Treasury prices took a beating late last week following the release of US Non-Farm Payroll numbers, which came in much stronger than expected. 10Y prices traded below 126.5 briefly, but since then we have not seen the bearish momentum gaining traction below 126.5. Instead, prices have been staying mostly between 126.6 – 126.7, suggesting that demand for 10Y continue to remain robust.

This is interesting as market is supposed to be pricing in a Fed Tapering scenario, which would definitely decrease demand for long-dated treasuries moving forward. Even if Fed does not taper in December, it is a matter of time before a tapering action will come in H1 2014. Hence we should have seen prices hitting below 126.5 as market is forward looking.

Hence the strong support/demand for Treasuries right now is a sign that the market may not be fully convinced that a tapering action may be coming at all. Perhaps that is also why the rally in US stocks is continuing – with Dow 30 hitting record high yesterday yet again. This may be good news for bears, as it suggest that a tapering scenario has not be fully priced in, which means should Fed really taper eventually the bearish reaction in 10Y prices will be huge; just like how prices reacted to the NFP when market was expecting a bearish print due to a pessimistic ADP employment numbers the previous week.

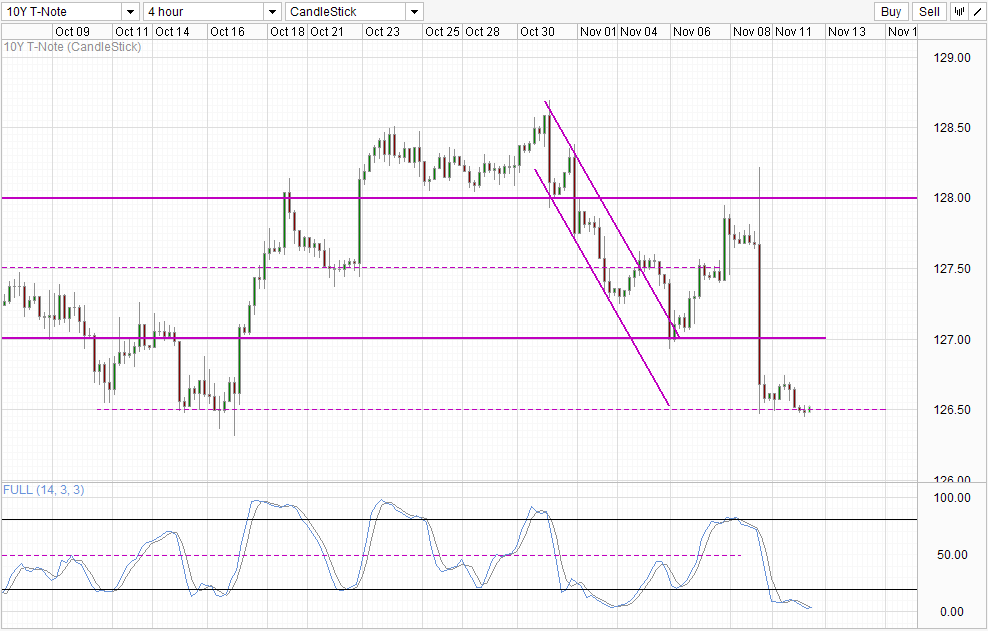

4 Hourly Chart

From a technical perspective prices look likely to rebound with Stochastic readings deeply Oversold. However, a proper bullish cycle signal is not yet in play, and prices may need to clear the 126.7 soft ceiling as a confirmation that a push towards 127.0 is possible. A break of 126.7 will likely result in Stochastic readings pushing above 20.0, adding bullish conviction.

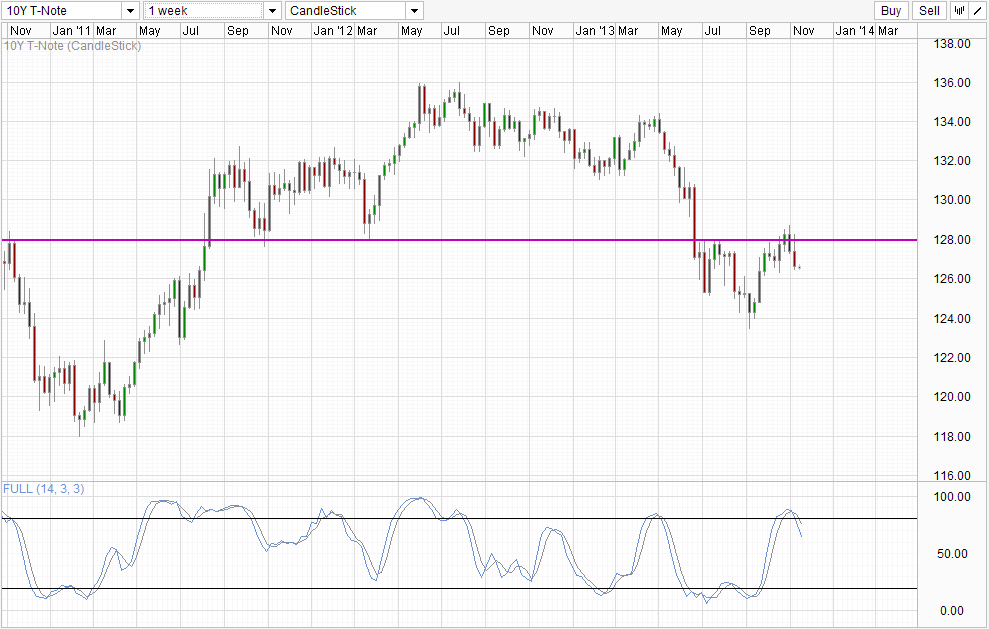

Weekly Chart

Long-term trend is bearish, in line with the long-term fundamental analysis above. 1st target would be 124.0 but prices would need to clear 126.0 soft support which will likely coincide with Stoch curve pushing below the “support” 55.0 – increasing the likelihood of bearish acceleration towards 124.0 should 126.0 is broken. This overwhelming bearish influence also imply that short-term rebound will be difficult to last long, and we could see prices reverting lower as early as 127.0 assuming that Fed doesn’t make any new announcements that may change the entire QE tapering outlook.

Fundamentally, US10Y traders should also take note of the actions of other Central Banks, as most major Central Banks’ outlook move in tandem. One would be hard pressed to find ECB being hawkish but BOE is being extremely dovish. One good example would be how 10Y prices moved higher following the rate cut by ECB last week – a surprising dovish move. This spurred speculators into thinking that the Fed may have a higher tendency to be dovish – a move that will delay QE tapering for now. Hence, do not assume that what RBA and SNB says will not impact US yields. As speculative play increases, so would sensitivity to any news in the market as that will help turn the rumor mill.

More Links:

USD/CAD – Limited Movement in Thin Trade

AUD/USD – Slide Continues Despite Excellent Australian Housing Data

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.