Rupee has weakened slightly today against the Greenback ahead of Q4 GDP numbers (to be released at 12:00pm UTC), which is expected to come in at 4.8% according to analysts consensus estimate. This increase in USD/INR can be attributed to traders expecting a weaker than expected GDP print, but credit should also be given to the strengthening USD whose impact is visible in major pairs such as EUR/USD, AUD/USD and GBP/USD. Given all these, it is actually rather remarkable that USD/INR managed to stay under 62.07 soft resistance especially since risk appetite in European stocks are bearish right now ( DAX -0.09%, FTSE 100 -0.27%) which should drive high risk currencies such as Rupee much lower.

Hourly Chart

Perhaps the high interest yields that RBI has raised made Rupee attractive to investors and give them reasons to hold onto INR, or at the very least make it expensive for speculators to short it. The true test of this new found strength in INR will be tonight. Should GDP numbers come in weaker than expected but USD/INR manage to stay below 62.07 by the end of day, we can ascertain that support for INR is strong and this bodes well for Rupee holders moving forward. Conversely, if 62.07 is broken today despite GDP numbers meeting or exceeding expectations, we can interpret this outcome as the breakdown of bullish sentiment for INR and further bullish push in USD/INR may be likely next week.

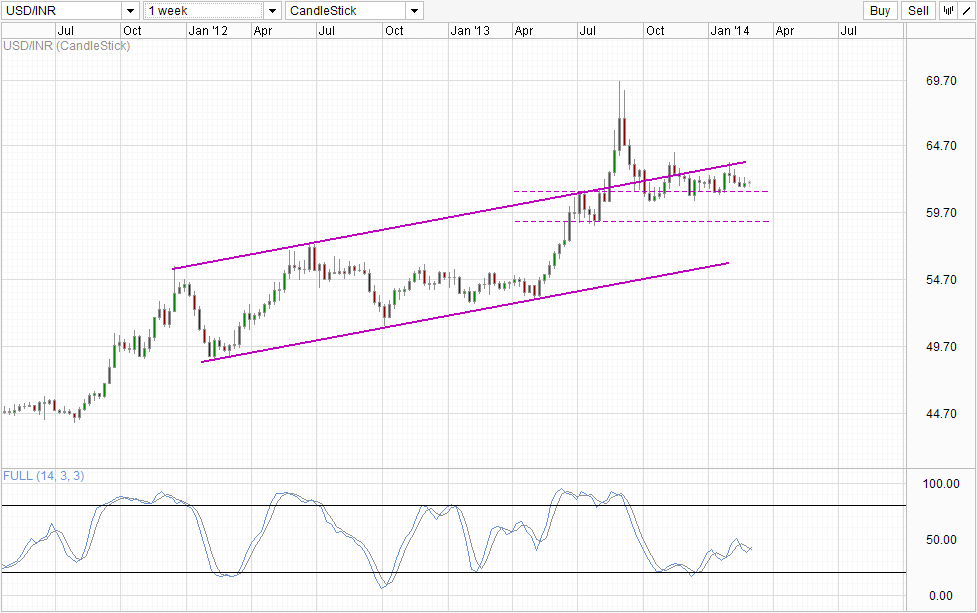

Weekly Chart

Nothing new from the Weekly Chart, as prices remain steady between Channel Top and the ceiling of consolidation range back in Jul 2013 which has been providing support for USD/INR. This is actually good for carry traders who abhors volatility, and the longer we stay within this band, expect to see more and more carry traders willing to buy INR and keep USD/INR down. Will this be able to negate the bullish pressure from USD entirely? We are unable to say for sure but similarly this uncertainty will prevent traders to go long USD/INR as the negative interest is too expensive to keep when one is unsure.

More Links:

EUR/USD – Regains Lost Ground back above Key Level of 1.37

AUD/USD – Trying to Claw Back to Key 0.90 Level

GBP/USD – Dealing with Resistance at 1.67

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.