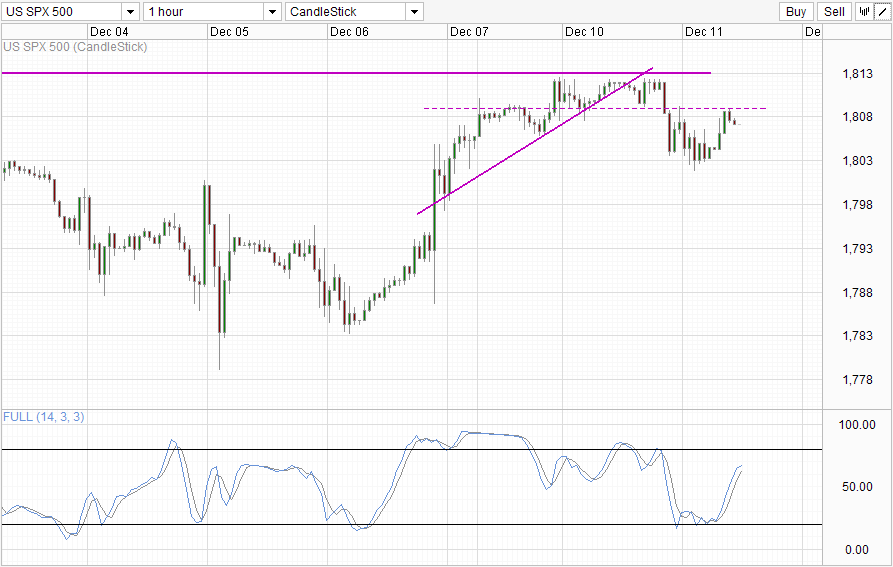

Hourly Chart

US stocks fell yesterday after the record close on Monday. S&P 500 index shed 0.32% but managed to stay above the 1,800 level despite the sell-off. This decline does not seem to be fundamentally driven as there wasn’t any major news releases yesterday, and the smaller news appear to be mostly bullish – Wholesale Inventories and Trade Sales both came in stronger than expected, while JOLTs Job Openings is also higher than expected for the month of October. The only mild disappointment was NFIB Small Business Optimism which came in at 92.5 vs 92.6 expected. Certainly one could argue that the better than expected economic numbers (especially JOLTs Job Openings) triggered QE Tapering fears, but that assertion may be hard to fly considering that we’ve just observed a lack luster response from the bears when Fed members expressed their strong desire for QE Tapering in December on Monday. This doesn’t mean that this assertion is impossible, just that it is highly unlikely that market will be as fickle from one day to the next.

Considering that prices have since rebounded following the rebound, the reason for yesterday’s decline seems to be merely profit taking and not a shift of sentiment. This would imply that overall bullish pressure remain intact, and we should not be expecting strong bearish sell-offs to come later today when US market open.

However, this doesn’t mean that price will continue rally back up to new record highs/close immediately. Prices are currently finding difficulty breaking the 1,809 resistance which opens up a move back towards 1,803 and perhaps even 1,800 round figure. Stochastic readings agree with stoch curve likely peaking soon just under the “resistance” of 65.0, and hence we should not be surprise if bearish momentum take hold from here even though long-term bias remain bullish.

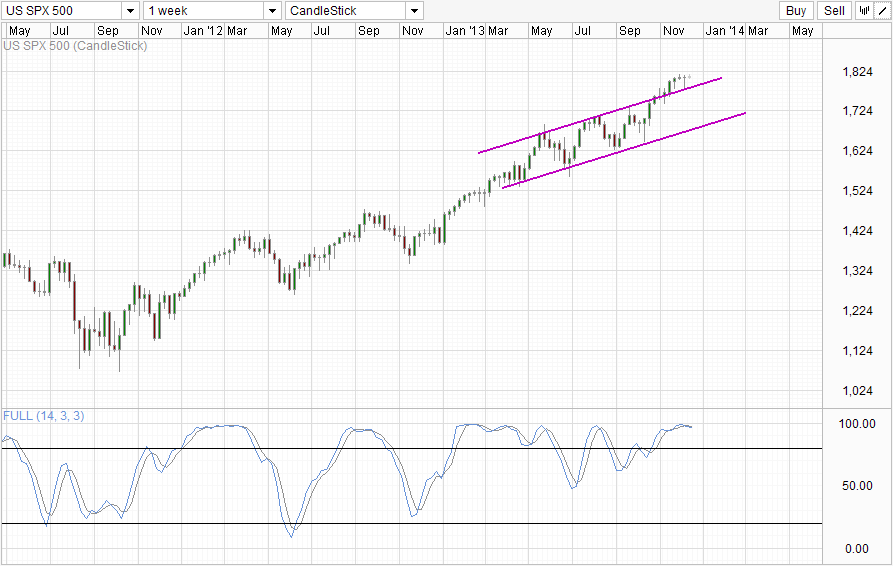

Weekly Chart

Weekly Chart is once again looking similar, and the outlook/interpretation remains the same as our previous analysis. Bullish pressure continues to remain in play and prices could still retreat back towards the rising Channel Top without invalidating this bullish bias, coherent with the Short-Term analysis which is open for bearish scenarios.

More Links:

GBP/USD – Settles at Resistance Level at 1.6450

AUD/USD – Moves to One Week High above 0.9150

EUR/USD – Runs into Resistance Level at 1.38

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.