The Euro traded lower against Greenback yesterday following a slew of weaker than expected economic data released during European hours. First off we have German Trade Balance which came in at 18.1B vs 18.9B expected, while growth in German Exports have fallen short at 0.3% vs 0.8%, but that is not as bad as Imports which actually shrank 1.1% amidst expectations of 0.7% growth. Besides Germany, we have unemployment numbers from Italy which was also worse than expected and perhaps more importantly worse than previous month. Euro-Zone unemployment rate was next, staying at 12.1% – a stubbornly high level that has stayed since April. Once again, despite all the talk of a Germany led European economic recovery, actual numbers suggest that the situation isn’t that much better as compared to 1 year ago.

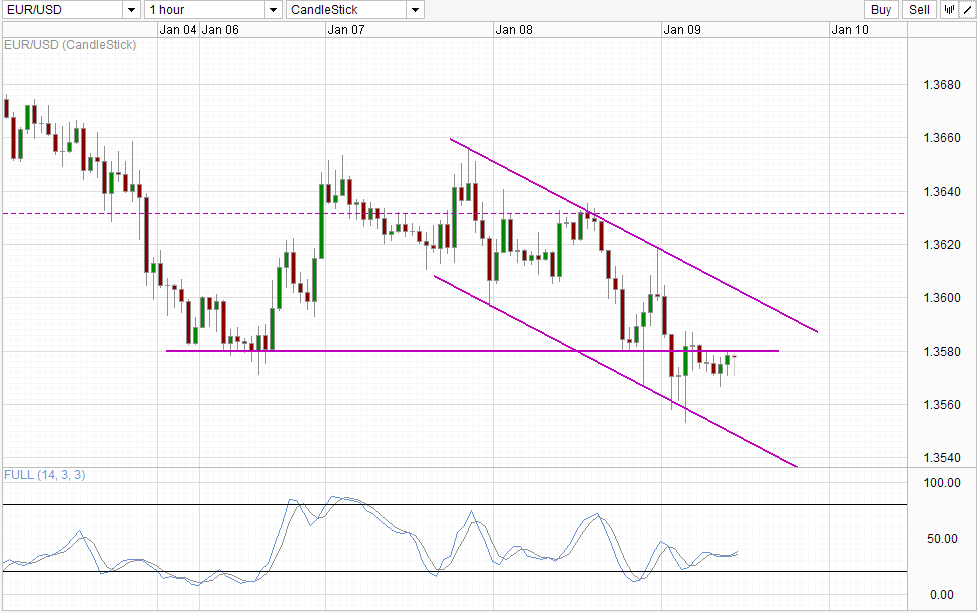

Hourly Chart

The bearish news collectively sent EUR/USD from 1.363 to a low of 1.358 during European hours, ignoring the better than expected Euro-Zone retail sales and German Factory Orders that were released a couple of hours after the slew of bad news. However, it is likely that the bearish push was not pure fundamentals alone, with prices already started declining during early European hours following a bearish rejection off the descending Channel Top. The degree of technical influence can be seen when prices rebounded off 1.358 and started to climb despite being the most aggressively bearish when the stronger economic news were released. This strong technical influence is also observed in subsequent price movement where prices rebounded off both Channel Top and Channel Bottom during US trading session.

Given that overall short-term bias remain bearish, the likelihood of 1.358 resistance holding is higher, and a move towards Channel Bottom once again is possible in the near term. Pushing below Channel Bottom right now seems less likely given that Stochastic levels will most probably be within Oversold region when that happens.

As a side note, it should be noted that EUR/USD actually ended up higher when the ADP employment numbers are released. This highlights once again that supposed taper fears is not in play, as the opposite would imply that USD would trader stronger and thus EUR/USD lower. Similarly, the supposedly “hawkish” Fed minutes that was released at 3am SGT (which the chart is based on) resulted in higher EUR/USD once again, echoing that the talks of heightened taper fears driving market lower is simply incorrect.

Daily Chart

On the daily chart, bearish pressure is building. We have an Evening Star bearish reversal candlestick pattern forming under the 1.363 key resistance level – confirming the Triple Top pattern that would open up 1.31 as ultimate bearish target. However, Stochastic readings remain deeply Oversold, and dampens the possibility of a strong bearish follow-through from here out. Nonetheless, short-term pressure is bearish and that could help nudge prices lower and allow the Stochastic Oversold status to be ignored (since Stoch indicator tend to be less reliable during strong trends). This becomes even more likely should current candle close below the spinning top candle on 6th Jan and preferably below the swing low of 7th Jan.

More Links:

GBP/USD – Pound Gains Ground After Strong US Employment Data

USD/CAD – Loonie Slumps As Pair Tests 1.08

AUD/USD – Little Movement As ADP Non-Farm Payrolls Shines

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.