Saudi rhetoric sees Brent in sight of $60.00 a barrel but is the rally in oil puffed up on talk or fundamentals?

Oil raced higher overnight with Brent finishing in sight of the magical 60.00 a barrel mark, spurred on by Saudi remarks supporting the oil production cut through to the end of 2018. Brent climbed 1.75% to close at 59.50. Meanwhile, WTI also managed to post a respectable 1.30% rally of its own to finish the New York session at 52.55. With Brent spot at two-year highs and the prompt futures in backwardation, the stage would appear set for an attempt higher. The 60.00 region will be a formidable obstacle, and it remains to be seen if oil can sustain these levels on the back of Russian and Saudi talk alone.

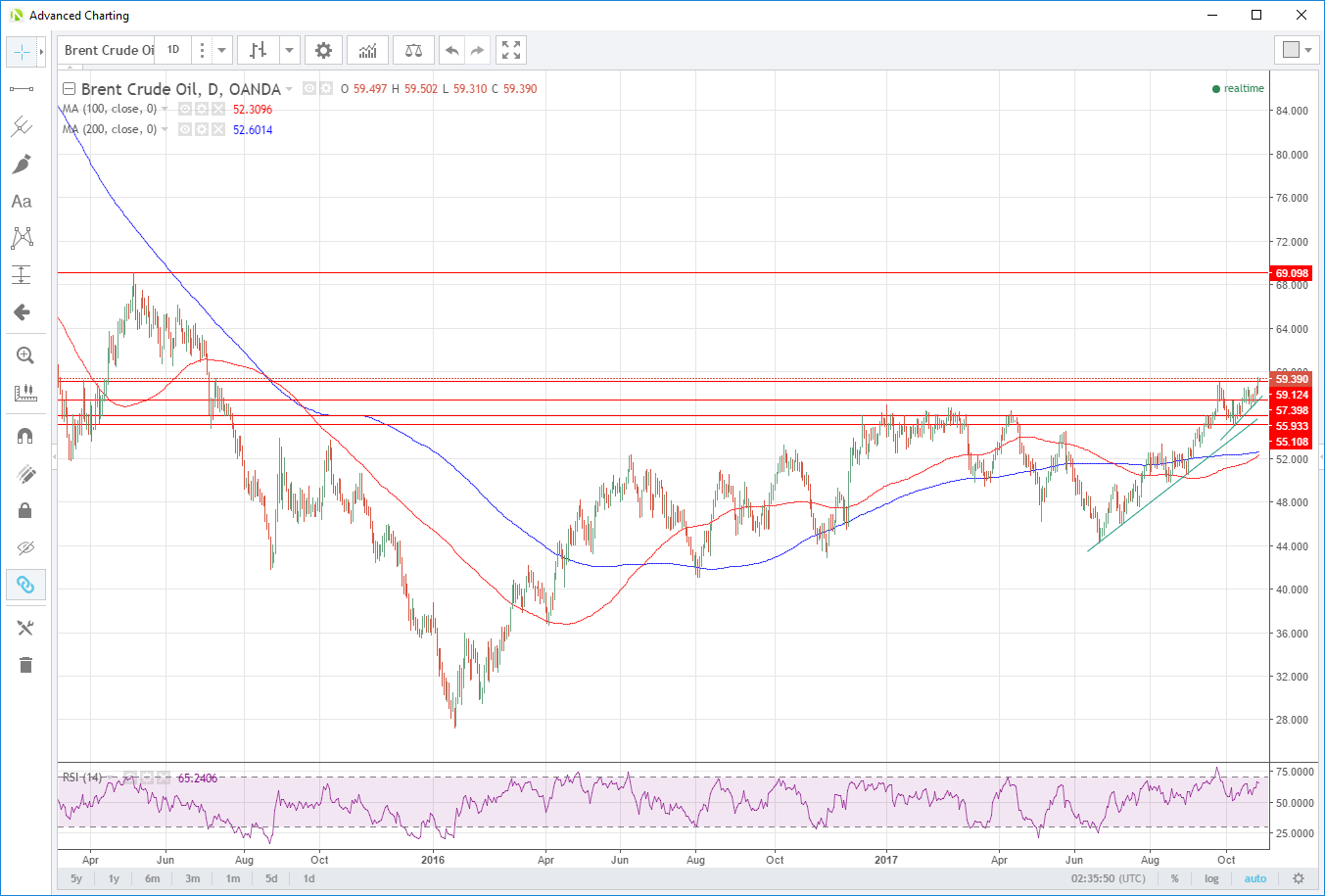

Brent

Brent spot has drifted 15 cents lower in early Asia to 59.35 as some profit taking has set in. Nearby support lies at 59.00 and 58.65, and the overnight high of 59.55, the first hurdle. We expect 60.00 to have substantial selling interest from producer hedging initially. A break, however, opens up a considerable amount of clear air on the charts with no notable resistance until the 68.00 regions. A daily close above 60.00 will set an interesting scene from a technical perspective.

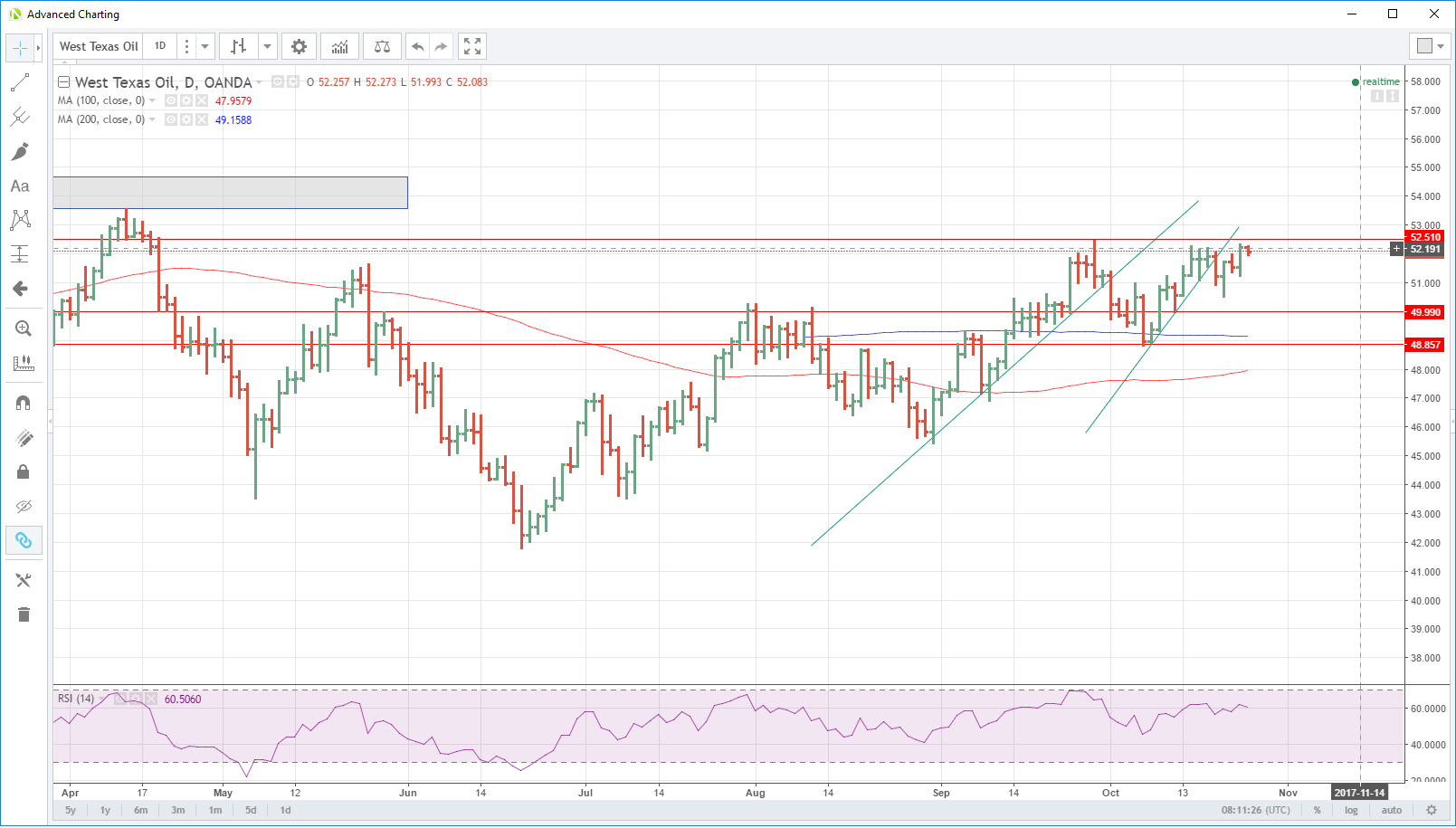

WTI

WTI spot lagged Brent overnight, weighed down by high inventory numbers and surging production. It too has seen some early Asia profit taking, drifting 10 cents lower to 52.45 although still very close to its New York highs. Trendline support appears at 51.90 followed by the 51.00 regions. Above here lies a substantial region of resistance between 53.50 and 54.50. This area capped all of the attempted rallies from the end of 2016 through all of quarter one of 2017. Given the amount of producer hedging around it will likely prove a very tough nut to crack initially. It may be assisted by the Baker Hughes Rig Count if it shows a significant drop this evening.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.