Nikkei 225 fell 1.2% yesterday following Bank of Japan’s decision to keep monetary policy as it is. Interestingly, even though very few speculators believed BOJ would increase the pace of stimulus this time round (the short odds are for a December announcement), the subsequent sell-off that followed was even stronger than the reaction post FOMC disappointment – a much bigger miss due to speculators getting ahead of themselves and pricing in strong dovish expectations.

This overreaction from BOJ announcement appears to be driven by profit taking activities, suggesting that we may be entering into a short-term bearish sentiment phase, which implies that more selling activities can be expected in the near term.

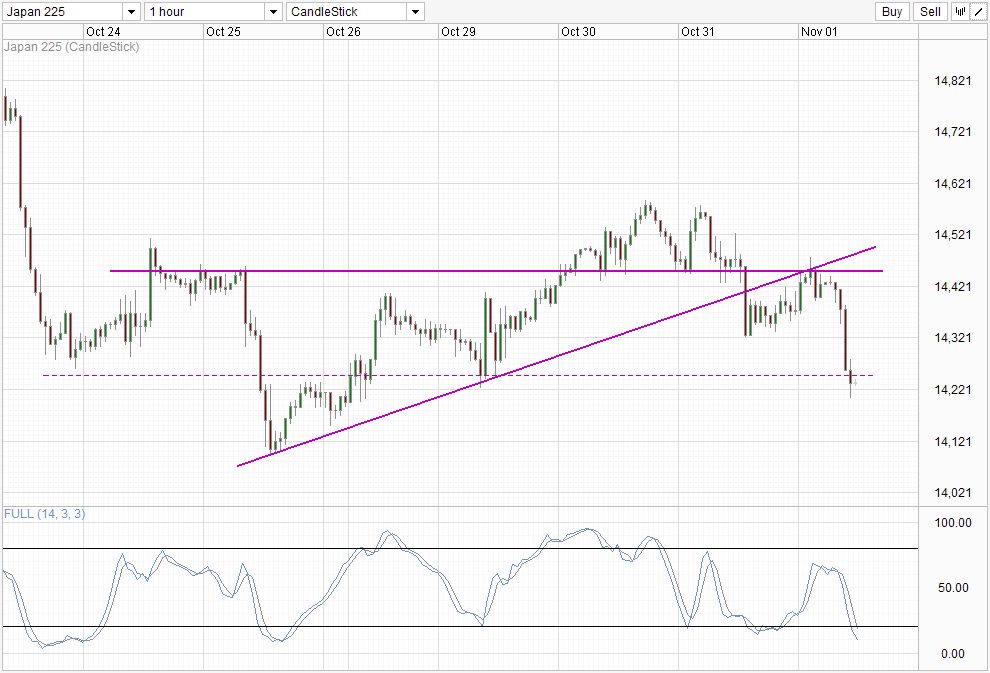

Hourly Chart

Price action today underlines this point perfectly, with prices trading extremely bearishly on the get go. Technicals agrees with the short-term bearish outlook, with price failing to breach resistance 14,450 and confluence with rising trendline a sign that the rally from 25th Oct is no longer in play, and initiative is given to the decline that started from 30th Oct.

Some support can still be expected above 14,100 which is the starting point of the aforementioned rally which was broken, especially since Stochastic suggest that current momentum may be slightly overextended, and a small pullback/recovery will be possible. However, should price stay below 14,250, bias will remain on the downside.

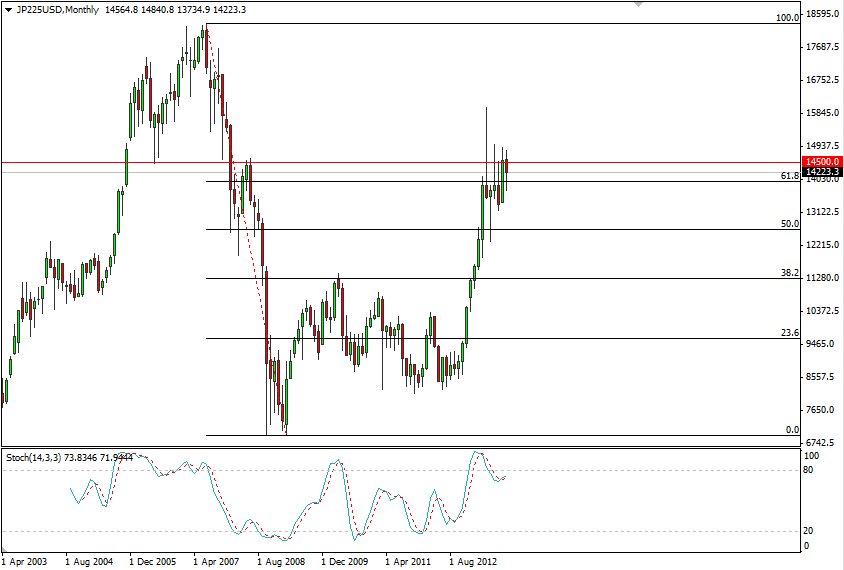

Monthly Chart

Looking at Monthly chart, perhaps the signs were already bearish to begin with prior to BOJ announcement. Prices were trading below the key 14,500 level during yesterday’s open levels, and it will be reasonable to think that traders were actively seeking excuses to short Nikkei 225, and BOJ statement just happened to be the convenient scapegoat to do so.

From a pure technical perspective, 61.8% Fib will be the first bearish target for November, and may open up more bearish objectives should we breach the 14,000 round figure. This may coincide with Stochastic curve pushing below the signal line, potentially igniting bearish acceleration towards the next 50% Fib objective.

However, it should be noted that current uptrend which started more than a year ago is still in play. Furthermore the heavily speculated December BOJ stimulus announcement will continue to add bullish speculative play from now till then. On the front of Yen, USD is slated to increase and that may help to pull USD/JPY higher, resulting in better earnings for Japanese exporters and hence higher stock prices as well. Therefore, do not take current short-term bearish outlook for granted as this is considered a counter-trend trade and may reverse unsuspectingly.

More Links:

S&P 500 Technicals – Mildly Supported But Long Term Bearish Reversal Lurks

GBP/USD – Finds Support at 1.60

AUD/USD – Continues to Drift Lower below 0.95

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.