Interesting movement in AUD/USD seen today. Prices was bullish when Monday session opened, but the bullish momentum was defeated at the first time of asking with soft resistance 0.897 ultimately holding despite bulls managing to climb above it briefly. Even the added momentum from breaking into the rising Channel (seen below) did not help bulls to consolidate their elevated position, and instead the fall back to 0.895 actually helps to affirm the bearish breakout of Channel, reversing earlier bullish bias into current bearish one.

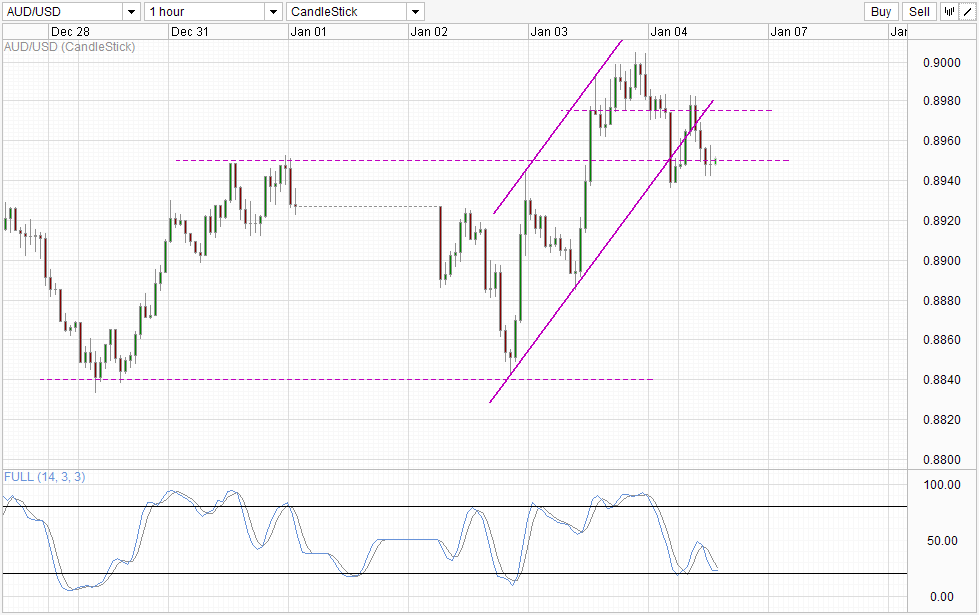

Hourly Chart

To be fair, bulls had an uphill task to pull off considering that weaker HSBC Chinese Service PMI numbers were released during the key moment when the 0.897 resistance was tested. Hence, we should not automatically assume that current 0.895 support will break easily, as a rebound towards 0.897 may be possible once again. Stochastic readings agree with Stoch curve already flattening. Readings are not within the Oversold territory but a trough is still possible considering that previous troughs were seen around the same levels.

Nonetheless, should 0.895 breaks, the next significant level will be 0.884, but expect 0.89 round figure to put up a reasonable fight especially since trading volume remains on the low side and directional follow-through is not expected to be far.

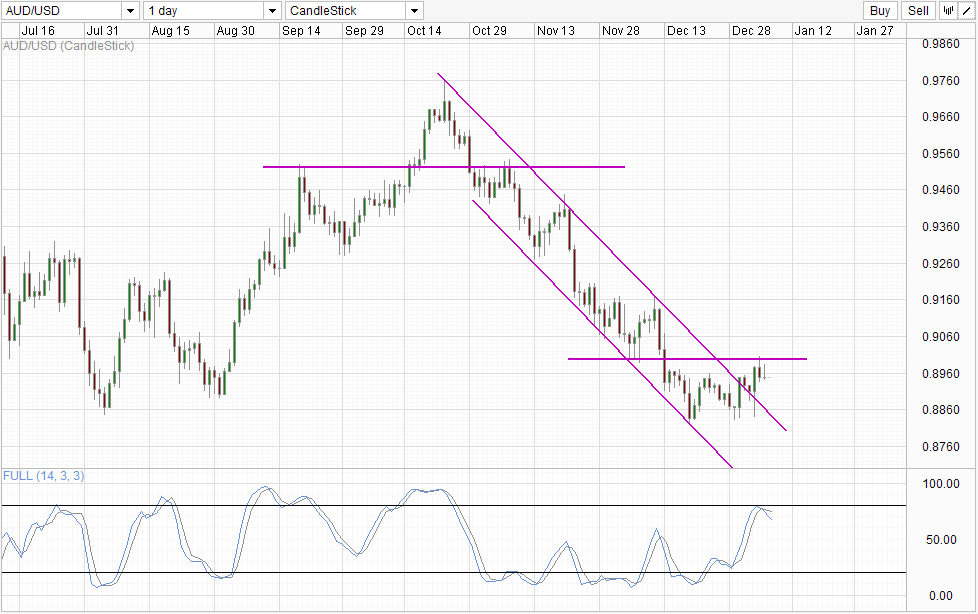

Daily Chart

Daily Chart echoes the bearishness bias seen on Daily Chart. Stochastic readings have recently formed a top in conjunction with the bearish rejection of the 0.90 round figure resistance. This opens up a move towards Channel Top or at the very least 0.882 which is the low of Dec’s consolidation – and potentially the confluence with Channel Top if price does the unlikely and swoop down sharply from here.

Fundamentals have not changed at all though, with AUD/USD remain earmarked to head lower in 2014 given continued USD strength and weak Aussie economic growth. However, expect strong buying interest from carry traders should AUD/USD fall too low, which will continue to support AUD/USD and prevent price from sliding down too fast. A more likely price action would be the decline seen from mid October where price went lower in measured steps. Then again, given that US10Y has breached the 3.0% level, there is a chance that interest rates will climb up higher from here. As it is, a 3% return is already much more attractive that the carry interest given by holding AUD/USD, and holding 10Y Treasury does not expose you to FX risk, and will definitely diminish carry interest. Hence, there is a chance that carry interest may not be as high as we think and traders trying to fade declines hoping for carry traders to support rebound may end up getting it wrong more often than right.

More Links:

EUR/USD Technicals – Triple Top Formed, Awaiting Confirmation

Gold Technicals – Trading Within S/T Bullish Channel

GBP/USD – Pound Drops to Start 2014

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.