- Gold (XAU/USD) plummeted below its 20-day & 50-day moving averages, and recorded a daily loss of 3.45% last Friday, 7 June; its worst daily performance since November 2020.

- The main negative catalyst has been a halt in China’s gold purchases in May after 18 consecutive months of buying through its official reserves.

- A further rebound in the US 10-year Treasury yield coupled with a steady increase in large speculators’ net bullish positioning in gold futures towards a 3-year high may add further downside pressure.

- Watch the US$2,380 key medium-term pivotal resistance on Gold (XAU/USD).

This is a follow-up analysis of our prior report, “Gold Technical: Stagflation risk and a softer US 10-year Treasury real yield are supporting the bulls” published on 15 May 2024. Click here for a recap.

After a minor recovery of +3% from its US$2,320 support seen on 3 June to a recent US$2,388 intraday high printed last Friday, 7 June, price actions do not have a positive follow-through as it sliced below both its 20-day and 50-day moving averages within three hours on last Friday, 7 June and slumped to record a daily loss of 3.45%, the most since November 2020.

China halted its official gold purchases in May

The main catalyst that triggered last Friday’s horrendous decline was a halt in China’s upward trend of gold purchases after 18 consecutive months of gold buying as seen from its latest official reserves data; the amount of gold in China’s reserves stood at 72.8 million ounces for May, unchanged from April.

The opportunity cost of holding gold has ticked higher

Fig 1: US 10-YR Treasury real yield major & medium-term trends as of May 2024 (Source: TradingView, click to enlarge chart)

Despite a mixed US labour data release for May last Friday where the unemployment rate increased higher to 4%, the first time since January 2022, most market participants seem to get fixated on the headline non-farm payrolls numbers that rose more than expected to +182K jobs, above the consensus estimates of +185K, and April’s downward revised figure of +165K.

The rosy headline non-farm payrolls data have pushed up the US Treasury yields as odds of a potential second Fed funds rate in the December FOMC meeting get priced out with only a 41% chance according to the CME FedWatch Tool as of 7 June 2024.

In addition, the US 10-year Treasury real yield has managed to stage a bounce after a test at a key support of 2.03% that confluences with the 200-day moving average, keeping its major uptrend phase in place since 8 March 2022 low intact (see Fig 1).

A further potential upmove in the US 10-year Treasury yield increases the opportunity costs of holding Gold (XAU/USD) as it does not yield any recurring fixed income, in turn may put further downside pressure on its prices.

Large speculator players’ net bullish positioning in gold futures heading toward a 3-year high

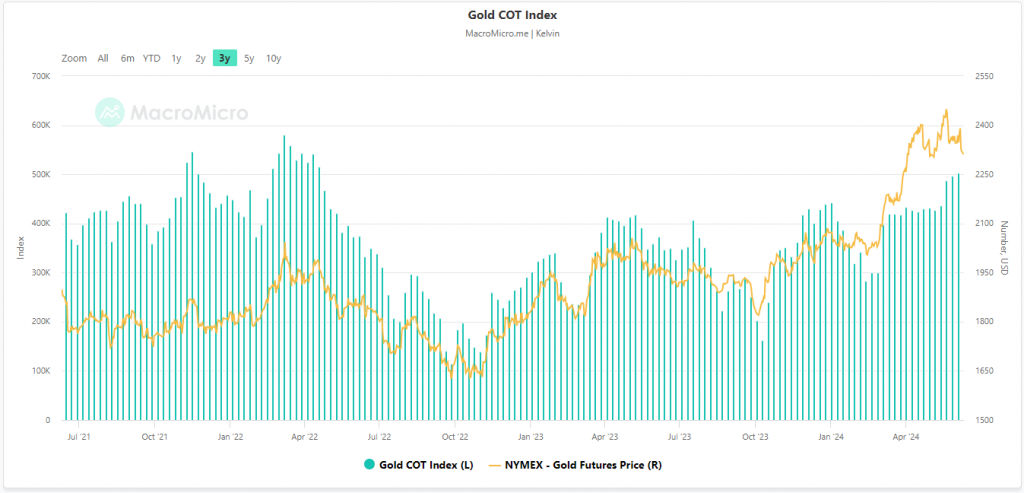

Fig 2: Commitments of Trader large speculators’ net positioning in Gold futures as of 3 June 2024 (Source: Macro Micro, click to enlarge chart)

Based on the latest data Commitments of Traders data as of 3 June 2024 (compiled by Macro Micro), the aggregate net bullish open positions of large speculators in the gold futures market of NYMEX (after offsetting the aggregate positions of large commercial hedgers) have risen to +503,233 contracts (net long), a steady of increase in the past three weeks, and coming close to its highest level in three years with +581,344 contracts recorded on 7 May 2022 (see Fig 2).

Given that net open large speculative positioning flows (primarily from hedge funds) are contrarian in nature which suggests that a relatively high level of net positioning may see an opposite reaction in price actions if related data or news flows disappoint.

In the current context of Gold (XAU/USD) movements, the risk of further profit-taking activities cannot be ruled out as large leveraged speculators have committed a relatively high amount of net bullish open positioning.

Thus, if there is a lack of fresh supportive catalysts coming out from this Wednesday, 12 June key risk events; the US CPI data release for May, and the US Federal Reserve monetary policy decision together its latest update on the “dot plot” projections for US inflationary trend, Fed funds rate may eventually see late buyers rushing to exit their positions which increases the risk of a liquidity cascading downward effect on Gold (XAU/USD) prices in the short-term to medium-term.

Medium-term momentum has weakened for gold

Fig 3: Gold (XAU/USD) major & medium-term trends as of May 2024 (Source: TradingView, click to enlarge chart)

In the lens of technical analysis, the Gold (XAU/USD) medium-term uptrend phase from the 6 October 2023 low has been damaged as price actions have decisively broken below its 50-day moving average with a daily and weekly close below it last Friday, 7 June (see Fig 3).

In addition, the daily RSI momentum indicator has broken below a key parallel ascending trendline support at the 48 level with a prior bearish divergence condition.

These observations suggest a bearish medium-term momentum condition has arisen that increased the odds that the price actions of Gold (XAU/USD) may unfold another leg of a multi-week corrective decline sequence within its major uptrend phase (as illustrated by green major ascending channel from 28 September 2022 low).

Watch the US$2,380 medium-term pivotal resistance with the next medium-term supports at US$2,206/2,195, and US$2,149/2,131 that confluences with the median line of the major ascending channel, and 38.2%/50% Fibonacci retracement of the prior rally from the 6 October 2023 low to the 12 April 2024 all-time high.

However, a clearance above US$2,380 sees the revival of the bullish impulsive sequence to retest the all-time high area of US$2,420/2,450 before exposing the next medium-term resistance of US$2,540.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.