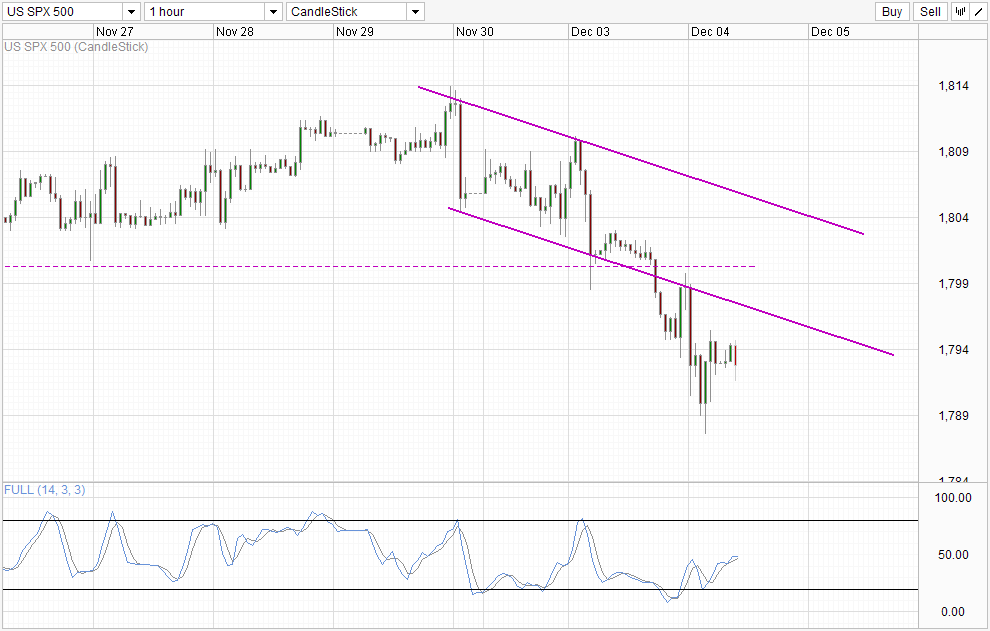

Hourly Chart

US Stocks fell for a third consecutive day with S&P 500 shedding 0.32%. The decline has once again been attributed by many analysts to QE taper fears with yet more bullish economic news supporting tapering action by the Fed. Latest ISM New York came in strongly at 69.5 vs previous month’s 59.3, while IBD/TIPP Economic Optimism has grown from 41.4 to 43.1, beating expectations of 43.0.

However, just like yesterday, this does not seem like a good explanation considering that S&P 500 prices actually rallied during the 1st few hours of US market session – around the time when the above 2 economic numbers were released. If the assertion that QE Taper fears are pushing price down, we should have seen an immediate bearish reaction and not a bullish one.

Instead, looking at price action, explanation via technical analysis may seem more reasonable. From pure technical price action alone, we can see that prices were already inherently bearish trading within a descending channel. Reasons for this short-term bearishness may be due to the lack of bullish conviction/follow-through with the FOMC meeting looming coupled with the fact that it is the final month of 2013, where trading volumes tend to drop with most of the traders going on vacations. This give room for bears to play in the interim, resulting in the slight bearishness.

Looking at Futures prices, the large bulk of bearish acceleration took place with the break of 1,800 support and when the break of Channel Bottom is confirmed just before New York noon, affirming the hypothesis that prices are being more technically driven currently. If this is true, then it would mean that the likelihood of prices rebounding off Channel Bottom may happen when US session come into play again later is high, potentially leading to yet another day of loss for S&P 500.

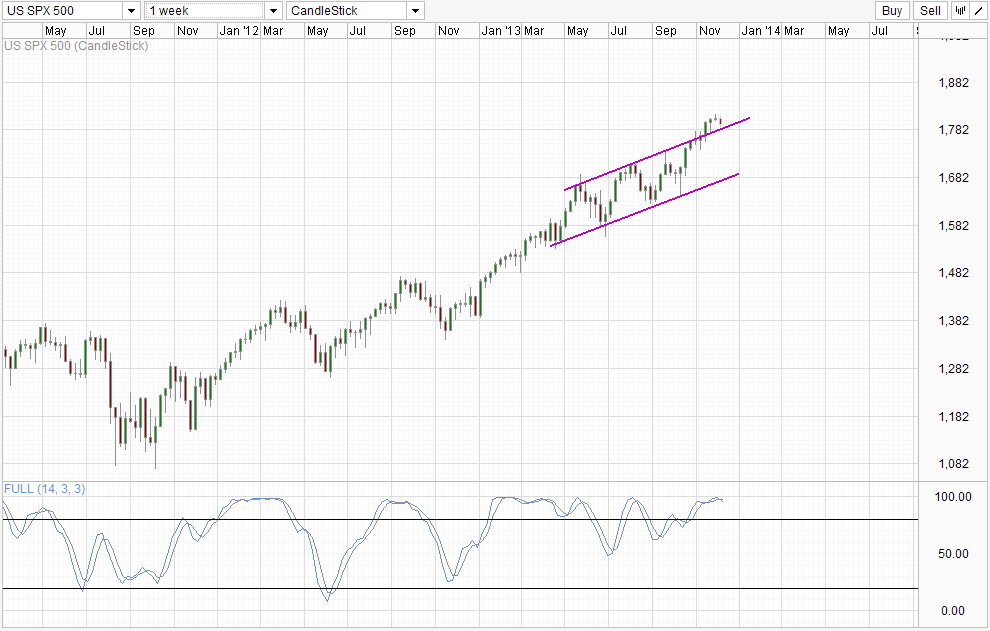

Weekly Chart

However, looking at weekly chart, it should be noted that prices may not go too far south with Channel Top providing support. Furthermore, it is unlikely that bearish conviction face the same problems as the bulls – where trading volume is low and conviction unlikely to be strong enough to bring price all the way to Channel Bottom by the end of this month. Also, December has been noted to be a bullish month with the Christmas Rally effect, which will provide additional support against strong bearish push.

Hence, the outlook in the short-term is clear – bears may be in force right now, but we could see bulls taking over sooner rather than later especially given the strong bullish uptrend seen via Weekly.

More Links:

EUR/USD – Finds Support at Key Level at 1.3550

AUD/USD – Continues Drive Towards 0.90 with Three Month Low

GBP/USD – Pound Gains as Construction PMI Jumps

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.