Investors Look Past US/China Tensions

European stocks are back in positive territory on Thursday while Wall Street is facing a mixed start, with the EU recovery package lifting sentiment on this side of the pond.

The details of the package still need to be agreed, which could take months and include fierce debate among the “frugal four” and the rest. The current proposition includes €500 billion of grants and €250 of loans, the former of which the Netherlands, Austria, Denmark and Sweden have voiced opposition to.

Still, a package to this number at least looks likely, regardless of what the agreed details will be. Whether this will be enough or disbursed in an effective way is a question for another day, coming on top of the €1.1 trillion budget and €540 billion rescue package, agreed earlier in the crisis, it takes the full spending over the next seven year period to around €2.4 trillion.

More importantly, it will be the first time the European Commission will borrow on behalf of the EU anywhere near this scale and could be an important first major step towards shared debt. Investors are clearly encouraged even if there’s still plenty to be critical of when it comes to Europe’s response to the crisis and horrendous recession to come.

Tensions heightened as China passes controversial Hong Kong law

Tensions between the US and China continue to grow, with Hong Kong the centre of the debate this week. China today approved a controversial national security law in the territory, one the Trump administration jeapardises its autonomy and therefore its special status.

We can now expect measures to be announced by the US and hostility to ramp up between the two world’s largest economies at a time when the global economy is least able to take it. With Trump facing re-election later this year and China becoming increasingly confrontational, this heightened hostility isn’t going anywhere soon. It’s not having much of an impact on markets outside of China and Hong Kong yet but that may not last.

Oil seeing profit taking

Oil prices are negative on the day again on Thursday. The rally looked to be running on fumes late last week, which is understandable when you consider the recovery that’s taken place since a barrel of May WTI crude fell to minus $40 a barrel.

Oil may now be back at healthier levels, aided by huge supply cuts and economies around the world emerging from lockdown, but they’re still not sustainable. We’re seeing some profit taking at the moment but it could easily still have further to run. Of course, that may depend heavily on how successful the eocnomic reopening is.

Gold failing to gain upside momentum

Gold is up almost 1% on Thursday after $1,700 came under considerable pressure a day earlier. Prices bottomed around $1,693 and have bounced back strongly since then. I would celebrate that success just yet though, only a daily close above $1,728 – Tuesday’s open – or even $1,735 – Tuesday’s high – would give me any confidence that the yellow metal has bottomed for now. Gold is really struggling to gather and hold onto upward momentum and there’s only so many times it can disappoint before people bail.

Bitcoin struggling

Bitcoin is hanging just above $9,000 today but struggling to push on after the rebound of the last couple of days. Momentum still very much appears to be with sellers of the cryptocurrency, with $8,500 being the next key level to the downside but $8,000 being the next big one. A break and hold above $9,300 could change that.

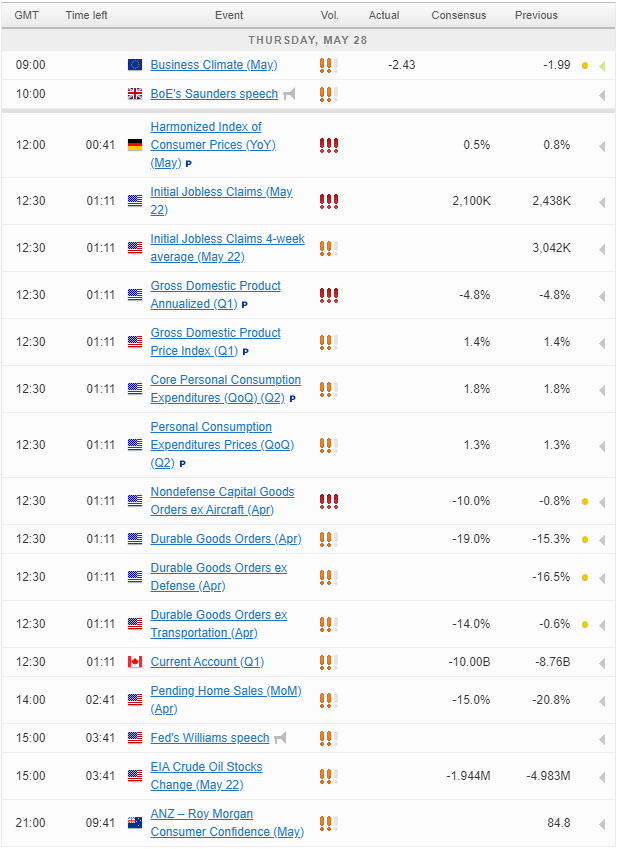

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.