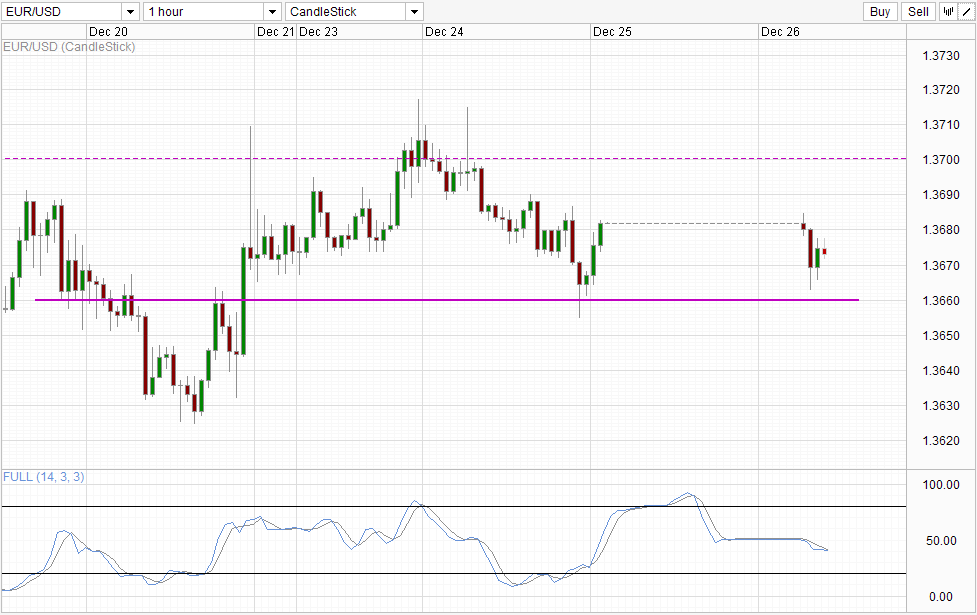

Hourly Chart

USD is not letting the holiday break affecting its stride. The Greenback strengthened when boxing day trading commenced, pushing against all major currencies including EUR, which shed slightly less than 20 pips from open to trough. If we ignore the empty candles on the chart, this morning’s decline seems like a continuation of the decline from 23rd Dec’s high. The fact that swing high today wasn’t able to match the previous swing high seen during 24th Dec US session suggest that previous bearish momentum remains in play, a notion that is seconded by Stochastic readings which have not hit the Oversold region.

However, traders should also note that prices did not manage to hit the swing low of the said US session on 24th Dec, and prices have since push back up above 1.367 soft support. Furthermore, Stoch/Signal line are converging and may even reverse soon. Hence, traders should not automatically assume that prices will be pushing lower immediately especially given that trading volume in the next few days will be low. A stronger bearish sign would be the break of 1.366 which will open up a possible move towards 1.3625 but even then traders need to be aware that any directional follow through during this week will be weak in during this period.

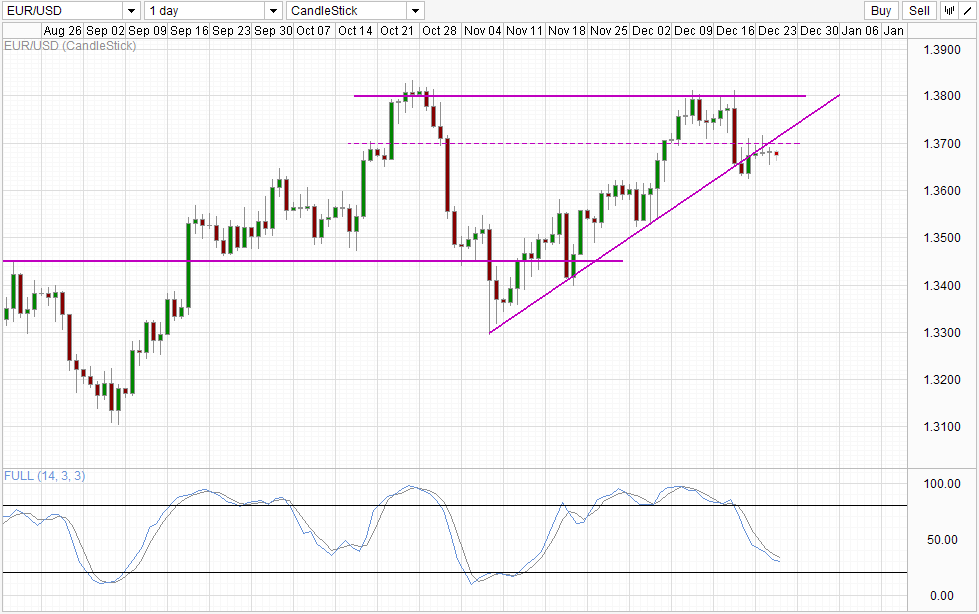

Daily Chart

Price action on the Daily Chart remain bearish as long as we stay below 1.37 and may even maintain slight bearish bias above 1.37 if the rising trendline remains intact. However, current bearish momentum may find support from 1.36 to 1.3625 as Stochastic readings are close to Oversold region, matching what Short-term chart is showing us.

Nonetheless, do not expect the short-term rebound to last long given the USD is expected to strengthen in 2014 while EUR may weaken as ECB remains highly dovish and have explicitly stated that negative interest rates are possible and a viable option if required. All these may simply be bravado from ECB that may not be called upon, but considering that EUR/USD has been rallying in the past month, it is clear that market has not really priced in a dovish ECB scenario, which gives us plenty of downside potential should ECB does ease again in 2014 (either via liquidity injection ala LTRO style or via interest rate cuts). Also, from a pure economic strength perspective, US is doing head and shoulders better than Euro-Zone, and that in itself should favor a lower EUR/USD moving forward before we even consider Central Bank actions.

More Links:

GBP/USD – Pound Shrugs Off Sharp US Data

USD/CAD – Loonie Holds Firm Despite Sharp US Numbers

AUD/USD – Rangebound As Markets Eye Key US Releases

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.