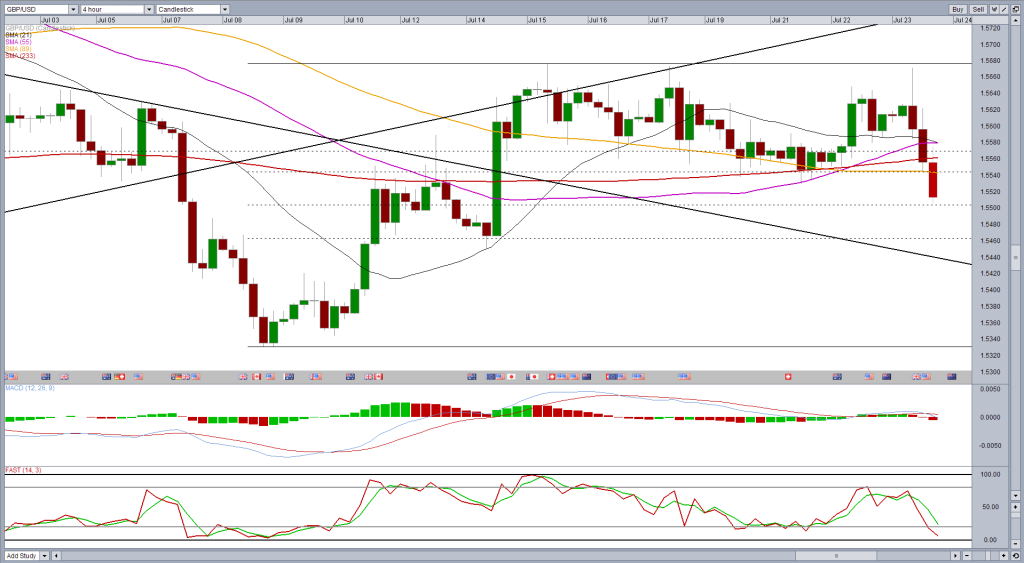

As highlighted yesterday (GBPUSD – Possible Morning Star on Key Support), cable was starting to look more bullish again following a week or so of consolidation and, despite threatening not to at times, the morning star formation was completed.

This was followed by a bright start to the trading session today, with the pair rallying towards the highs from 15 and 17 July and looking like threatening a break above them.

With UK retail sales data being released this morning, it was not surprising to see the pair consolidate ahead of the number and even then, it formed a flag, a bullish continuation pattern.

Unfortunately, the number was much worse than expected and given how important the consumer is to the UK economy and maintaining spending is to the inflation outlook, it was not surprising to see the pound plummet on the number.

It’s worth remembering that the pound has performed well recently as the Bank of England has suddenly become much more hawkish with Governor Mark Carney suggesting recently that a hike could possibly come as early as the end of this year. This is well before the middle of next year which had been suggested previously. Clearly, anything that threatens to push this back again is bearish for the pound.

From a technical standpoint, the picture is looking much more bearish now and if the pair ends the day below yesterday’s open, it will create a bearish engulfing pattern on the daily chart.

At the moment, the pair is finding support around 1.55, a previous level of support and resistance and the 50% retracement of the move from 8 July lows to 15 July highs. If this is broken, further support could be found around 1.5450-1.5460 – 14 July lows and 61.8 fib level – although given today’s move, this may no longer be as strong as support as it would without it.

If this is broken, it will be interesting to see how the pair reacts to the 89-day simple moving average which for quite a while now has been a key indicator of bullish and bearish bias.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.