Kiwi Bulls must be humming to the tune of Ain’t Nothing Gonna Hold Me Down by Men At Work. Certainly nothing seems to be break their stride right now. Not US Stocks that is pulling back slightly after yesterday’s rally; not the strengthening USD which has dragged majors such as EUR/USD, GBP/USD and AUD/USD lower this morning; and certainly not a worse than expected Building Permits that came in -8.3% versus -3.5% estimated.

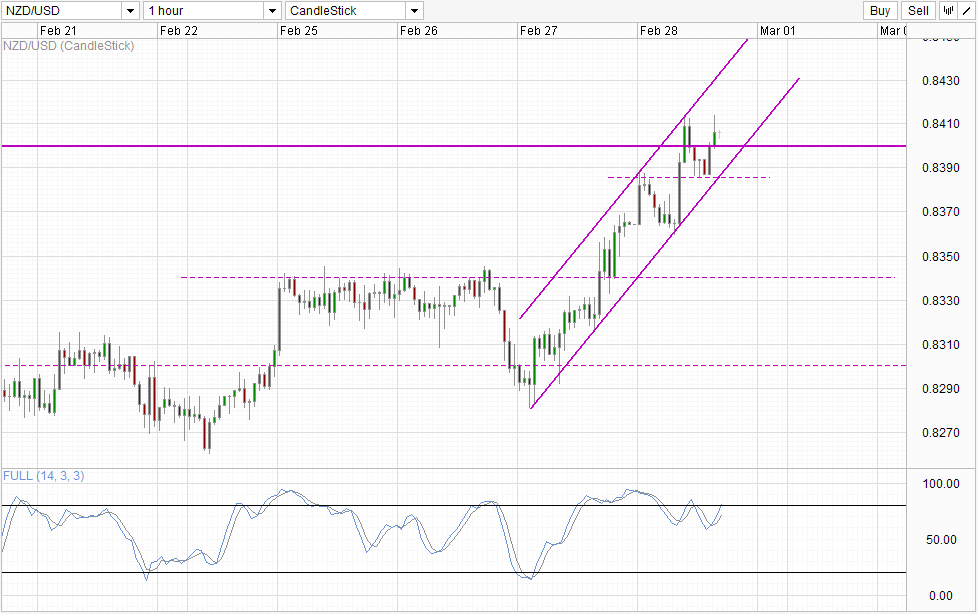

Hourly Chart

Instead, prices climbed sharply during Asian hours, climbing all the way above 0.841. Even though there was a temporary setback, bullish pressure remained intact as prices stayed above the soft support of 0.8385 which was marked by yesterday’s swing high. Given all these, a move back towards Channel Top may be possible in the short-term, and we could see a newer weekly high being made later today. That being said, the possibility of a Channel Top break is unlikely as Stochastic readings tell us that momentum is already Overbought. Furthermore, as this is the final day of trading for Feb and the last day of the week, it is unlikely that strong trends will develop. Instead, there is additional downside risk as traders will have a higher tendency to take profit and close out their positions – increasing the chance of a pullback towards the end of the day.

Hence, traders who wish to go long right now may face higher risk of getting underwater, while upside may be limited. Conservative traders may wish to wait for Monday’s cues to determine if bulls will be able to continue their stride. Therefore, the best case scenario would be seeing a pullback later but having price staying around 0.84 this week followed by a strong bullish push early Monday morning and that will give confidence for bulls to enter.

Daily Chart

Daily Chart shows promise of a potential 0.84 break but we are only at the infant stages right now, as prices have yet to overcome the swing high seen in Jan. Preferably price should push above the swing high and above 0.845 resistance to strengthen bullish conviction, but ideally true bullish extension will only occur when the swing high of Oct 2013 has been overcome, and right now we’re still a fair distance away from that. Stochastic readings are close to the Overbought region, decreasing the likelihood of prices flying all the way up without experiencing any pullbacks in the interim.

Fundamentally, with RBNZ rate decision coming soon, it is possible that traders are ready to load up NZD in anticipation for the much awaited rate hike. If this is the reason for NZD/USD current bullishness, then it is unlikely that current bullish pressure will be able to last for long as bullish pressure will may dissipate post RBNZ’s rate decision no matter what the outcome is. Should the central bank hike rate as expected, we could see potential buy the rumor sell the news behavior. If RBNZ keep rates flat, speculators will be disappointed and will start to unload NZD positions, sending prices lower. This may not derail the long-term uptrend of NZD, but will definitely impact the NZD/USD bullish potential in the coming weeks.

More Links:

GBP/USD – Dealing with Resistance at 1.67

AUD/USD – Trying to Claw Back to Key 0.90 Level

EUR/USD – Regains Lost Ground back above Key Level of 1.37

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.