Price action in AUD/USD behaved as expected yesterday. Bears pushed prices lower but the consolidation floor between 26th – 27th March stood, with prices subsequently rebounding higher during US session. What is notable is that AUD/USD managed to hold onto the gains made during the US session and did not suffer any significant pullbacks, suggesting that overall sentiment is bullish. This bullishness is confirmed when prices suddenly pushed up higher at 8pm EDT even though there wasn’t any news announcements. Prices did suffer slightly due to the less than impressive numbers from both China official Manufacturing PMI and HSBC’s version, but any bearish pressure was quickly snuffed out with prices staying above the highs of yesterday.

Given this strong bullish pressure, one should have expected a much stronger bullish reaction when the RBA rate decision was announced. The central bank held rate as expected, and reiterated their stance of keeping rates stable (read: no more rate cut) as a loose monetary policy is needed in order to keep the economy going. This isn’t anything special as RBA has basically said the same thing in previous policy announcement. But given the strong underlying bullish pressure spotted earlier, a break of 0.93 was expected and at the very least prices should have stayed close to the round figure resistance even if we fail to break it.

Unfortunately, prices did nothing of that sort, but instead collapse spectacularly to 0.9255. This highlights the strong resistance of 0.93, and suggest that there are ample traders seeking to short AUD/USD at reasonable prices. Given that fundamentals of Australia economy isn’t really outright positive right now, coupled with the fact that USD is expected to strengthen significantly, it should also be noted that AUD/USD remain on the high side historically, and as such it is not surprising to see many bears lying in wait hoping for a larger correction in AUD/USD with or without RBA help.

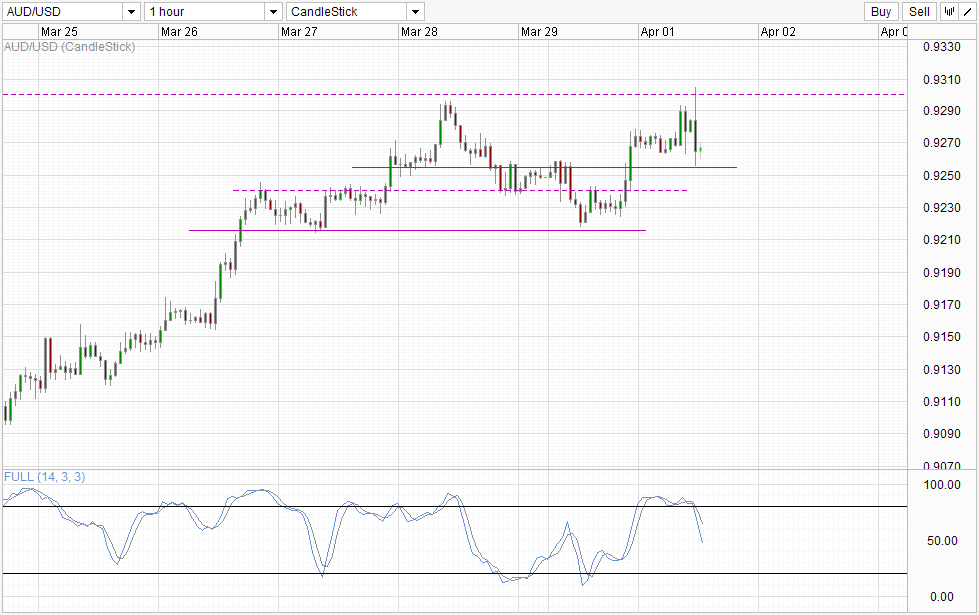

Hourly Chart

Is 0.93 going to be the waterloo for current bullish momentum? Right now there is very little evidence to show that a bearish reversal is in play. From the hourly chart we can see prices remaining broadly supported, and a retest of 0.93 is still possible. A break of 0.92 round figure support is needed fully invalidate current bullish bias but Stochastic indicator does not favor such a scenario as Stoch curve will likely be oversold when the 0.92 support is reached, reducing the likelihood of a strong bearish follow-through.

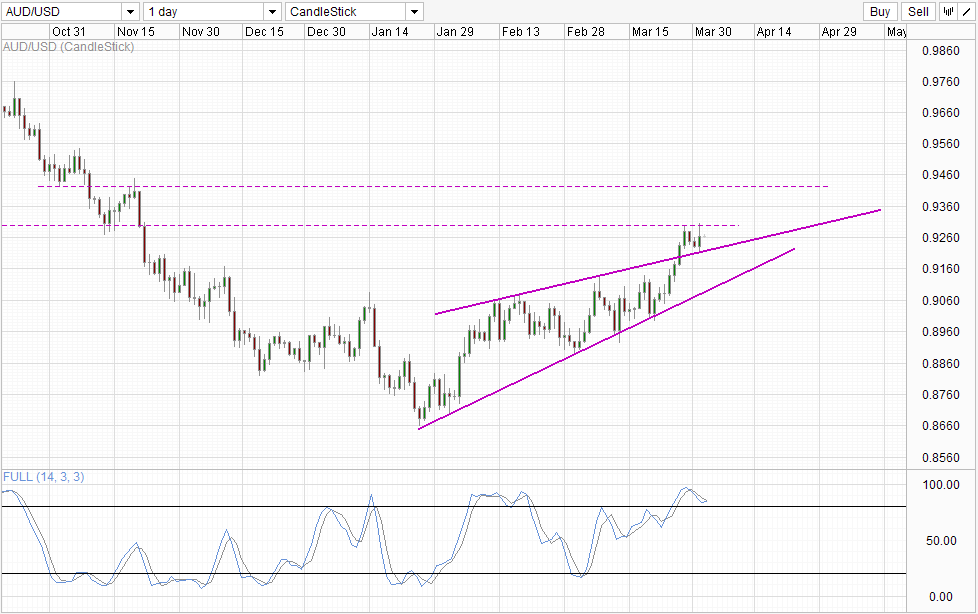

Daily Chart

Daily Chart agrees, with prices likely to find support from the top of the wedge which would allow bulls to remount a retest of 0.93 once again. Stochastic indicator agrees as Stoch curve has since reversed higher and appears likely to cross the Signal line, suggesting that we will most likely not see a bearish cycle signal in the immediate future.

However, bearish direction is still favored in the future, and as such we cannot rule out a reversion of bearish momentum that has been in play exactly 1 year ago and more recently the bearish push that started in October 2013. Given the continued USD strengthening narrative, it will take significant shift in Australia’s economy and optimism in order for a long-sustained bullish move in AUD/USD. As such, traders who still want to go long AUD may want to explore other AUD crosses instead.

More Links:

Gold Technicals – Staying On The Bearish Road Towards 1,270

GBP/USD – Pound Remains Firm After Dovish Yellen Comments

USD/CAD – Loonie Flies Higher As Canadian GDP Rebounds

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.