Are the bulls back? Early signs are good. S&P 500 grew 0.38%, while Dow Jones Industrial Average managed to stay in the black albeit barely at +0.06%. Nasdaq 100 was the most bullish with a 0.87% gain, in line with historical trend which expects the Tech heavy index to gain the most followed by S&P 500 and then DJI during bullish trends.

However, the verdict remains out as there is a high possibility that yesterday’s rally may simply be a dead-cat bounce following the sharp declines seen in the previous 2 trading days. Furthermore, as there isn’t any economic news releases that could have changed broad market sentiment, the risk of this being just a technical rebound becomes even higher.

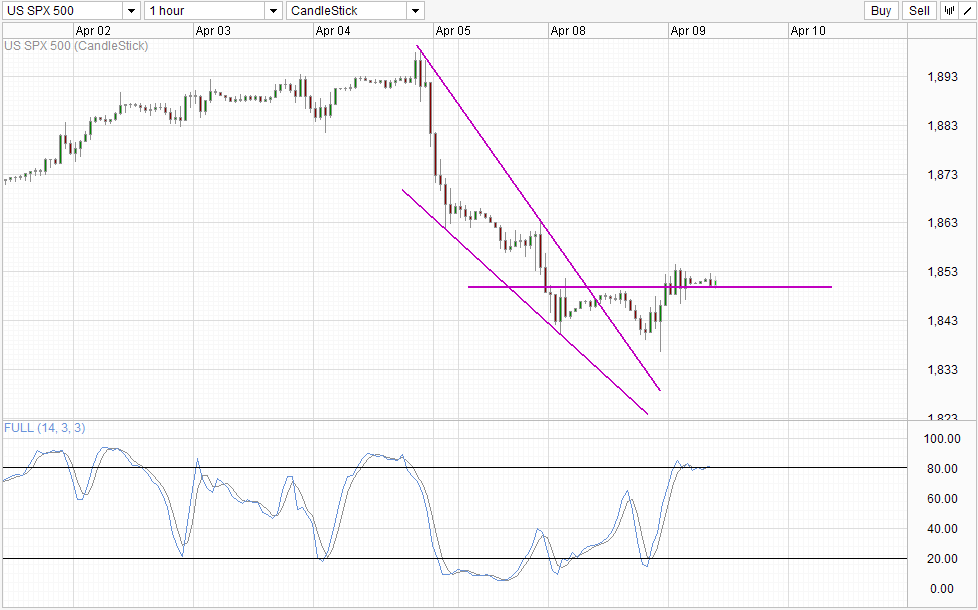

Hourly Chart

Price action on the Hourly Chart echoes the same message. Stochastic readings are straddling the 80.0 line, suggesting that a bearish cycle signal may not be that far away. Also, even though we have cleared the 1,850 significant level, S/T pressure remains highly bearish below 1,865. As such, do not be surprised that prices if prices do head lower from here out.

That being said, bulls can still remain cautiously optimistic as bearish momentum is clearly taking a break as price has since broken away from the descending wedge. Broad risk appetite appears to be recovering as well, with Asian stock indices (baring Nikkei 225) making decent gains across the board. As such, even if current rally may prove to be a slight respite, we should still be able to expect some slight gains moving forward or at the very least see S&P 500 prices staying afloat for a while more before the next leg of bearish sell-off happens.

Daily Chart

Daily Chart is more bullish than Hourly Chart. Early signs suggest that a move towards Channel Top will be possible, while Stochastic indicator appears to be slowing down, potentially reversing around the levels last seen in mid-March when prices similarly rebounded off Channel Bottom similar to today. This increases the likelihood for prices to push towards Channel Top, keeping uptrend intact.

However, all these doesn’t help to alleviate fundamental concerns one bit. Stocks are still overbought at over-inflated prices, driven largely by borrowed money. Hence, even if the recent sell-off fail to evolve into a deeper bearish correction, significant downside risks will continue to hang around like a monkey on our back. This will likely translate into sharp declines whenever there’s weakness seen in bullish, and bulls will likely be able to pick up the pieces if market euphoria remains in play. This outlook is similar to price action seen since mid-Feb where there’s strong volatility and slight overall bullishness.

More Links:

GBP/USD – Pound Soars After Sharp UK Manufacturing Data

AUD/USD – Strong Gains By Aussie Despite Weak Business Confidence Numbers

USD/JPY – Yen On A Roll After Upbeat BOJ Comments

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.