Yen has been strengthening against USD in the past few days, led by weakening USD following a more dovish than expected FOMC meeting minutes and flight to safety flow due to the decline in global stocks. As a result of this decline, prices have since lost close to 300 pips from last Friday’s high of 104.15.

It would be easy to simply declare that bearish trend is in play, short USD/JPY and call it a day. But it should be noted that USD/JPY bearish trend isn’t really the strongest nor the most convincing despite the bearish factors mentioned above. There seem to be some fight left in the bulls which can be seen from the fact that prices remained mostly supported above 101.5 despite a lack of stimulus action by BOJ earlier this week. Economic numbers such as Machine Orders from Japan have been weaker than expected, and that should have driven JPY stronger as market has given USD/JPY a huge premium and the premise that BOJ will be able to turn the economy around. As more evidence against the effectiveness of BOJ’s stimulus continue to pile up, market should be disappointed with the central bank and doubt their ability to maintain Yen at a weakened level.

Speaking of efficiency of the stimulus, one member of the policy board said that it is possible that the weakened Yen is having a bigger impact on pushing up inflation than previously thought. Board members also agreed that the increase in sale hike will not affect consumer spending while labor markets and wages are improving Whether these opinions are valid or mere delusions remain to be seen, but it is clear that BOJ members are comfortable and may even be pleased about current stimulus measures. As such, we should not expect more stimulus from BOJ in the immediate future, yet another reason for market to be disappointed and yet more bearish factors for USD/JPY.

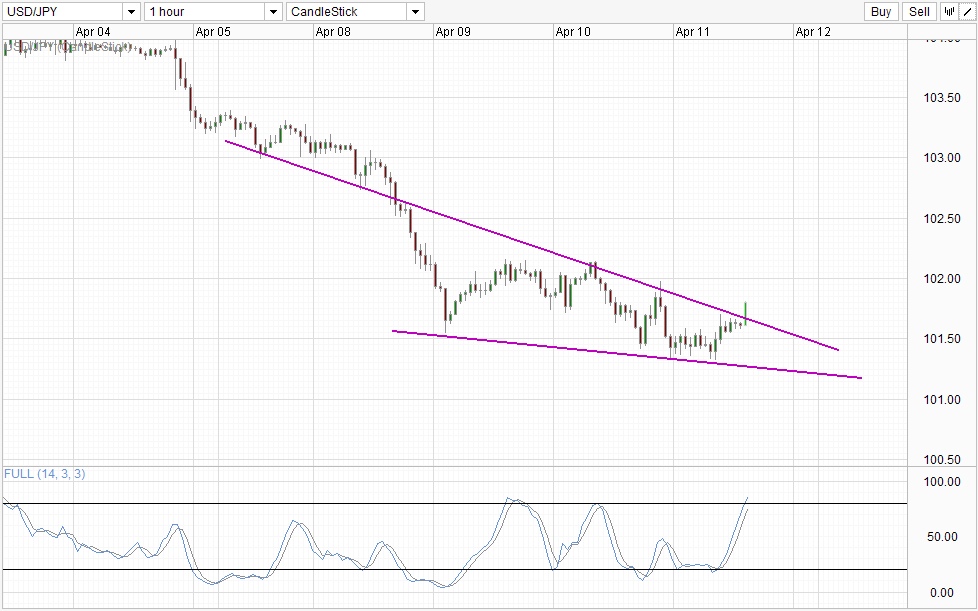

Hourly Chart

Hence, the fact that prices remained supported above 101.5 and has even pushed up higher today after the minutes are released suggest that bullish strength should not be easily dismissed. Considering that current price has surpassed the descending wedge top, 102.0 – 102.15 is a reasonable bullish target in the near term. However, given all the long-term bearish factors it is difficult to imagine USD/JPY continue to climb higher, increasing the likelihood of a bearish rebound around the aforementioned level. Stochastic indicator concurs as Stoch curve is already within the Overbought region, favoring bearish cycles moving forward.

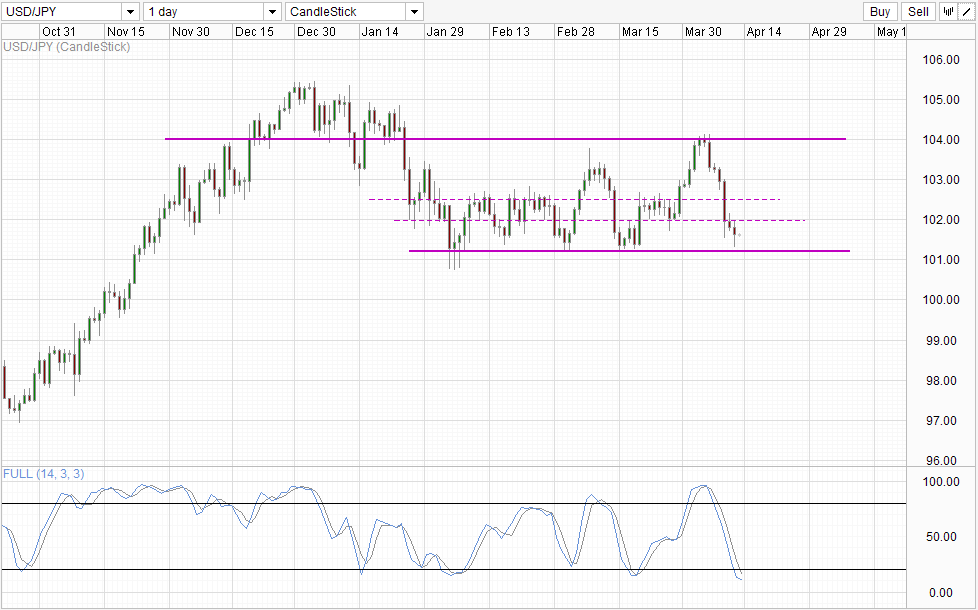

Daily Chart

Daily Chart shows significant support level at 101.2, and that can be a reasonable bearish target for current short-term momentum. However, given that market isn’t truly disappointed with BOJ either, we should be able to expect bullish rebound off the 101.2 level instead of a breakout. Once again, Stochastic indicator agrees as the indicator is at the most oversold levels since August 2013. If 101.2 does break, we could see strong bearish pullback as it is likely that market confidence in BOJ will be totally gone when that happens. From a technical perspective the uptrend that has been in play since October 2013 will be invalidated, opening up a move back towards 97.0.

More Links:

USD/JPY – Yen Rally Continues Despite Strong US Unemployment Claims

S&P 500 – Potential Major Shift In Sentiment Seen

GBP/USD – Pound Slightly Lower As US Unemployment Claims Dip

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.