EUR/USD traded lower early Monday morning despite a broad “risk on” sentiment which saw Asian stocks indexes trading mostly higher. Furthermore, we have good news last Friday from Moody’s which has upgraded Spain’s sovereign rating one notch higher to Baa and changing the outlook to “Positive”. This may not really be impactful as Moody’s upgrade is most likely a rubber-stamping of approval from the credit rating agency after market has shown its support for Spanish sovereign debt by way of driving interest yields lower. Nonetheless, this shouldn’t be a bearish driver for EUR, and hence it is interesting to see such price action happening.

Perhaps market is placing more weight on the rhetoric spoken by ECB’s President Draghi over the weekend, who said that the central bank will be ready to introduce additional stimulus if ever needed. This may have triggered bearish fears in EUR as more stimulus should drive EUR lower due to additional liquidity flooding the market. However, this behaviour was seldom observed, as past stimulus plans (not rate cuts) have resulted in gains for EUR/USD as market became more confident about holding EUR believing that ECB will never let the EUR fail. Hence, the notion that additional stimulus result in weaker EUR is not readily established. Furthermore it should be noted that other risk currencies such as AUD, NZD and GBP are all currently trading lower against the Greenback, with declines even more aggressive than EUR/USD. As such, what we could be seeing right now may be more USD strength related than purely EUR weakness.

Hourly Chart

Technicals suggest that EUR/USD is currently under bearish pressure, with Friday’s rally unable to break the descending trendline that has been in play since 19th Feb. However, there should be ample support found around 1.3725 where prices have also rebounded from on Friday. Given that EUR/USD is not the most bearish amongst the major USD pairs and there isn’t anything fundamentally weak about EUR (at least in the short-term), a rebound off 1.3725 higher towards descending trendline may be more likely compared to a break of 1.3725 on current bearish momentum.

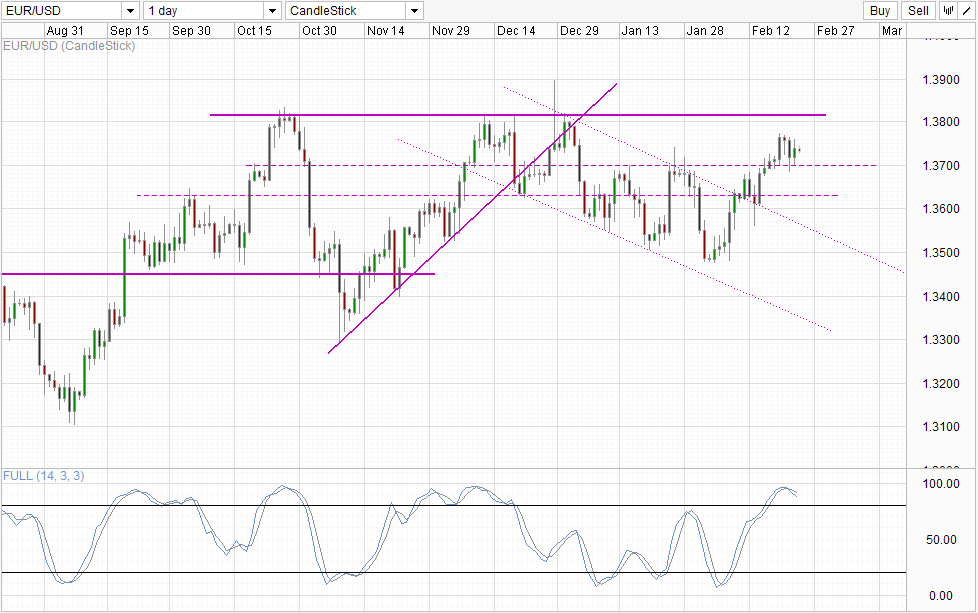

Daily Chart

Daily Chart is slightly bearish for now but there is still no clear definition where prices is heading as the possibility for both higher and lower scenario remains open. Bullish cycle can still be regarded as in play as we stay above 1.37 with 1.3815 as a viable bullish target. On the other hand, we may have already seen a top in EUR/USD with Stochastic readings are currently pointing lower yet we’re still above the 80.0 level – suggesting that a bearish cycle is coming but we’re still short of a proper signal. Given the same lack of bullish/bearish conviction in S/T price action, trend traders may need to wait a while more before a significant move occurs. The corollary implies that S/T swing traders may have a better time in the interim.

More Links:

Week In FX Europe – BoE Is The Leading Contender

Week In FX Americas – Loonies Takes A Brief Flight

Week In FX Asia – CB’s Dictate Their Domestic Currency Moves

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.