After breaking above the descending channel that it has traded within for more than a year, the Australian dollar has failed to gather much momentum against the greenback and once again appears to be struggling to push on.

I highlighted on Tuesday (AUDUSD – Bullish Breakout Unconvincing) that while the move above the channel should be a very bullish move, it hasn’t looked very convincing and while Friday’s high was broken, the same remains true.

The pair hit a new one month high on Wednesday but has already stalled again and we could now be seeing a bearish reversal pattern forming. Following Tuesday’s bullish marabuzo candle (albeit a relatively small one), a spinning top formed on Wednesday which on its own, highlights the indecision in the pair but doesn’t offer bullish or bearish bias.

Today we’ve seen some early selling in the pair and if we don’t see these losses reversed, an evening star could form which is a bearish reversal setup. Given how unconvincing the initial breakout was, it would suggest that this wasn’t as significant as we’d normally expect. Also given the fundamental issues highlighted on Tuesday, this would make a lot of sense.

Instead, what the breakout could indicate is that the pair has bottomed out for now and may be in the process of establishing a new trading range, with 0.73 possible being the upper end of it.

If the evening star does form, it will be interesting to see whether the pair breaks back below the 100-day simple moving average and into the channel which would confirm my suspicions that this was not the bullish move it could have appeared.

It’s also worth noting that the pair continues to trade below the 21-week SMA, despite having traded above it briefly. A weekly close below here after the initial pressure would in my view be quite a bearish signal and again support the view that the channel breakout was not the bullish move it could have been.

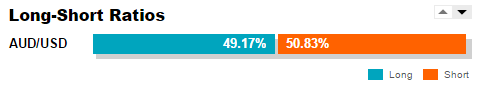

To get access to our Open Position Ratios tool and many others, visit OANDA Forex Labs.

To get access to our Open Position Ratios tool and many others, visit OANDA Forex Labs.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.