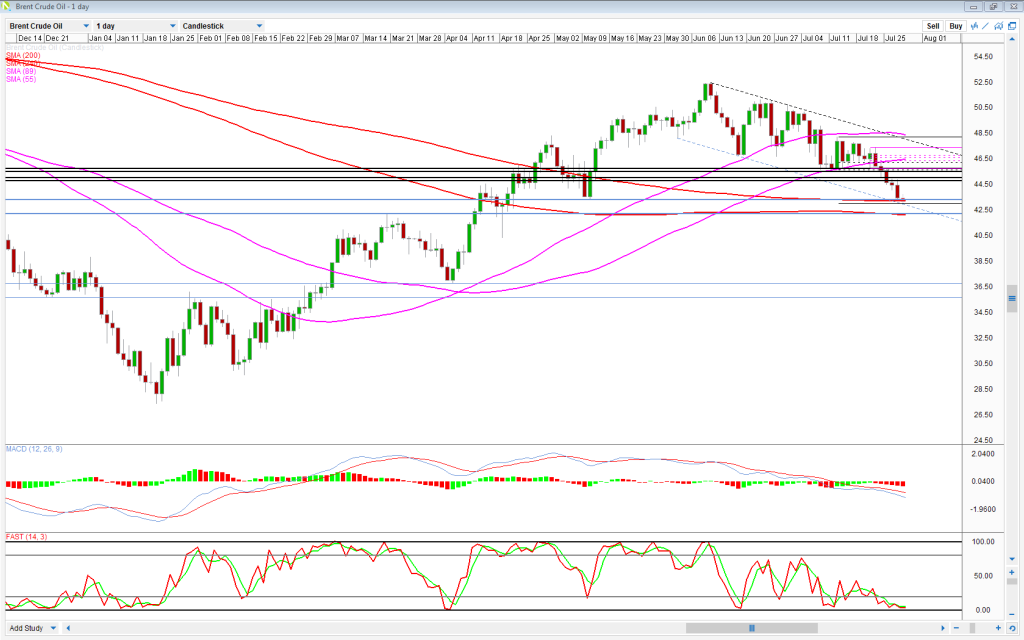

Last week, I wrote a piece when Brent crude was testing the July lows and threatening to break below the 89-day simple moving average (Brent Crude – Key Support Coming Under Pressure). Since then the level has broken and we now find ourselves trading around that next major support level.

How Brent behaves here could offer strong insight into how oil is going to play out in the coming weeks, as a break below the 200 and 240-SMAs and a major prior level of support and resistance would be a very bearish move. This could trigger another significant move to the downside.

Given that we’re now on our sixth consecutive losing day, I wonder whether the bears still have it in them to force such a significant break on this occasion. Should we see it, it would be send yet another strong message.

GBP/USD – Pound Dips, US Jobless Claims Miss Expectations

The stochastic and MACD histogram on the 4-hour chart, below, both suggest that the move is losing momentum during the most recent lows. Should we see some profit taking at this level, it could prompt a correction in Brent, which would bring two levels into consideration.

The first, if we’re looking at a shallow correction, is around $44.75-45, a recent level of support and resistance and the 38.2% retracement of the move from 12 July highs to the current lows (assuming of course we have reached a low – this could be adjusted if new lows are made).

OANDA MP – Markets Eye BoJ Decision (Video)

The second, and possibly more likely, is around $45.50-45.75, last week’s major support and the 50% retracement of the above move. Should we see a reversal off one of these levels, it could be followed by another attempt to break below the 200 and 240-SMAs.

A break of these now, or following a correction, could see Brent head back towards another major zone of support and resistance around $35.65-36.75 in the coming months. The next important level of support though could appear around $40-41.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.