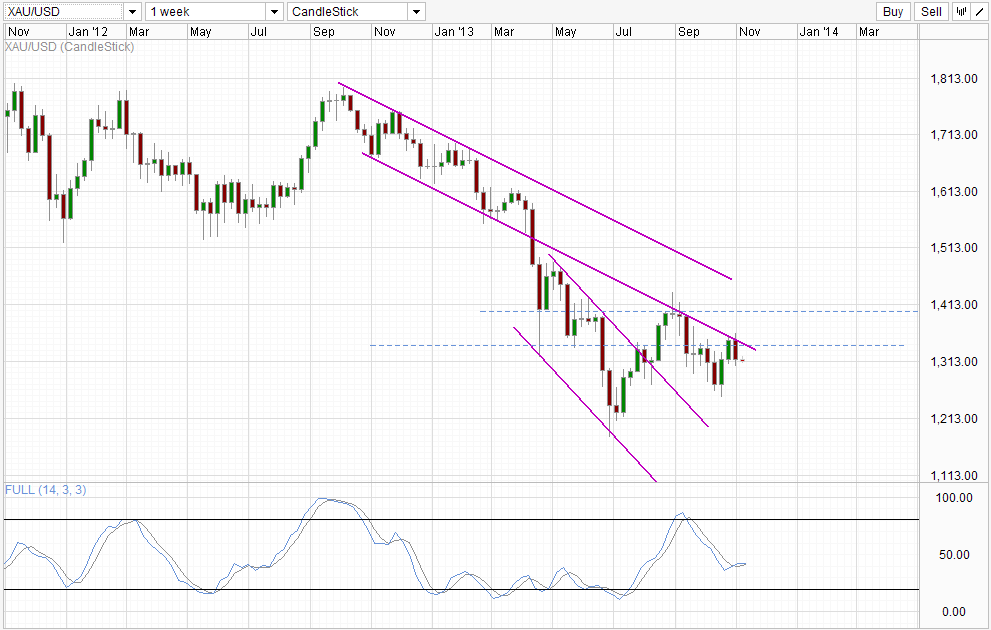

Weekly Chart

Gold prices have been trading mostly flat this week instead of giving us the strong bearish reaction that technical bears have been waiting eagerly for. Nonetheless bearish pressure remains, and we are currently trading mildly below Friday’s close, which is still a small victory for bears.

However, prices should ideally trade below last week’s lows or at least the lows of 2 weeks ago in order to show stronger bearish conviction. This may possibly push Stochastic readings low enough to cross the Signal line for a bearish continuation signal.

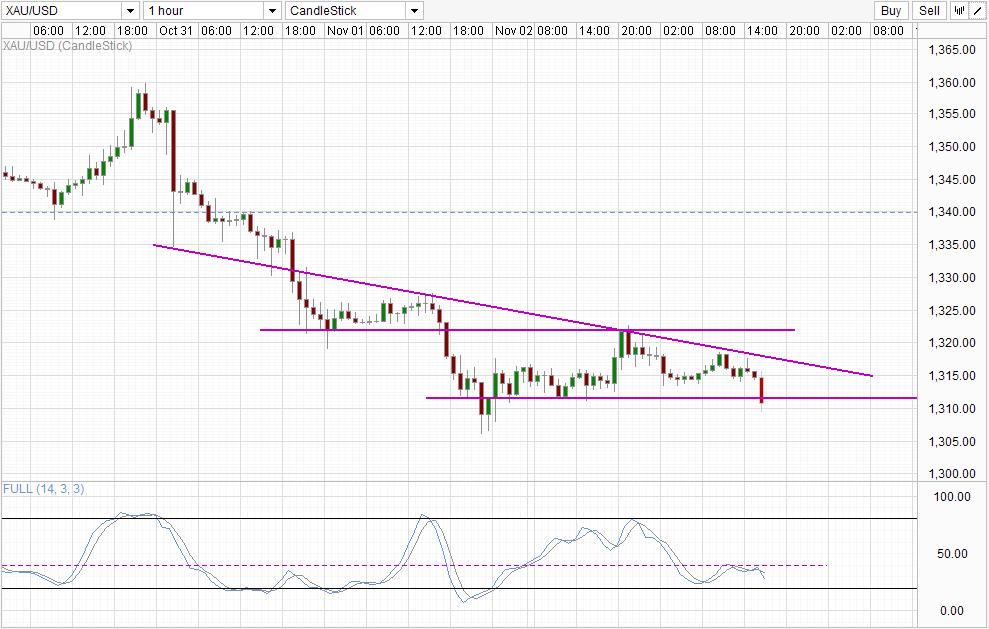

Hourly Chart

Looking at short-term charts, the signs are good – prices are retesting the support zone that stretches from 1,311 all the way to 1,306. The fact that short-term descending trendline remains intact is positive for the bears, as it showed that bulls have made their pullback move but were unable to breach any significant resistances – decreasing the likelihood of further pullbacks in the immediate future. However Stochastic readings are not as optimistic. Despite the rejection by the 40.0 level, Stoch curve does not have much space to go before we are in Oversold territory again. Hence even though we could see prices pushing below and even break 1,306, the likelihood of a retest of the aforementioned support zone is high. This is especially true when we consider that 1,306 is not terribly far away from the 1,300 significant support, where numerous buy orders have been placed. As such, a temporary bullish push may occur when price hit the level, increasing the probability of a 1,306 retest.

Furthermore, we do not have any insight on what institutional speculators are doing right now, and there runs the danger of these institutions entering heavily once again seeking bargain buys when prices dipped further. Hence, an ideal bearish scenario would be price hitting 1,300 but with the subsequent pullback unable to breach above the support zone. Any bearish move after that will be a good confirmation that the next phase of bearish momentum is in play, and a proper push below 1,300 will be more likely.

More Links:

US10Y Technicals – Trading below 127.5 Once More

AUD/USD – RBA Hold Rates at 2.50%, Wants Weaker AUD

EUR/USD Technicals – 1.35 Support Band Holding

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.