After trading mostly flat on Monday, prices started moving steadily lower today. The driver today – stronger than expected HSBC/Markit Services PMI which came in at 47.1, much better than previous month’s 44.6. This better than expected showing in service sector push INR higher, but weakness remains as the index continues to remain below the 50.0 par level. This explains why the Indian main stock index Sensex remain heavily bearish, losing 1.06% today even as INR strengthens by almost the same percentage versus USD.

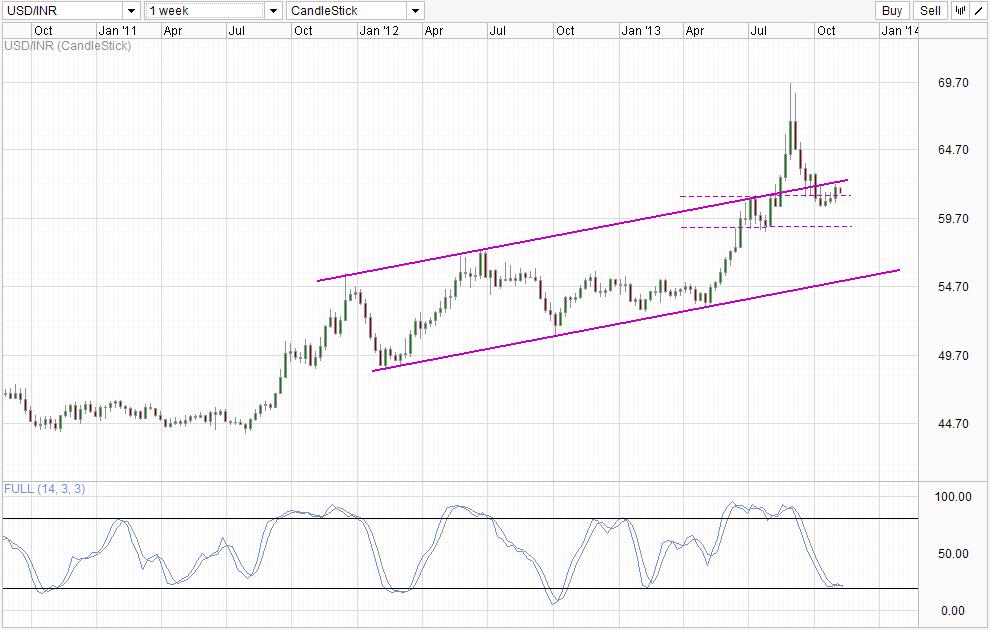

Weekly Chart

Nonetheless, the bearish push extends the slight decline that has been in play since last Friday. This decline can be interpreted as a bearish rejection from Channel Top, which opens up a move towards the 61.35 support level and potentially reopening up a push towards 59,0 should we breach the July consolidation zone once again. Furthermore, this bullish push has successfully avoided a bullish cycle signal from Stochastic indicator, and has pushed Stoch curve lower once more, suggesting further bearish momentum for now.

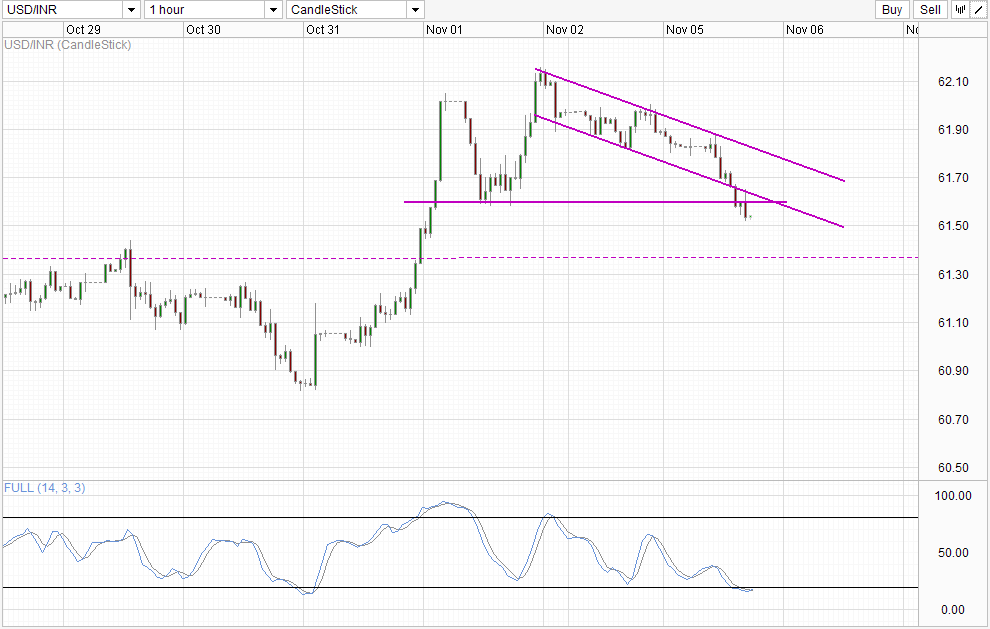

Hourly Chart

Short-term chart shows the extent of the bearish momentum, where prices have broken the descending channel and the 61.6 soft support. Currently Stochastic readings are Oversold, increasing the likelihood of a retest of 61.6. But should the resistance ultimately hold in conjunction with Stoch curve staying below 20.0, the likelihood of price moving towards 61.35 increases. However, it is unlikely that price can head much lower from there as short-term Stochastic readings will also be deeply Oversold. Similarly, Weekly Stochastic readings may reach Oversold as well, hence increasing the likelihood of a short-term bullish rebound.

More Links:

AUD/USD – RBA Hold Rates at 2.50%, Wants Weaker AUD

EUR/USD Technicals – 1.35 Support Band Holding

Gold Technicals – Next Bearish Phase In The Making

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.