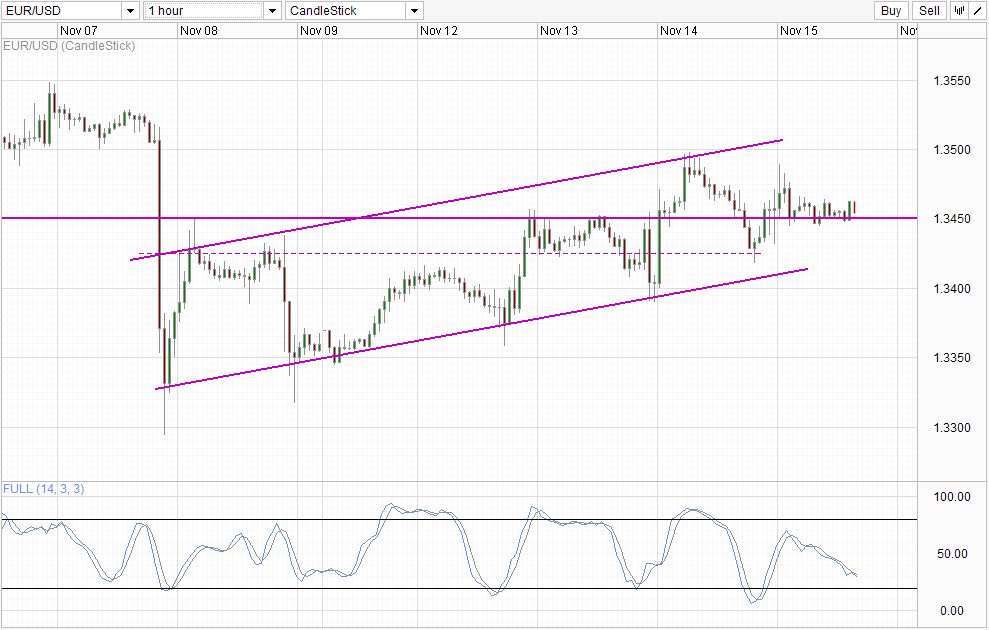

Hourly Chart

EUR/USD traded lower after the failed test of 1.35 yesterday. Prices broke 1.345, but managed to find support from last Friday’s ceiling and subsequently pushed higher during US session. As prices did not really test Channel Bottom during the decline, it remains to be seen whether this Channel is valid (as Channel Top only has 2 point of reference, and neither looks “clean”). Hence it may be slightly unfair if we consider bulls for being “weak” for not being able to test Channel Top. Not that it matters though, as we can still fault bulls yesterday for their failure to hit previous swing high even though USD was weakened following Janet Yellen’s testimony to US Senate for her confirmation as Fed’s Chairperson. Prices are currently staying above 1.345 now, but the sequence of higher highs and higher lows that started this week is broken, reflecting slight weakness in current bullish run.

With Stochastic readings pointing lower, momentum is still bearish for now. Should 1.345 breaks, price will likely seek out the lower trendline for support. As stochastic readings will likely be oversold should that happens, a rebound scenario should be more likely accordingly. But given that the previous strong underlying bullishness of EUR/USD is weakening, and given that the fundamental reasons for long-term USD decline is weak (market may have overreacted to Yellen’s “dovish” comments), it would not be surprising if prices breaches the lower trendline and hit 1.34.

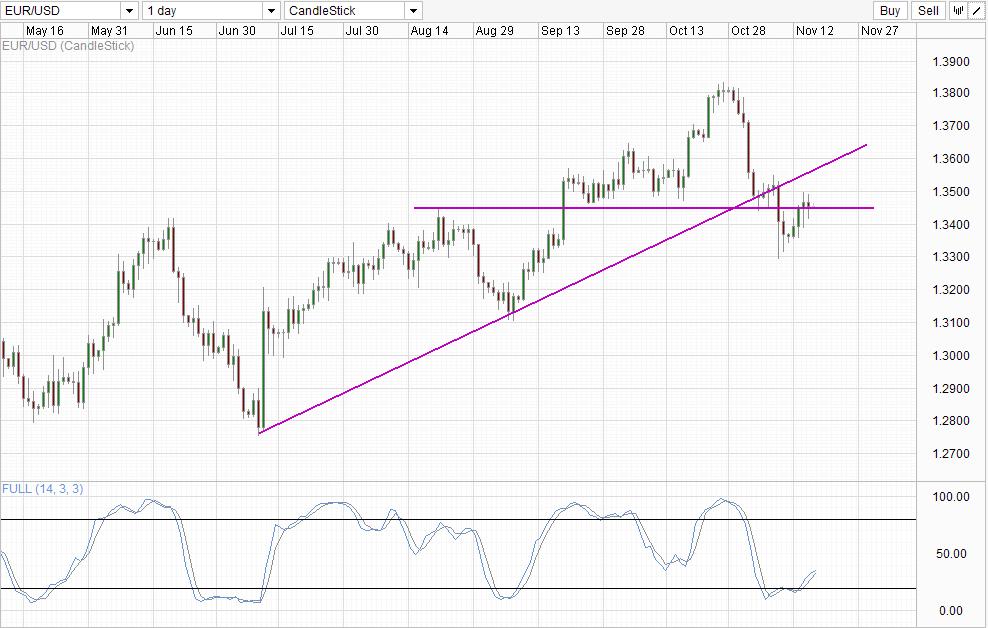

Daily Chart

Long-term trend is not exactly clear. Even though short-term chart tells us we are trading above 1.345, this observation is not apparent on the Daily chart, and we may need further confirmation for a push towards the rising trendline. Even though Stochastic readings are pointing higher fresh off a Bullish Cycle signal, Stoch curve has a “resistance” of its own around 40.0. This echoes the need for further bullish push from here in order for stronger bullish conviction. Should 1.345 fails, 1.330 opens up as the bearish target, but the long-term uptrend will still be intact, and only a break of 1.31 will negate the bullish bias.

More Links:

S&P 500 – Bullish Breakout But Fundamentals Sketchy

US10Y – Higher Risk of Bearish Pullback Than Stocks

GBP/USD – Pound Keeps Rolling, Shrugs off Weak Retail Sales

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.