Nikkei 225 prices have stabilized after the huge sell-off last Friday. This is actually a good sign for bulls as it is clear that Asian traders are not as bearish compared to the US traders, or at the very least they are not more bearish than their US counterpart.

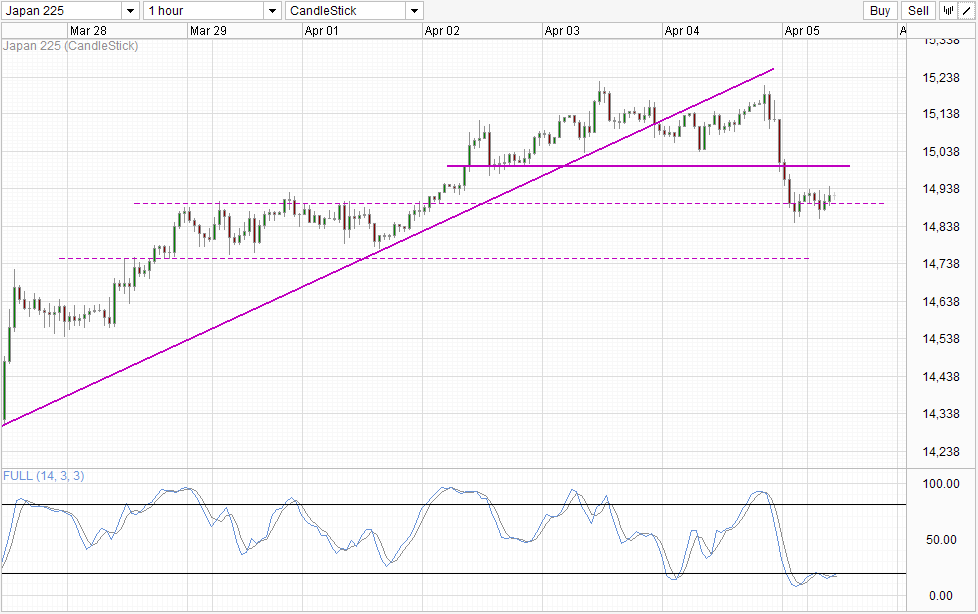

Hourly Chart

This would imply that prices may be able to recover and go back up to 15,000 round figure. Even if prices break current support of 14,900, it is unlikely that we will see strong bearish follow-through as prices will likely find support around 14,800. Stochastic readings agree as Stoch curve is within Oversold region currently, favoring a bullish cycle moving forward which suggest that a bullish push higher may be possible.

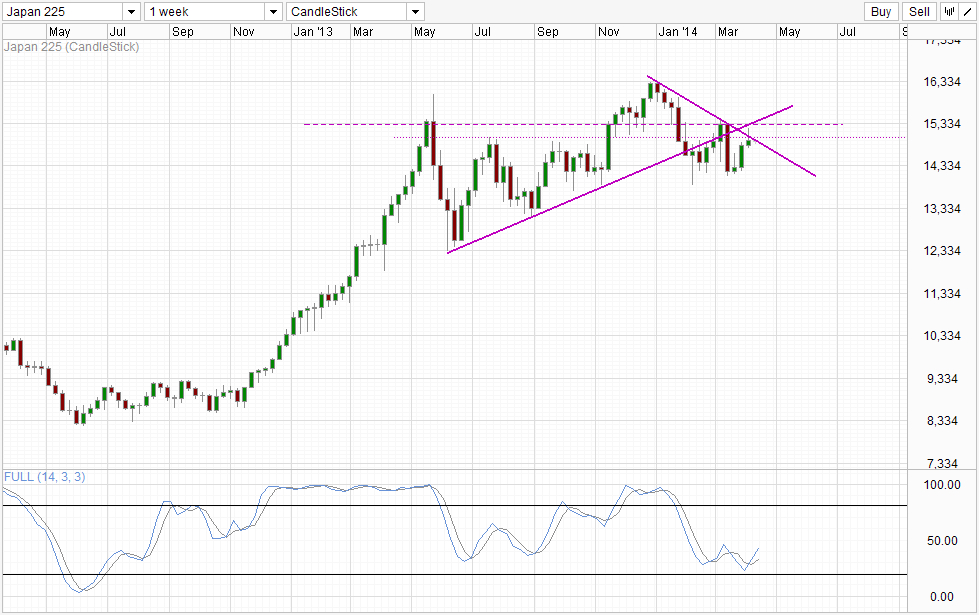

Weekly Chart

Weekly Chart is less optimistic though, with last week’s candlestick having the possibility to be a bearish reversal candlestick. Furthermore, prices appear to have been rejected by the rising and descending trendlines, and the same could be said about the 15,280 resistance and 15,000 round figure line. However, long-term wise it is also unlikely that prices may go down all the way as broad trend is bullish – increasing the likelihood of support levels such as 14,000, 13,300 and 12,300 holding. Furthermore, Stochastic indicator is fairly close to the Oversold region, increasing the likeilhood of a bullish rebound when any of the aforementioned support levels are touched.

Fundamentally, it should also be noted that traders remain optimistic about the Japanese economic outlook. Also, rightly or wrongly these traders are also expecting Central Bank BOJ to implement the next round of stimulus package that will help to send asset prices even higher. The latest rumor mill suggest that Bank of Japan will double their ETF purchases in the next round of stimulus expansion which will be announced during their monetary policy meeting tomorrow. If this indeed is true, it is likely that Nikkei 225 will start climbing back up and the recent swing high reached at the start of the year will be a viable bullish target. On the other hand, even if BOJ doesn’t announce any additional stimulus package tomorrow,we could still see prices staying supported as that is the nature of over-optimistic speculators just like how US stocks continued to rally time and time again despite FOMC not announcing QE3 during early 2012.

Does that mean you should join in the bull run? This is entirely up to your risk appetite. It bears remembering that global stock prices are extremely overbought right now with P/E ratios hitting recent record highs. Also, leverage levels have increased significantly, topping the levels seen before the 2007 financial crisis. Hence, to say that current prices are running on borrowed money (and borrowed time) is under stating it, and eventually we may see a strong bearish reversal coming soon. How soon? Nobody knows exactly but this would be the risk that traders need to be mindful of moving forward. Certainly the upside is strong, but downside are equally and may even be more aggressive should it materialize.

More Links:

Gold Technicals – Staying Above 1,300

Week in FX Europe – Draghi Hits Back At IMF Low Inflation Expected

Week in FX Asia – China Adds Stimulus as Japanese Tax Hike Arrives

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.