should that continue, rate hike forecasts will start to slip, especially with interest rates now already elevated. Today’s jobs report should offer some insight on this, with average earnings having arguably become the most important component of it. Still earnings are only expected to have risen by 2.5% compared to a year ago, below last year’s peak and well below where they need to be for inflation to sustainably return to target.

Naturally, the unemployment and non-farm payrolls numbers will also attract a lot of attention, with the former expected to remain at 4.1% and the latter rising by 190,000. While the ADP has often not been a great estimate of the NFP number, a 250,000 number on Thursday may suggest NFP expectations are a little low, creating some upside potential. Whether the dollar follows and holds will likely depend on those wage numbers though.

EUR/USD – Euro Dips Lower, Eurozone Inflation Matches Forecast

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.