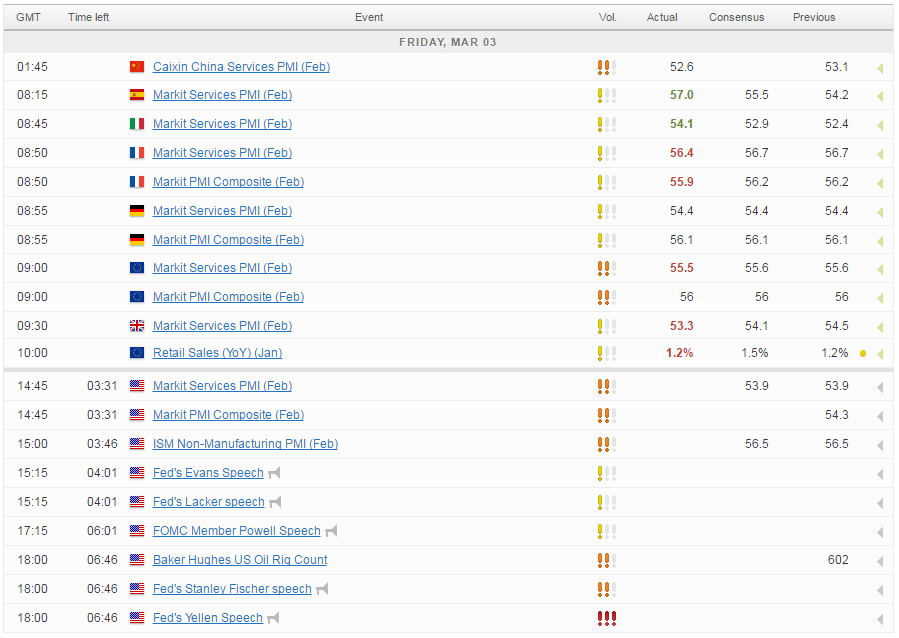

After a subdued start to trading in Europe on Friday, investors are gearing up for what could be a volatile end to the week as we hear from four Fed policy makers and get the latest surveys on the all-important US services sector.

The week has already been dominated by the US central bank, with a large number of Fed officials making public appearances ahead of the blackout period – which starts tomorrow – and voicing their support for a rate hike very soon. Investors may have been slow on the uptake to begin with but the last week really has driven home the coordinated message that not only is a rate hike imminent but that it could come at the meeting in two weeks.

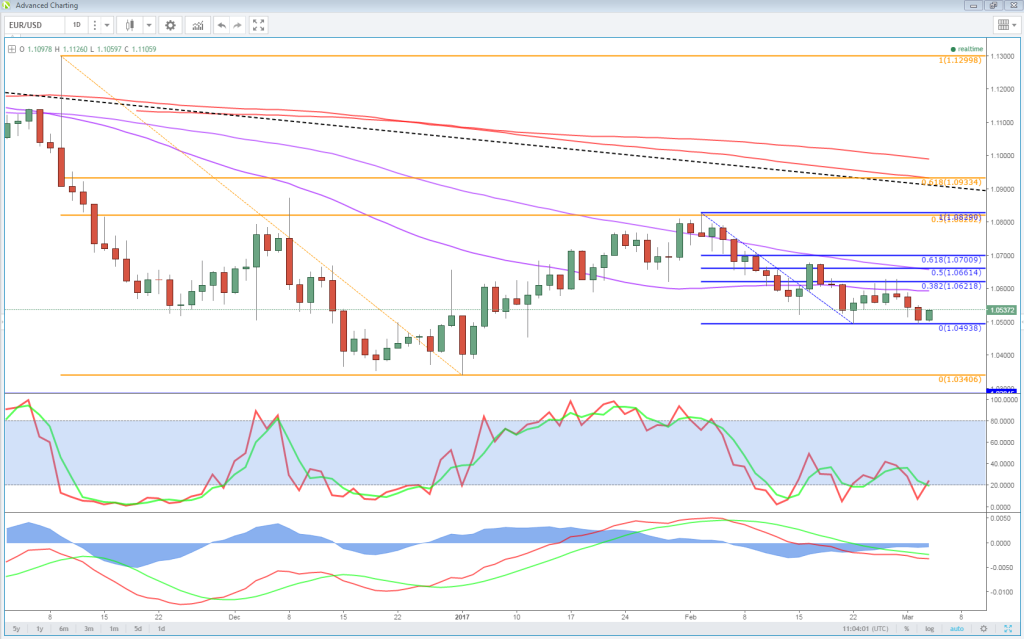

EUR/USD – Euro Shrugs Off Weak German Retail Sales

This has forced investors to radically change their expectations for the meeting with the implied odds rising dramatically from below 20% not long ago to above 75% now. With four more officials speaking throughout the day today, including Chair Yellen, vice Chair Fischer and two other voting members of the FOMC, it is now down to them to fine tune the message and ensure markets are properly positioned ahead of the meeting.

Source – CME Group FedWatch Tool

The dollar is taking a breather ahead of these speeches, as well as the two important services PMI readings, having rallied strongly since the start of February as markets fell back in line with Fed expectations. Whether the dollar is able to build on these gains in today’s session will depend on just how hawkish policy makers are, particularly Yellen who as Chair has considerable influence over the outcome of the meeting in a couple of weeks.

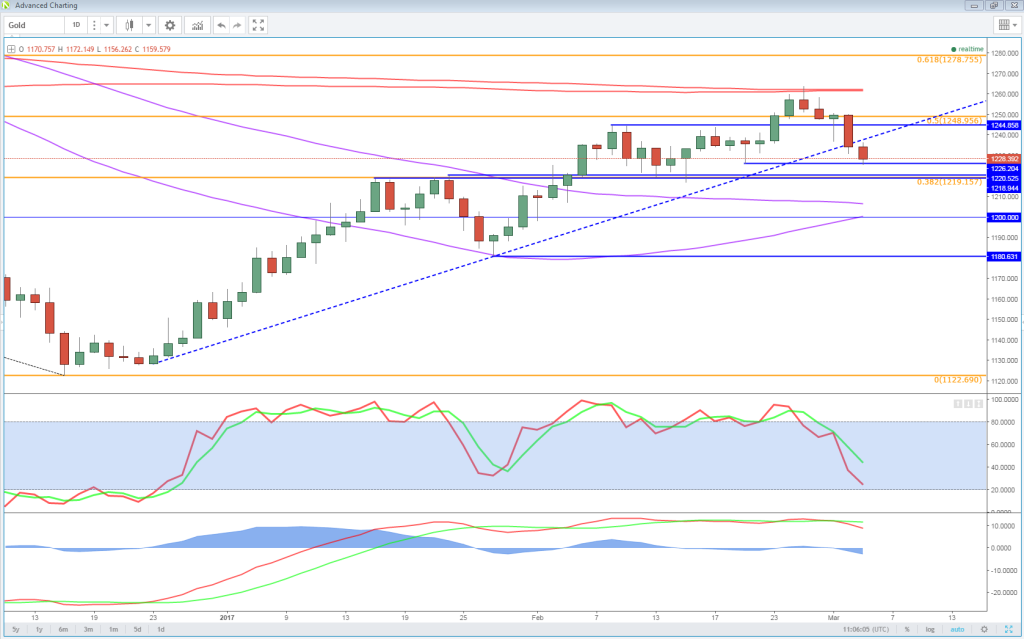

Precious Metals. We Meet Again Mr. Bond’s.

The euro has once again found support against the dollar around 1.05, the third time it has done so in recent weeks but given the political risk in the region ahead of some big elections and the run that the dollar has been on, I wonder how long this will last.

OANDA fxTrade Advanced Charting Platform

OANDA fxTrade Advanced Charting Platform

Gold is off around half a percent today which is interesting given that the dollar is also paring gains. This potentially suggests the rally has run out of steam and the prospect of more rate hikes has proven too much for Gold bulls. I think $1,220 will be key here and should we break below then things will start to look more bearish here, with the next key levels below being $1,200 and $1,180.

To find our positions ratio tool and many others, check out OANDA Forex Labs.

To find our positions ratio tool and many others, check out OANDA Forex Labs.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.