Bulls have managed to claw back a huge portion of losses suffered yesterday. The sell-off occurred following a failed push to break 0.834 resistance during early European trading session which was exacerbated by broad “risk off” appetite during the same period. It is likely that technical pressures from the break of 0.832 soft support added wind to the sails, sending prices to a low of 0.8282.

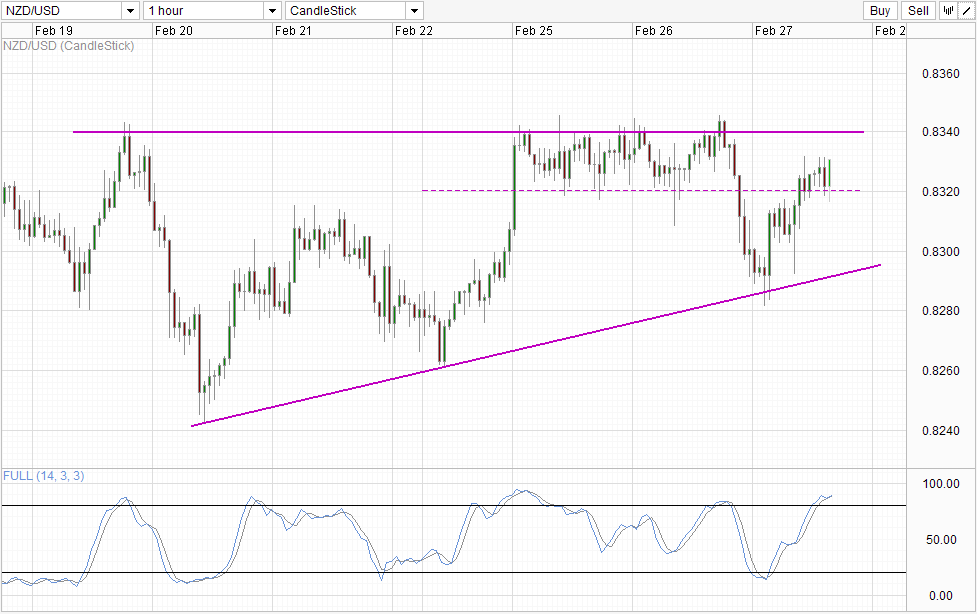

Hourly Chart

Prices did not stay low for long though, as NZD/USD bulls sent prices back up quickly, in part due to technical bulls pushing from the rising trendline, giving the impression that bullish sentiment is alive and well despite the decline. This impression is further strengthened when prices climbed higher after the Trade Balance numbers for Jan was released earlier this morning. Latest Trade Balance figures was better than expected at 306M, but it should be noted that this figure is a huge cut from previous month’s 493M. Furthermore, exports has actually fallen from 4.75B to 4.08B, and the only reason why trade balance improved was due to a larger fall in imports. As such, it is hard to classify the trade balance numbers as bullish – and the fact that prices still managed to climb up higher subsequently is a testament to the bullish sentiment.

Given the bullish strength, it is not unreasonable to think that price may still test 0.834 resistance even though Stochastic readings suggest that current rally may be Overbought. However, breaking above 0.834 will be another issue altogether and the likelihood would be lower considering the strong bearish reprisal yesterday after the failed attempt to break it.

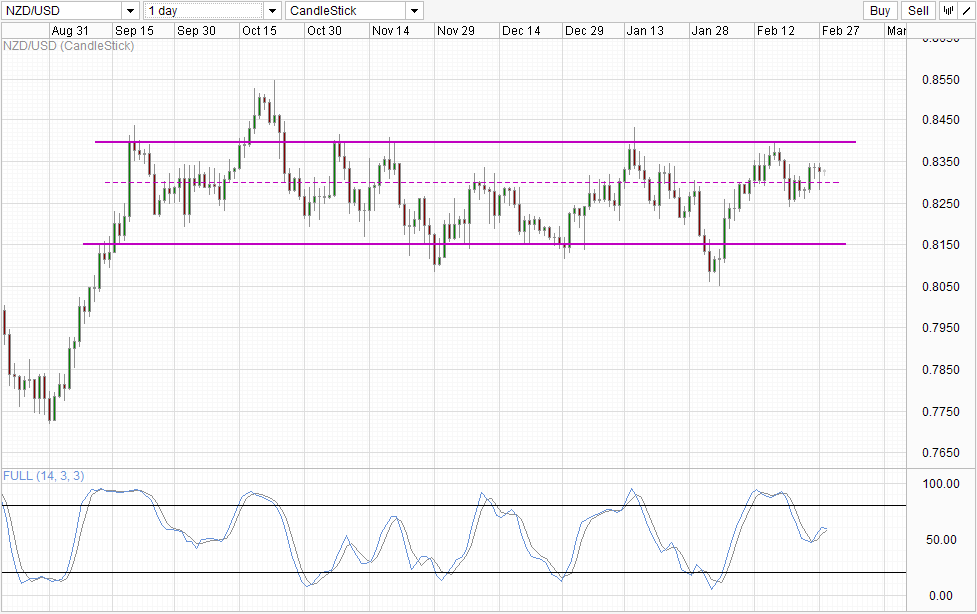

Daily Chart

Nothing much to be said on the Daily Chart. Sideways is the name of the game now, and even though heading towards 0.815 is preferred, it is equally likely that prices can simply stay in limbo or even move up higher within the sideways band. As such, traders should seek confirmation before automatically assume that a move towards 0.815 has started.

Fundamentally, NZD continues to exhibit bullish strength as Central Bank RBNZ is expected to raise interest rates soon. The strength of NZD is even clearer when we compare it to neighbours AUD which has suffered a torrid session against USD in the past 2 days. However, USD strength is also something that we should not ignore, and that will continue to shackle any bullish potential of NZD/USD. Traders who wish to play NZD’s strength may hence wish to look at other NZD crosses such and not pair it with another strong currency.

More Links:

GBP/USD – Receives Solid Support at 1.66

AUD/USD – Continues to Trade Around Key 0.90 Level

EUR/USD – Drops Sharply Below Key Level of 1.37

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.