US Stocks hit new highs yesterday following comments from the Fed Chairperson nominee Janet Yellen. The current Fed Vice Chairperson suggested that stimulus will continue for as long as the economy remain fragile, but deny that current asset prices are “bubble-like”. Nonetheless, Yellen agreed that current $85 billion monthly purchases “cannot continue forever”, suggesting that a tapering event is still a go eventually, with the question of when still in the air.

This is nothing new to be honest, and in fact Yellen’s comments during the Q&A yesterday was of a much more neutral/balanced tone versus her prepared statements which was released on Wednesday. Hence it is interesting to see that market entered into a bullish frenzy, interpreting her words as confirmation that QE 3 will continue indefinitely and perhaps well into 2014. It seems that market just want to hear what they want, and this opens up a real danger of strong bearish pullback in stocks should the Fed introduce a firm timeline in December, or taper in early 2014.

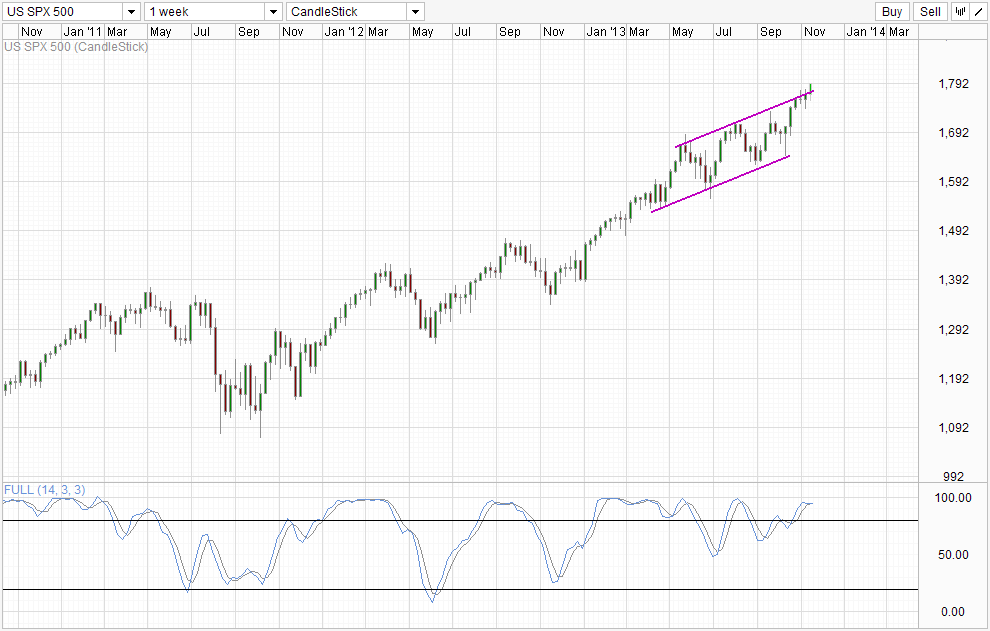

Weekly Chart

Nonetheless right now, bullish momentum is definitely riding high, which means that fundamental traders who want to play the downside risks mentioned above will be going again broad bullish momentum, not a great proposition as market can definitely stay solvent longer than any of us can (unless your last name is Buffett). Furthermore, price has just broke the Channel Top that has kept bullish momentum in check, suggesting that further acceleration higher may be possible. Hence to short S&P 500 right now will be extremely risky. You may be right eventually but the drawdown will be huge as well.

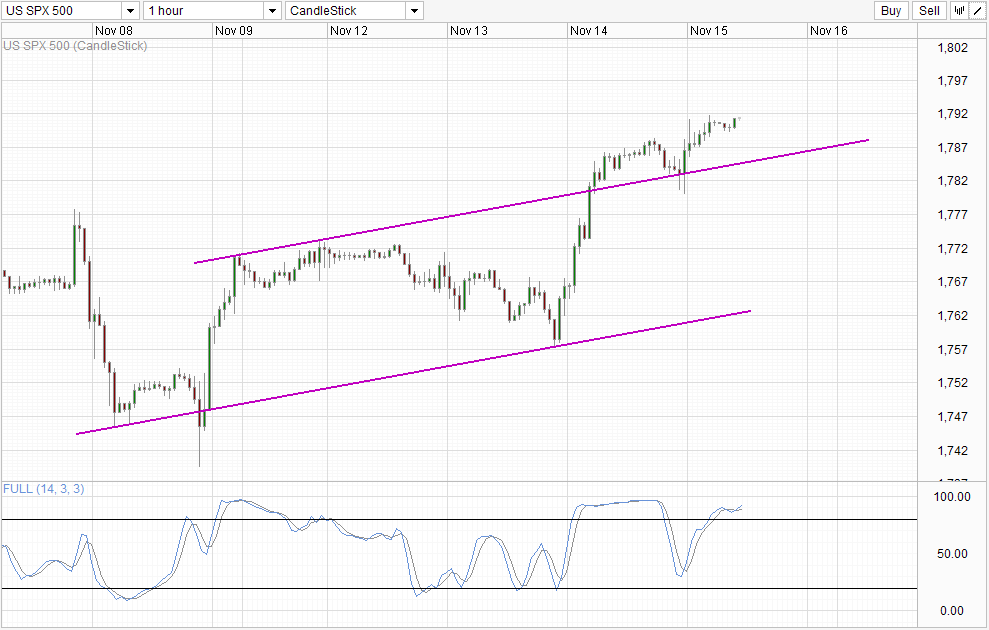

Hourly Chart

Bullish momentum is also strong on the short-term, with prices similarly breaking its own Channel Top. Right now there is very little point of reference as S&P 500 is at its record high levels, hence traders will need to look at how price reacts at the next significant pullback. Currently this would be the previous swing high around 1,788 which will be where Channel Top would be at the end of US trading session today. If prices does pullback towards 1,788 at the end of US close, and opens next Monday bullishly, this can be interpreted as a sign that Short-Term bullish momentum is still in play, and yet more record highs may be formed next week. The reverse is true, should prices break below Channel Top today, coupled with a bearish Monday, the likelihood of a strong bearish pullback increases.

There is a 3rd scenario though, where prices continue to rally towards 1,800 and perhaps beyond. In such cases we may have to simply let it go and wait for future pullbacks to tell us more about the market. Chasing rallies isn’t a prime strategy for trend traders. Fortune may favor the bold, but do so at your own risks.

More Links:

GBP/USD – Pound Keeps Rolling, Shrugs off Weak Retail Sales

USD/CAD – Pushes Above 1.05 on Weak Unemployment Claims

AUD/USD – Lower on Weak Aussie Data

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.