Behold, the day for bears have cometh!

Gold prices tanked heavily after the bearish rejection of 1,330 resistance, breaking the 1,315 key level in the process which led to even stronger selling pressure. What is more surprising is the fact that prices managed to breach 1,300 round figure support, resulting in the strongest hourly decline seen since 7th March – when US Non Farm Payroll for the month of Feb came in stronger than expected.

To be fair, there was bullish economic news in the form of stronger than expected Consumer Price Index when the strong sell-off occurred, but CPI data has rarely resulted in strong market reaction, and the difference between the actual figure vs expectations was only a mere 10 basis points, hardly a huge surprise. Hence, it seems more likely that already bearish traders are simply using this data as an excuse to sell more Gold. Case in point, US equities futures were actually mostly flat when the economic number was released, lending strength to our assertion that it is the strong bearish sentiment rather than fundamental data that has driven prices lower.

Anyway, the analysis above may not even be necessary to determine that there are strong bearish undercurrents right now. Yesterday we’ve seen sudden escalation of conflict between Ukraine and Russia, with the former reporting that Russian Airborne soldiers have landed in Ukraine territory. This surprise move by Russia can be construed as an act of war, but prices of Gold remained flat after pulling back to 1,303 thereabouts, a move that seems more related to the technical pullback after the overreaction by the bears at the 1,300 break rather than a genuine bullish push due to concerns over the possibility of war breaking out.

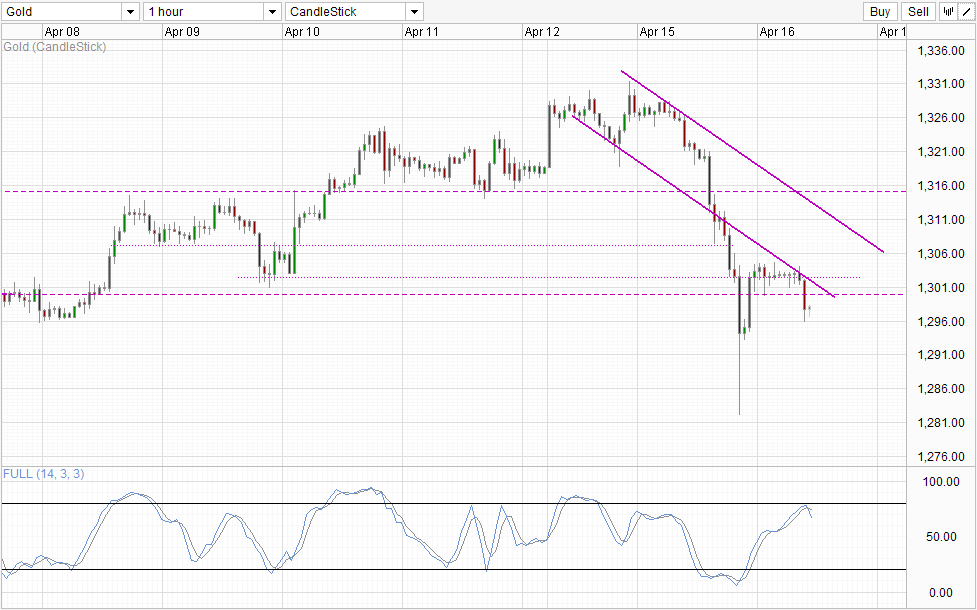

Hourly Chart

Hence, we can see from here that Gold traders are still extremely bearish, and the latest break of 1,300 during Asian hours is yet another testament for the strong bearish sentiment. From a price action perspective, the latest bout of selling can be interpreted as a bearish rejection off descending Channel bottom and confluence with 1,303 resistance. Stochastic curve has also reversed, crossing over the signal line and indicating that a bearish cycle is in play right now. Even though we did not see Stoch levels entering the Overbought region, there are historical precedence where stoch peaks have formed around current levels. That being said, a break of 1,296 soft support is preferred to confirm S/T bearish momentum that may lead us all the way to low 1,280s and potentially lower.

More Links:

Gold Technicals – Bulls Failing The 1,330 Test

WTI Crude – Staying Supported Above 103.0 Despite 104.0 Rejection

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.