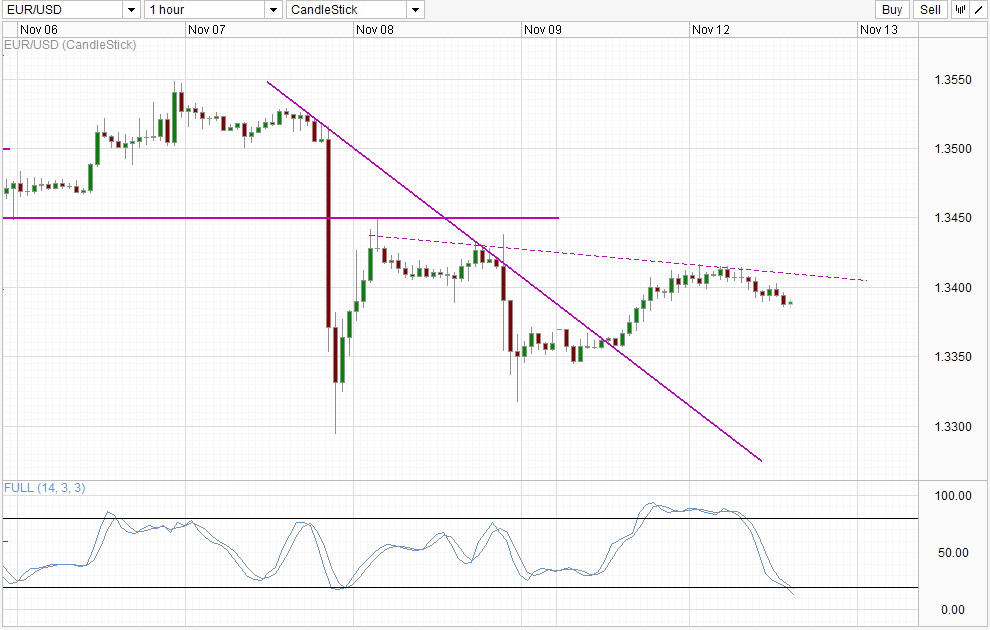

Hourly Chart

EUR/USD has recovered significantly yesterday, trading consistently above 1.34 by the time US session was over. However, there didn’t seem to be any fundamental news release that could have spurred EUR/USD higher, leading to the conclusion that yesterday’s rally was simply inspired by the inherent bullishness of EUR/USD further fueled by the break of the descending trendline during early European/late Asian hours. This would also explain why prices weren’t able to push much further beyond 1.34, as there wasn’t any catalyst available; technical bulls are running on their own in this one.

As a result, the likelihood of prices retracing back below 1.34 increases, and that is where we find ourselves currently, with prices is heading lower towards 1.337 resistance turned support. Similar to yesterday, there isn’t any major economic news scheduled that could inspire stronger bearish momentum. Latest comments by Fed Member Richard Fisher which reflected his support for a QE cut (he is voting in 2014) may drive USD higher and thus EUR/USD lower, but it is unlikely that much traction can be gain as he is a well known hawk within the Fed ranks. His latest comments are certainly not new, and market isn’t surprise that the Dallas Fed President vocal response against continued QE.

Hence, the likelihood of 1.337 holding becomes higher, and that is echoed by Stochastic indicator with readings that are already within the Oversold region, favoring an eventual bullish pullback towards 1.34 once again.

More Links:

Gold Technicals – Sliding Lower Gingerly

US10Y Technicals – Finding Support On 126.5

GBP/USD – Pound Lower in Thin Trading

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.