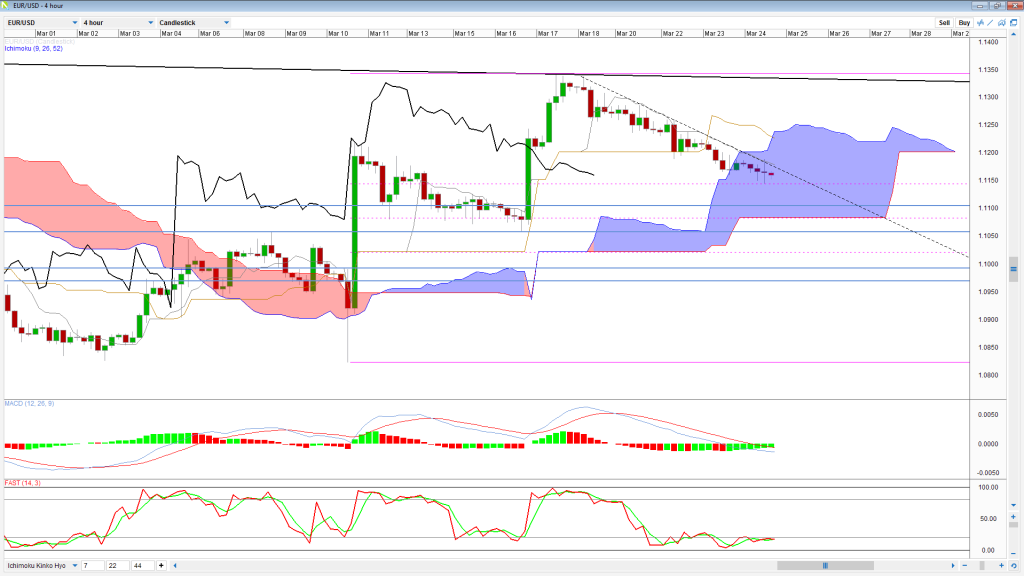

EURUSD is on course to extend its losing streak to five consecutive sessions today but despite this, it still appears to be in correction mode, rather than the early stages of a reversal.

The pair is currently finding support around 1.1140 – the 38.2% retracement of the move from 10 March lows to 18 March highs and the top of the Ichimoku cloud on the daily chart.

While this could be a logical reversal level if it is going to continue its push higher, I haven’t yet seen a convincing reversal pattern in the price action that would convince me the pair has turned bullish. A break above 1.1187 – resistance since yesterday afternoon on a number of occasions – may be that bullish signal.

If instead the pair rotates back to the downside, the next key level could be 1.1080. At this level, the 50 fib level coincides with the bottom of the Ichimoku cloud on the 4-hour chart and its bullishness will be truly tested.

This also lies within the cloud on the daily chart, which suggests it remains bullish and would represent a logical area for a reversal back to the upside.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.