Yet more bearish news from Japan. Industrial Production for the month of Feb grew 6.9% VS 9.9% expected on a Y/Y basis. M/M basis is even worse, shrinking by 2.3% when a growth of 3.6% was expected. This is not the first time that Industrial Production numbers were disappointing though. Since the start of 2013, this economic measure has come in below expectations 12 out of 15 times. However, that has not stopped traders from believing in the Abenomics hyped before, with Japanese stocks climbing while JPY weakens consistently for most part of 2013.

Things are rather similar right now. Nikkei 225 is bullish today despite the latest setback, while USD/JPY continues to climb up higher even though latest data reflects yet again the failure of Abenomics or at the very least the over optimism of the market on the efficacy of the stimulus thus far. It is also possible that these traders are simply focused on the possibility of additional stimulus package by BOJ in either May or June. The only problem is that BOJ themselves have been trying to distance away/refusing to commit to any confirmed stimulus top up, instead opting to use rhetorical statements about how they’ll intervene if necessary (perhaps they’ve taken a leaf out of Draghi’s playbook). Hence, there is a huge chance that market will be disappointed in due time, increasing the potential downside risks.

It should also be noted that USD/JPY has been steady in the month of Feb and Mar, 2 months that traditionally see strengthening of Yen due to repatriation of overseas funds by Japanese. The reason why prices didn’t do so can be attributed to the fact that foreign funds have been seen exiting Japanese stocks. This increases the downside risk of Japanese stocks further, but is a mixed signal for Yen.

If Abenomics eventually fail, it is possible that Japanese Yen will strengthen in the short run as market will take back the premiums they have given USD/JPY in the past 1.5 years on the promise of BOJ intervention. However, fundamentals will also dictate that demand for Yen will be lower as Japanese economy will likely be extremely weak (and perhaps even hopeless) if even Abenomics fail to revive the sleeping giant. Hence, the convention about Yen being a “safe haven” may need to be rewritten and we could see Yen capitulating in the worst case scenario for Japanese economy.

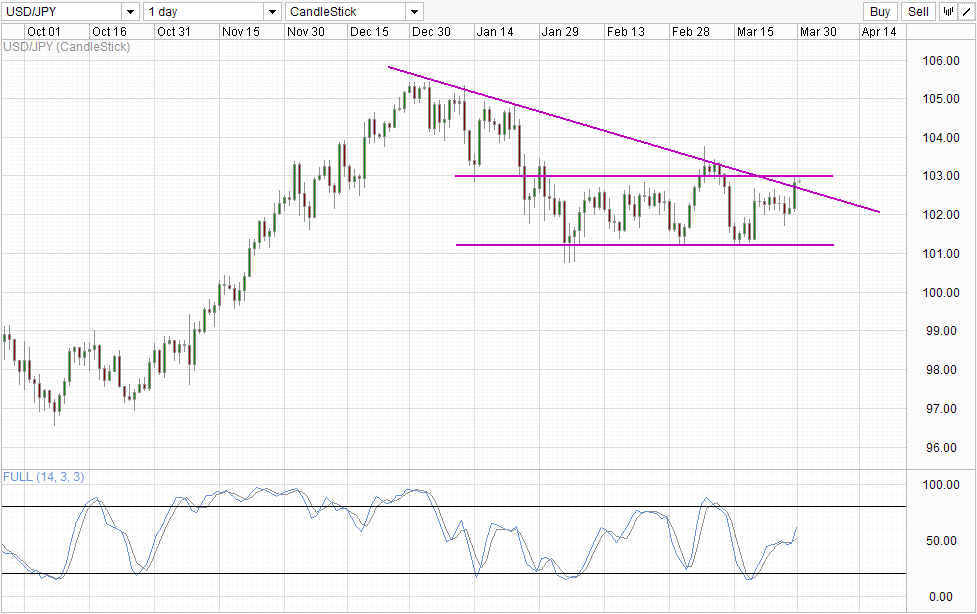

That being said, it seems that Japanese traders are still “living the dream”. What this means is that a breach of 103.0 resistance is possible since prices have just broken above the descending trendline, while Stochastic curve still have space to go higher before the end of current bullish cycle. However, a breach above 103.75 previous swing high is less certain. Nonetheless, if market continue to believe that additional stimulus from BOJ is coming, a break of the aforementioned resistance for a move back above 104.0 is not impossible.

More Links:

AUD/USD Technicals – Bearish Response Seen Ahead Of 0.93 Break, RBA Rate Decision

Week In FX Asia – Kiwi On Steroids

USD/JPY – Solid Japanese Retail Sales, CPI fail to Move Yen

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.