Oil spikes on reports of tanker explosions

Oil prices have spiked on Thursday following reports of tankers being attacked in the Gulf of Oman, off the coast of Iran.

This comes a month after allegations of sabotage in the same region, which was blamed on Iran and threatened to stoke further tensions in the region. It comes at a time when the US has imposed sanctions on Iran in an attempt to reduce oil exports to zero, ruin the economy and apply maximum pressure to the regime after Trump pulled out of the nuclear accord.

The knee jerk reaction is more a response to the risks associated with higher tensions in the region and prospect of more attacks, than immediate impact on oil supplies. It comes at a time when oil prices have been under pressure from weaker economic prospects and record US output, despite efforts by OPEC and its allies to reduce output and cut the oversupply.

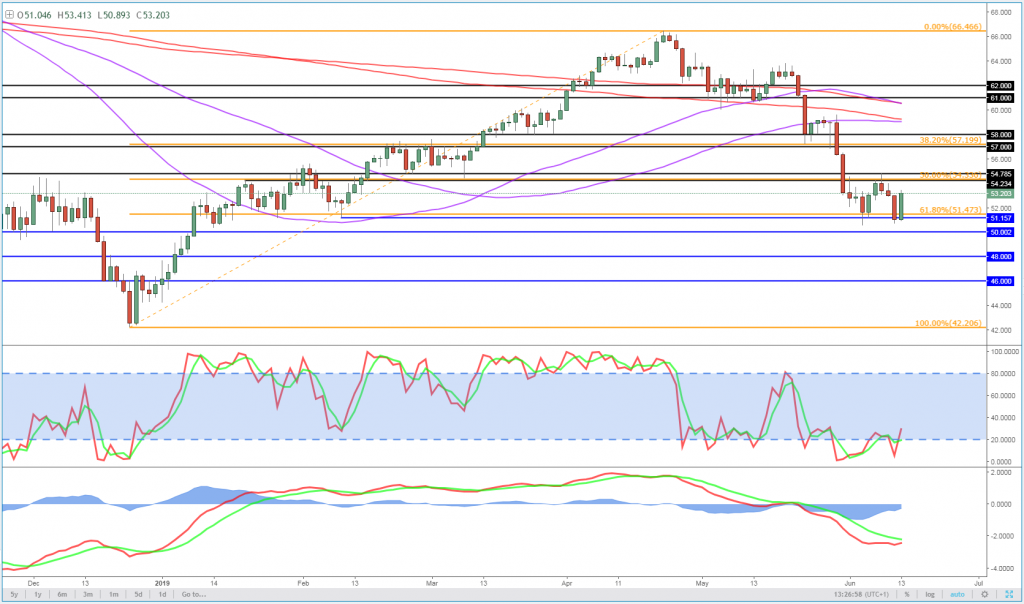

WTI Daily Chart

OANDA fxTrade Advanced Charting Platform

WTI was hovering around $50 – long term support and 61.8% retracement of the 2018 lows to 2019 highs – when the reports came out which may have aided the rally, being such a key support level. As long as prices remain below $55 though, being the recent high, it will continue to look vulnerable. A lower high, if registered, would be seen as weakness given what triggered the rally.

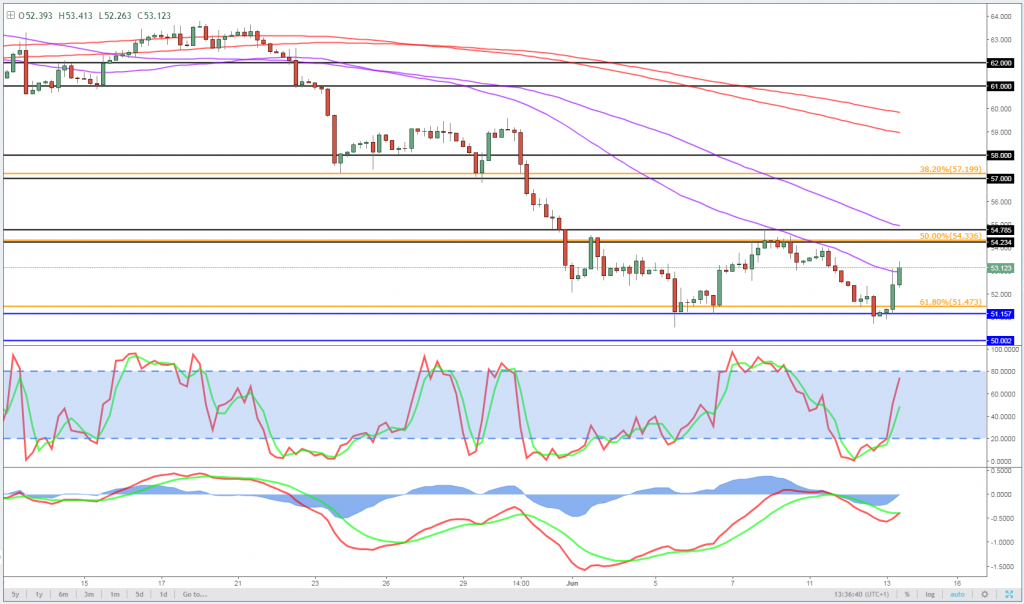

What may give a bullish impression today is a close above $53, which would create a bullish engulfing pattern – albeit a slightly imperfect one – and see us close above the 55-period moving average on the 4-hour chart which price has recently tracked below. This would make the next couple of days very interesting.

WTI 4-Hour Chart

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.