On the day that Greece has struck a deal with its creditors on a new three-year bailout, the euro, to the surprise of many, is down heavily against the dollar and further declines may follow.

It seems logical to think that a positive result for the eurozone – albeit not necessarily for Greece but that’s another story – would be beneficial for the single currency. Especially when it has been hit hard on the open the last three weeks on rising Grexit fears.

Instead, it’s the dollar rather than the euro that is enjoying the greatest benefit, prompting the euro to fall back to 1.1050 against the dollar from 1.1186 where it traded prior to the deal being announced.

Why is this happening?

There will be a number of reasons touted for today’s move as to many people, it totally defies logic. Some may suggest it’s a case of buying the rumour (or in anticipation of a deal) and selling the fact, something that is quite common in the markets. Others may suggest that the deal isn’t all it’s cracked up to be and either won’t pass through parliament or is only delaying the inevitable.

In fact, it’s probably neither of these things. While these events can and sometimes do impact the fundamental outlook of a region and therefore its currency, this result doesn’t actually change too much and there hasn’t been any real evidence that a collapse in talks and Grexit have been priced into the euro at all.

Currencies react far more to changes in interest rate expectations and one thing this result did do is remove one of the two risk events that the Fed highlighted as being obstacles to rates being hiked this year. In other words, a Greek deal is hawkish for US interest rates which is dollar bullish.

What’s the technical outlook?

In recent months, EURUSD has looked a little more bullish but has at no stage really taken off. And since the middle of May, any rallies have been sold into before the previous high has had an opportunity to be breached.

It has also remained below the descending trend line – dating back to 14 July 2014, almost exactly a year ago to the day – and the 144-day simple moving average. These were tested once again on Friday and today and were once again protected.

The selling which has followed has created quite a bearish picture for the pair and if we can see a close below Friday’s opening level, it would be even more bearish still. It would also provide a close below the trend line support that makes up the flag (albeit an imperfect one).

Further support could be found below here around 1.10 but a more important support level will be 7 July lows of 1.0916. A break of this could then bring 27 May lows of 1.0820 into focus.

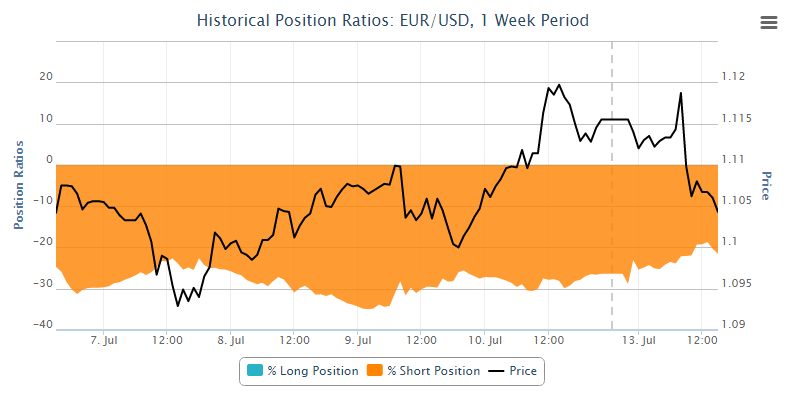

As you can see, OANDA clients were among those to be caught out by the surprise reaction to the news but were quick to get back on the right side of the trade. With certain support levels now being broken, it will be interesting to see if they will become increasingly bearish or are unconvinced by the move. They have been bearish for some time now and that appears to be growing once again.

*The above tools and many others can be found in OANDA Forex Labs.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.