European equity markets are expected to open a little softer on Tuesday, with traders continuing to eye moves in oil, the pound and the yen, as well as the latest economic sentiment surveys from the eurozone and Germany.

The pound appeared to find some stability on Monday following the flash crash on Friday and yet it continues to drift lower. Once again this morning it’s down by close to half a percent and approaching 1.23 against the dollar. While we may see it find support soon, there appears to be little faith in sterling right now due to the huge uncertainties around Brexit and therefore further turbulence likely lies ahead for the pound.

The only currency not capitalising on the depreciating pound is the yen, which is coming under some welcome pressure itself. Haruhiko Kuroda’s admittance on Monday that hitting the 2% inflation target will likely now have to wait until 2018 gave the yen the dovish kick it needed and that the central bank, through policy action, has struggled to give it. With the markets now coming around to the idea of a Fed rate hike in December, the Bank of Japan may have to work less hard in the coming months to talk down its currency against the greenback.

Chart – OANDA fxTrade Advanced Charting

USDJPY – First Bullish Confirmation Achieved

Fed policy maker – and FOMC voting member next year – Charles Evans claimed overnight that he would be fine with the central bank raising interest rates in December but would prefer to see inflation rise closer to the 2% target before deciding. Neel Kashkari – also an FOMC voter next year – recently appeared to share Evans’ views on this and we’ll find out if this remains the case when he speaks later on today.

Oil is currently trading a little lower today but is likely to remain volatile throughout the session. Comments from Vladimir Putin on Monday sparked some life into oil once again as he talked up the chances of a coordinated production freeze between Russia and OPEC, something the market needs if gains are going to be sustained. I’m sure we’ll continue to hear more on this in the coming weeks ahead of the OPEC meeting next month which should ensure oil remains quite volatile.

Chart – OANDA fxTrade Advanced Charting

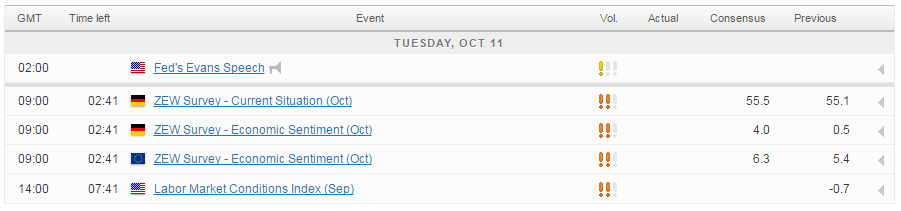

The only notable data release today will be the ZEW economic sentiment surveys from Germany and the eurozone, both of which are expected to marginally improve again but remain below pre-Brexit levels. While the hard data currently suggests the Brexit impact has been muted, confidence clearly remains fragile and expectations are that it’s a matter of when the numbers turn bad rather than if.

OANDA MP – Oil Surges on Putin Comments (Video)

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.