A Promising Start to the Week

The week has got off to a decent start, with Europe up a couple of percent and Wall Street eyeing a similar open as lockdown easing measures provide cause for optimism.

In these uncertain times, I’m sure that optimism will be replaced with fear, which in turn will be replaced with promise and maybe even a sprinkling of exuberance, repeatedly over the coming months only for the cycle to start again. Ultimately, it all depends on the second wave, when it rears its ugly head and how bad it is. Not to mention how far the testing, vaccine and cure has come along in the interim. But this morning we’re optimistic, so that’s nice.

At times like this, you wonder what impact people’s general mood has on the markets. We all want to be safe but the ability to leave your house, maybe go to work, see friends and family (while abiding by the latest guidelines, of course) and even grab a coffee will naturally put people in a better mood after two months of lockdown. The fact that the sun is shining doesn’t do any harm either.

Obviously there’s the far more fundamental benefits of all of this. As businesses reopen, more people can return to work which means more companies may survive and people’s jobs be saved. We’re in the midst of a severe recession, there’s little we can do about that but the more life returns to normal, the less severe it will be. From a markets perspective, this is the second most important thing behind avoiding a second wave that sets us back a month.

No repeat of last month, it seems, for June WTI contract

If there’s going to be a repeat of last month’s antics in the oil market, it’s going to come as an even greater shock this time around. We’ve gone full 180 and rather than plunging to new depths, the rally is only gaining momentum, with the June contract up almost 10% and above $32 a barrel.

The supply cuts of the last month combined with gradual reopening of various countries around the world has put a significant dent in the supply/demand imbalance and alleviated capacity concerns that led to last months panic.

Gold springs back to life above $1,750

Gold has sprung back to life in recent sessions and taken the previous highs with relative ease. Now above $1,760, it’s looking very bullish indeed. There seems to be widespread agreement that the fundamental factors are supportive of gold prices, with the dollar the only major headwind.

But it’s inflation that we all appear destined to be talking about for the foreseeable. It makes sense, unprecedented stimulus, higher costs of doing business and deglobalisation are all inflationary, at least in theory. An inflaiton hedge is one of the core arguments in favour of gold and will likely be a key talking point in the months ahead.

A lot of pressure on $10,000

Bitcoin survived another run at $10,000 last week and has already been on the defensive again today. This is another key battleground and one that looks to currently favour the bulls. That momentum could fade with a break of $9,000 but at the time of writing, it’s looking less likely.

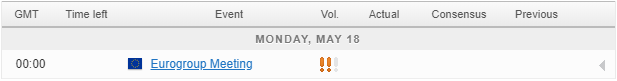

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.