More of the same seen yesterday. Stock futures of US indexes were mostly bullish during Asian/European hours but started sliding heavily once US session commenced, a pattern that started since last Friday. This time round, we have stronger Durable Goods Orders (2.2% vs 0.8% expected) and Markit US Services PMI (55.5 vs 54.0 expected), and as such the decline can only be attributed to the bearishness of US traders and their sentiment alone. The fact that today’s headlines have to resort to invoking the ongoing Russia/Ukraine crisis as the major factor in yesterday’s slide speaks volume about the non-reason prices decline, as it is clear that issues in eastern Europe is not getting worse, and neither are threats of sanctions materializing.

Regardless, the same question remain – what does this mean moving forward?

When we asked this question a few days ago, we were wondering if the bearishness of US traders was going to be a temporary blip or perhaps we were looking at the beginning of a bearish reversal. This is a legitimate concern as Asian/European traders continue to support dips, and there is a strong likelihood that US traders may actually follow suit if the rest of the world continue to stay bullish.

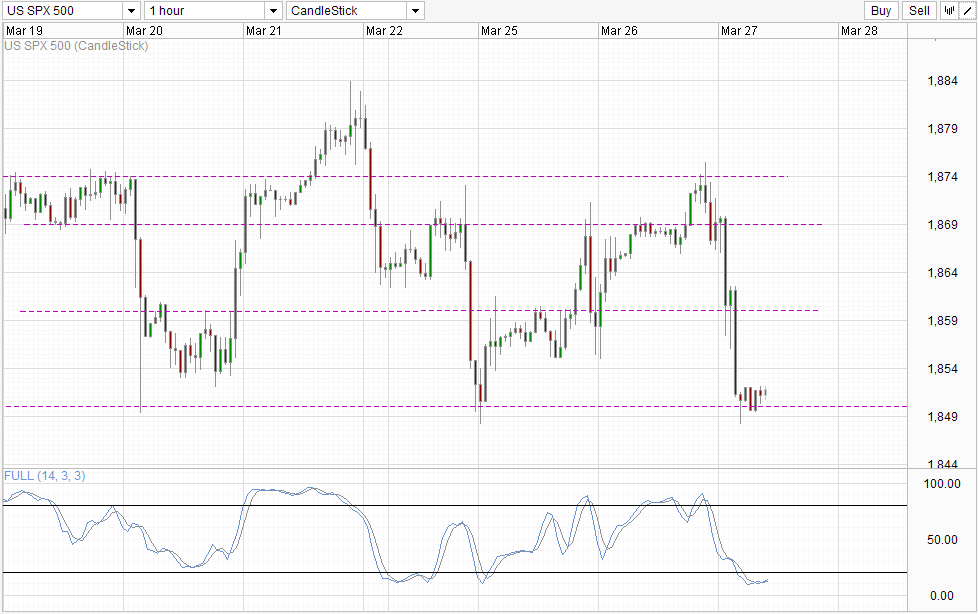

Hourly Chart

However, after 4 consecutive days of declines during US trading hours, we can conclude that bearish sentiment of the US traders are indeed strong, and the possibility of Asian/European traders being led by the aggressive selling behaviour of their US counterparts becomes higher. Nonetheless, we cannot be certain, and with prices currently staying above 1,850 also highlights the fact that Asian/European traders are not giving up the bullish fight either. As such, a break of 1,850 support is necessary for a show of bearish conviction, and should they occur, it is likely that bearish acceleration may take place. Stochastic indicator may be within Oversold region right now, but given the huge bearish potential, we may be able to ignore the counter-trend signal and we may simply see Stoch readings staying heavily oversold for an extended period should 1,850 is broken.

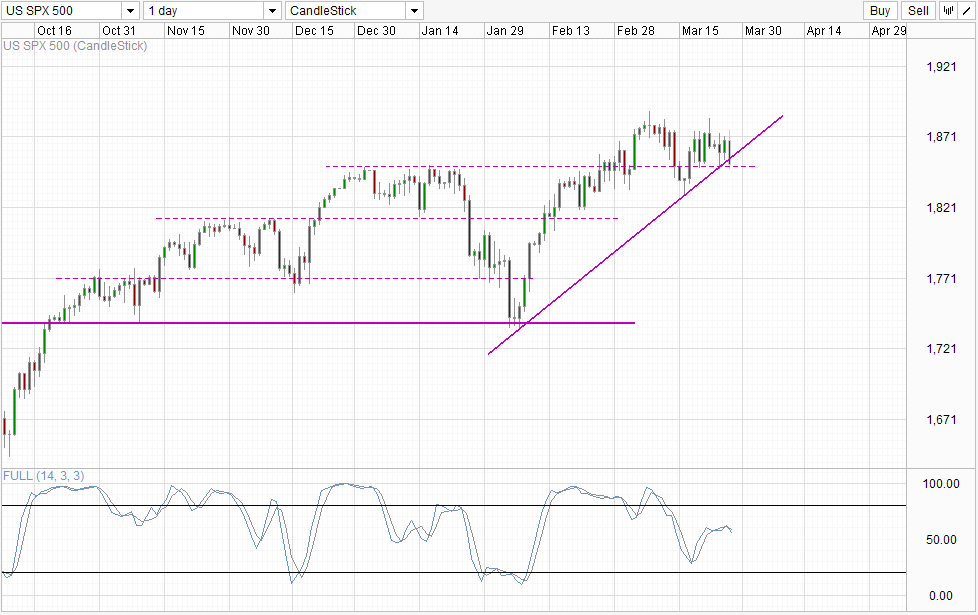

Daily Chart

Daily Chart agrees with the strong bearish outlook, as prices is now trading below the rising trendline, reducing the bullish bias. We are still a fair distance from invalidating current bullish trend which started in Feb, but should we break below 1,850 convincingly, a move towards 1,812.5 becomes highly possible. Stochastic indicator on the daily chart agrees with Stoch curve pointing lower, reverting back to the bearish cycle and favouring further price declines with more than half of the bearish cycle to go.

We’ve had numerous false start previously, but is this the significant bearish decline that everybody is waiting for? Fundamentals tell us that stock prices are highly inflated relatively to historical ratios, but as long as market is willing to pay the premium, stock prices will stay afloat and may even go higher. Hence, seeking strong confirmation is the name of the game here as we do not want to go against the majority of market players especially when there is bullish euphoria.

More Links:

GBP/USD – Pound Moves Higher After Mixed US Manufacturing Data

USD/CAD – Little Movement As US Manufacturing Numbers Mixed

USD/JPY – Rangebound Trading Continues

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.