USD/CHF has edged downwards on the first day of the trading week. There were dramatic developments in Italy over the weekend, as Italian Prime Minister Mario Monti announced that he will be resigning his post. Monti, who has gained the respect of the markets with his skillful handling of Italy’s debt crisis, stated that he could no longer lead the country without the support of former Prime Minister Silvio Berlusconi’s party. The dramatic development means that Italians will head to the polls early next year. The markets are concerned that the political uncertainty could have an adverse impact on Italy’s weak economy, the third largest in the Euro-zone. Italy is mired in recession, and the loss of Monti’s steady hand at the helm could undermine confidence in the shaky Italian economy. Immediately following the resignation announcement, the Standard & Poor’s rating agency was quick to state that it was concerned whether the new Italian government would continue to practice austerity, and warned that it could lower Italy’s credit rating if the economy does not improve in 2013.

In another important development, the German Bundesbank lowered its growth forecast for the Euro-zone’s largest economy. In its semi-annual report, the Bundesbank stated that it expects GDP to grow 0.7% this year and a negligible 0.4% in 2013. Earlier this year, the powerful central bank had predicted GDP growth of 1% in 2012 and 1.6% in 2013. On a positive note, the report stated that the economy should expand by a respectable 1.6% in 2014. In Switzerland, Foreign Currency Reserves showed almost no change compared to the November release, with a reading of 424.8 billion francs.

The US posted solid employment numbers. Non-Farm Employment Change dipped in November, but came in well above the forecast. As well, the US unemployment rate dropped to 7.7%, its lowest level since February 20o9. However, Prelim UoM Consumer Sentiment had a weak release, as the important consumer indicator dropped to 74.5 points, a four-month low. The market estimate stood at 82.4 points. There are no scheduled releases on Monday from either the US or Switzerland.

USD/CHF for Fri, Dec 7, 2012

USD/CHF for Mon, Dec 10, 2012

USD/CHF Dec 10 at 16:25 GMT

0.9332 H: 0.9370 L: 0.9324

S3 S2 S1 R1 R2 R3

0.9065 0.9164 0.9240 0.9315 0.9385 0.95

USD/CHF Technical

The pair has moved upwards since late last week, but was unable to break resistance at 0.9385 before retracting. Strong resistance can be found at the round number of 0.95, and this line is acting as the top of the range. On the downside, the bottom of the range lies at 0.9240.

•Current range: 0.9315 to 0.9385

Further levels in both directions:

•Below: 0.90, 0.9065, 0.9164, 0.9240 and 0.9315.

•Above: 0.9385, 0.95, 0.9650 and 0.9783.

•0.9315 is providing weak support. 0.9240 is stronger.

•0.9385 is the next line on the upside.

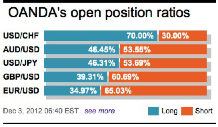

There is a strong bias towards long positions, indicating that USD/CHF has room to move on the upside. With the pair already testing the 0.9385 line, there is no major resistance until the round number of 0.95, which is the top of the range. However, traders should bear in mind that the pair had a significant slide in November, and the pair could be impacted by further developments in the Euro-zone debt crisis.

USD/CHF Fundamentals

There no scheduled events on Monday from the US or Switzerland.

Expectations

With no economic data out of the US or Switzerland, the pair could enjoy a quiet day. However, the lack of releases could exaggerate the impact of external events, such as the political uncertainty in Italy. If there are no dramatic developments, narrow range trading could be the order of the day.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.