It’s been a relatively quiet start to trading on Monday, with the focus throughout the markets remaining on the timing of the next rate hike and the upcoming U.K. referendum.

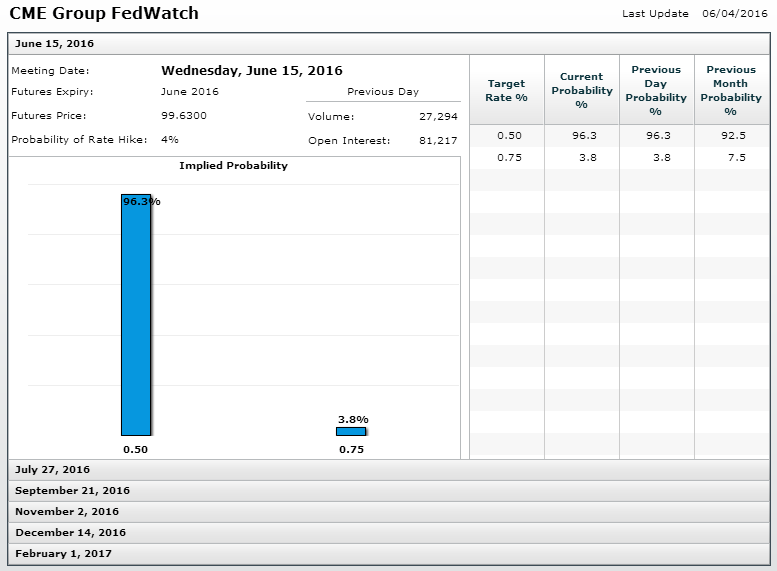

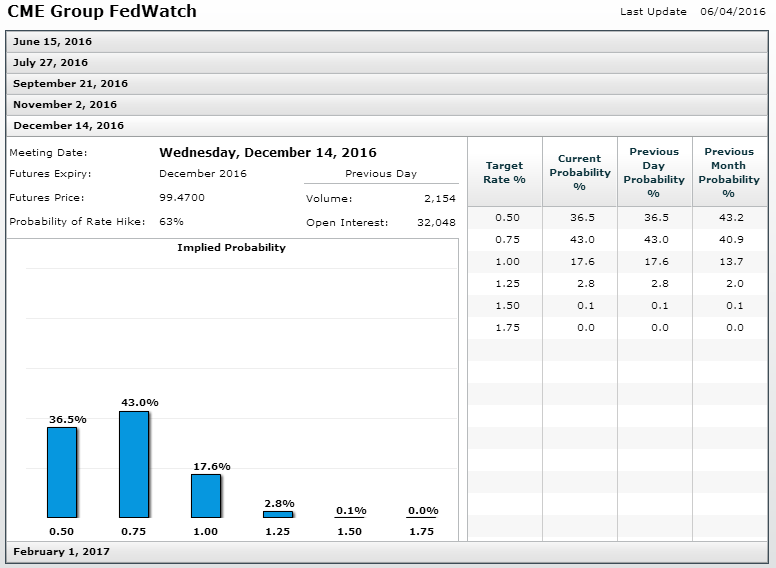

Friday’s jobs report cast serious doubt on the prospect of a rate hike in June, something the Federal Reserve had been trying to talk up in recent weeks after the markets all but priced it out. The Fed now finds itself back to square one though following the May jobs data, with the implied probability of a June hike now back to 4% and the first hike not expected until December.

Source – CME Group FedWatch Tool

I imagine the Fed will probably concede defeat in June given the monumental effort it would take to bring the markets back in line and the tightening of the Brexit polls. We’ll hear from Fed Chair Janet Yellen this afternoon who should provide more clarity on this. I imagine the message will probably be that June remains live although I wouldn’t be surprised if she instead focuses on a summer hike, rather than June specifically, which would indicate that July is very much on the table.

The “Big” Dollar Remains Down, But Is It Out?

The U.K. referendum has definitely thrown another spanner in the works, especially now that recent polls suggest it could be much closer than many were expecting. It’s worth noting that the polls were not that accurate in the lead up to the Scottish referendum or the U.K. election, particularly the online polls, so they should be taken with a pinch of salt. That said, with little else to go off, the markets are going to remain very sensitive to them given the consequences that a vote to leave could have for the pound.

The pound is already off 1% against the dollar today after more polls over the last 24 hours put the “Leave” campaign in the lead, in one case quite considerably so. While I would expect more downside if the polls continue to show the “Leave” campaign gathering momentum, the pound is likely to be very volatile in both directions over the next couple of weeks. The polls are having a significant impact on the pound and some of them are sending very different messages. While support for “Leave” is clearly growing, I still believe it will be a relatively comfortable win for “Remain” on June 23, albeit possibly not quite as comfortable as some will have hoped.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.