US 10Y has been relatively stable in the past few trading days despite strong speculation in the market regarding Fed’s QE Tapering likelihood. Things got even heated yesterday, when Yellen and Bernanke both spoke at different occasion on US economic outlook and how the Fed should/and would view things in the months to come. Not only that, we also have Fed member Evans chiming in good measure – and the overall theme was highly congruent: A tapering action is not going to be coming so soon.

Bernanke placed more focus on interest rates, saying that Fed funds rate can remain around 0.0% even if unemployment falls below the “target” 6.5%. His likely successor Yellen echoed the same views, and added her own spices by saying that she would like to see the US economy improve further before tapering. While Evans was more explicit in his speech said that the Fed is “not in a hurry to taper” as “bountiful” accommodation is needed. Considering that all 3 members will be voting in the upcoming December meeting, the likelihood of a December tapering event just got marginally lesser.

Why only marginally?

Well, Bernanke, Yellen and Evans are well-known doves, and it is not surprising that these 3 are singing in the same dovish chorus praising QE. But even so, whatever these 3 have said should not have triggered QE tapering fears, and therefore it is highly interesting to see US10Y prices trading lower.

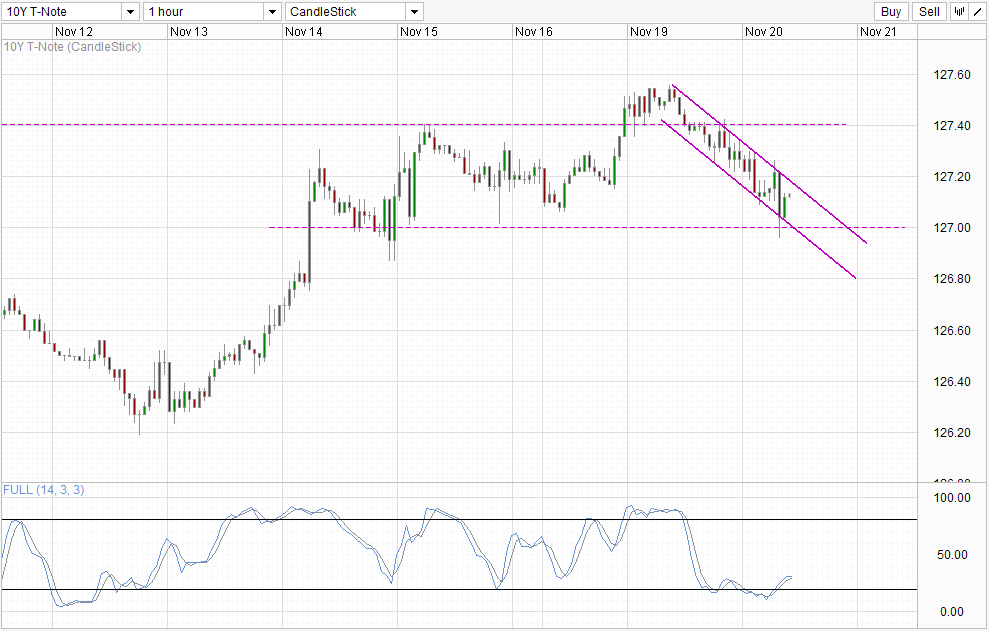

Hourly Chart

But the fact is that prices are heading lower, and this can be interpreted as a sign that the underlying sentiment of US10Y remains bearish – a notion that has been in play ever since the word Taper come forth in 2013. Even if a December taper doesn’t happen, a tapering action still can be expected in 2014, or 2015 or even later. Of course many analysts and market players believe it will come sooner rather than later, but the idea is the same: QE3 cannot last forever. Hence it is no surprise that demand for 10Y has been bearish in 2H 2013.

Announcement from Chinese Central Bank PBOC yesterday played a significant part as well, with the Governor stating that they will be lowering the ratio of Long Term US Treasuries held to maturity – meaning they may be selling some of their long-term T-bonds, or at the very least buy less long dated Notes/Bonds moving forward. No matter how you slice it, demand of Treasuries from the largest buyer in recent years will fall, and that added yet another bearish driver to prices.

From a technical perspective, prices are holding above 127.0 for now. But with descending Channel still very much in play, we could see prices pushing lower once again. This is echoed by Stochastic readings that suggest that bullish momentum may reverse soon as Stoch curve is flattening just around the “resistance” band between 30.0 – 40.0 based on where previous troughs have been spotted. Hence a retest of 127.0 is still possible.

Weekly Chart

Bearish pressure is bearish as long as we are under 128.0. However, Stoch curve tells us that bearish momentum is on the wane, with significant support to be expected above 126.0. Given the likely no-taper December FOMC outcome, it seems that fundamentals agrees. However, once we’ve gotten the risk event out of the way, the bears will be able to come out and play, and a proper test of 126.0 and further bearish objectives may be possible – until the next FOMC meeting draw nears that is.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.