Monetary policy expectations have had some wild swings over the past couple of months on the Bank of Canada. At the end of November, the market was fairly confident, about two-thirds sure that BOC would raise rates by 25 basis points. Oil prices however were not able to stabilize at $50 a barrel and the December swoon that hit global equities drove safe-haven currencies stronger, especially punishing commodity currencies. Expectations in December quickly erased hike expectations for the January 9th meeting and pushed it off to the summer. Over the past week, we have now seen expectations grow for the next move to be a cut, with the Wednesday’s meeting pricing in a 20.5% chance for a cut. There is a growing view that we could see a surprise hike from the BOC. The stabilization of oil prices is key for Canada and we could see BOC have a more optimistic tone following the recent data from the last meeting.

Employment continues to be strong in Canada, the November reading posted a record high and December came in line with expectations. The November inflation reading came in at 1.7%, the slowest annual pace since January, and in the middle of the central banks 1.0 to 3.0% target range. Canadian growth also came in better than expected the first month of the fourth quarter, but the pace could be lower than what the BOC was expecting. The housing market is also cooling and we could see a further slowdown if the BOC continues to raise rates. The likely scenario is for no change, but we could see the market swing back to expectations for a rate hike this year.

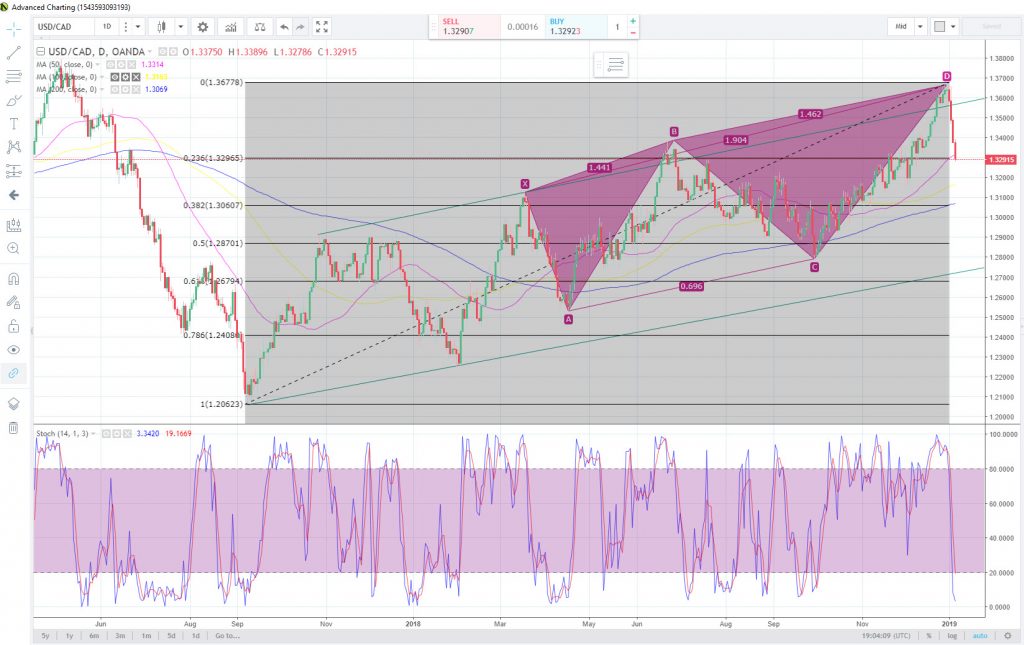

The Canadian dollar was one of the worst performing currencies against the greenback in 2018, losing almost 9% for the year and over 6% in the fourth quarter. Since making a 20-month low at 1.3664, the Canadian currency has appreciated 3% over the past four trading days. The current move is breaking below the 50-day SMA, which currently trades at 1.3331. If bearish momentum accelerates key support could be found from the 100-day SMA, which is at the 1.3171 level. Major support lies at the psychological 1.3000 handle. The worst might be behind the loonie, but if it we see price recapture 1.3650, the bullish move could see a clear path towards 1.4000.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.