The euro has been boosted against the dollar since last Friday following the release of the US Q2 GDP data that delivered a hammer blow to rate hike chances and therefore the greenback.

The moves that followed took the pair through the 1.1150 resistance that it had traded primarily within for the month prior to the data and further upside may be on the cards.

The pair broke as high as 1.1240 yesterday – a prior level of support – before heading back to the level that had provided so much resistance over the last month. How the pair reacts at this level could offer great insight into where it’s headed next.

OANDA MP – Dollar Bounces Ahead of Data (Video)

It’s also worth noting that the 50 fib level – 7pm 28 July lows to 2 August highs – also falls within this previous resistance zone, which could offer further support.

Should it find support at this once important resistance level, it would act as confirmation of the initial break and could trigger another rally in the pair.

If this does happen then the first key obstacle to the upside would be yesterday’s highs, followed by 1.13 which has been a notable support and resistance level in the past.

GBP/USD – Cable Ticks Higher as Services PMI Matches Estimate

That said, confirmation of the break at 1.1150 would indicate to me that the market has turned much more bullish on the pair and suggest a move higher could be on the cards. If so, we could see 1.14 and even 1.15 tested in the coming weeks, something we haven’t seen since the Brexit vote.

It’s worth noting that this appears to be primarily a dollar driven move and so if anything changes from a dollar perspective, be it a strong jobs report on Friday or hawkish commentary from Fed officials for example, this moves could be quickly reversed.

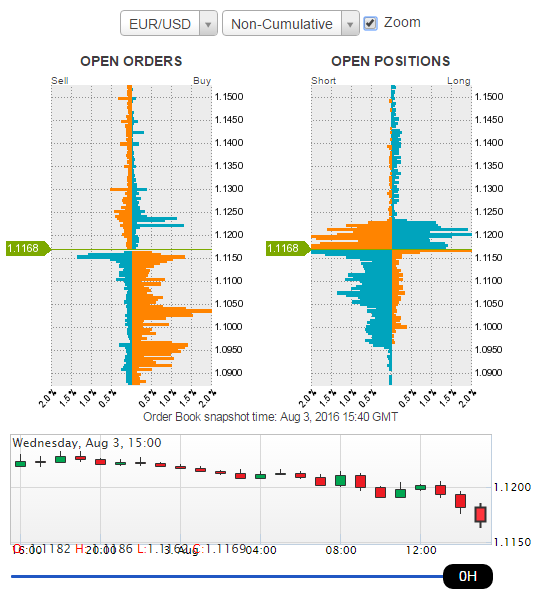

As you can see from the OANDA Forex Order Book, below, there are a large number of pending buy and sell orders around the 1.1150 level which suggests this is going to be a key level of interest.

This and many other tools can be found in the Forex Labs section of the OANDA website.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.