US Stocks traded higher yesterday following dovish talks from Fed officials. S&P 500 gained 0.43% while Dow 30 had a stronger jump at 0.82% – reaching a new 33rd record close in 2013.

William English, head of Fed’s Division of Monetary Affairs wrote a paper supporting current low interest rates strategy as long as unemployment stays above 6.5%. The paper even suggest that lowering the threshold to 5.5% may even be preferred. Another paper by David Wilcox – Director of Research and Statistics similarly call for continued “highly accommodative monetary policy”, implying that the Fed research section would prefer to see QE continuing in its current form for a little while more.

Cleveland Fed President Sandra Pianalto further echoed the same sentiment in her speech yesterday, saying that she hopes to see economic recovery accelerating further before the Central Bank starts to wind down asset purchases. However, it should be noted that Pianalto isn’t a voting member of the FOMC, and even though the Cleveland Fed President will be given a voting seat in 2014, Pianalto will be ending her term in December, making her opinions about QE purchases irrelevant.

Similarly, it is unlikely that the 2 Fed papers will be able to gain further bullish traction considering that they were already circulating around as early as Tuesday, with market likely to have heavily discounted the move by now. Furthermore, the 2 papers are not saying anything new, but merely reflecting what most of the dovish Fed members were already thinking. Those that have been hawkish will remain hawkish, while the already dovish ones will not be able to exert more influence beyond the singular vote that they hold.

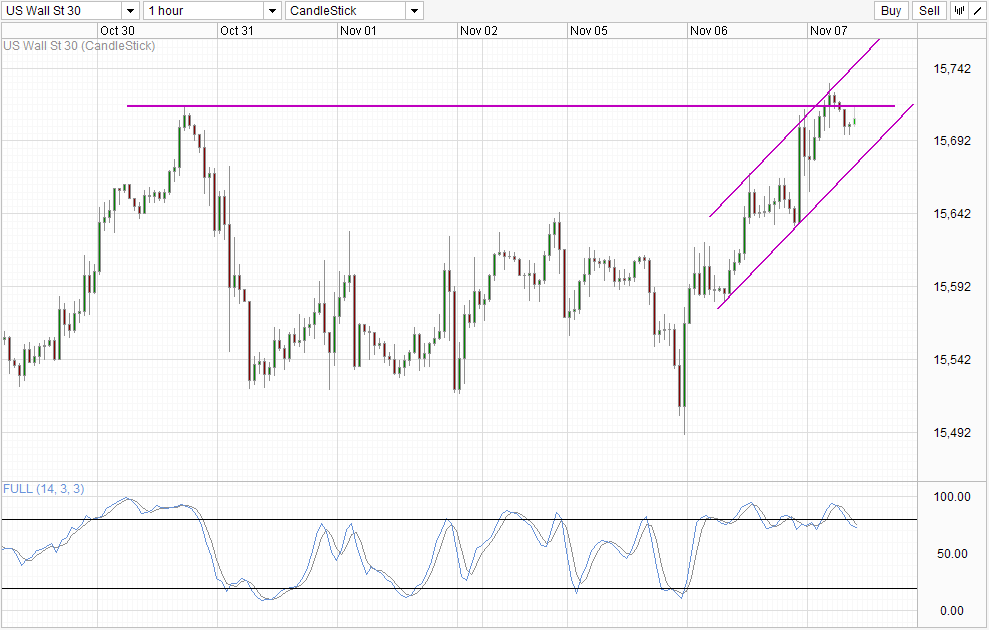

Hourly Chart

Therefore, the likelihood of prices being able to break much higher from here is in doubt. Or rather, the fundamental reasons for stronger bullish momentum to emerge is suspect. From a technical perspective, there could still be bullish momentum resulting from a bullish breakout, but currently price is trading below the 30th Oct swing high, with Stochastic readings showing a fresh bearish cycle signal.

Currently Stoch readings are still “supported” from the 70.0 level where stoch peaks were seen between last Thursday and Friday. If Stoch readings manage to push below 70.0, the likelihood of a stronger bearish reversal towards Channel Bottom becomes more likely.

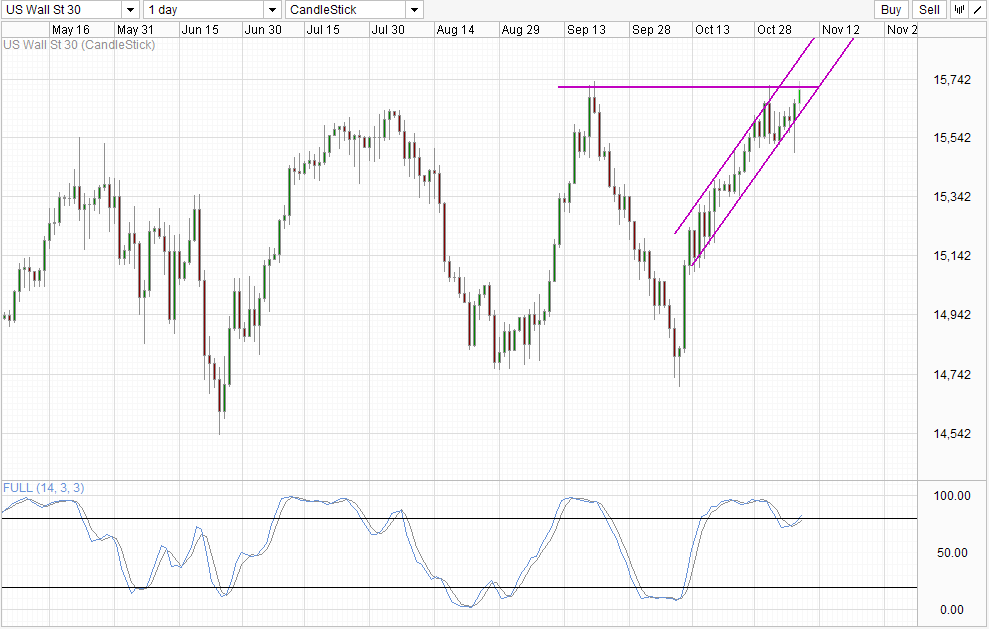

Daily Chart

It is interesting to see price action of hourly chart looking like a microcosm of Daily Chart. Prices are facing a resistance from a prior swing high. Similarly, a rising channel is in play while Stochastic readings were being Overbought recently as well. The only difference is that direction of Stochastic curve on Daily is pointing higher, unlike the ones in Hourly Chart. However, stochastic readings could still revert lower from here just like what happened back in early August 2013, which was the onset of the huge decline that sent prices from above 15,560 close to 14,750 when the move is over.

Considering that the risk of a QE Taper event in December persists, while fundamental reasons for price to push towards record highs are lacking (no QE taper is not a good reason for continued rally). The possibility of a strong bearish pullback is real, and traders should not automatically assume that more rallies will come forth following the latest record close.

More Links:

GBP/USD – Consolidates around 1.61

AUD/USD – Consolidates above Key 0.95 Level

EUR/USD – Recovers to Above Key 1.35 Level

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.