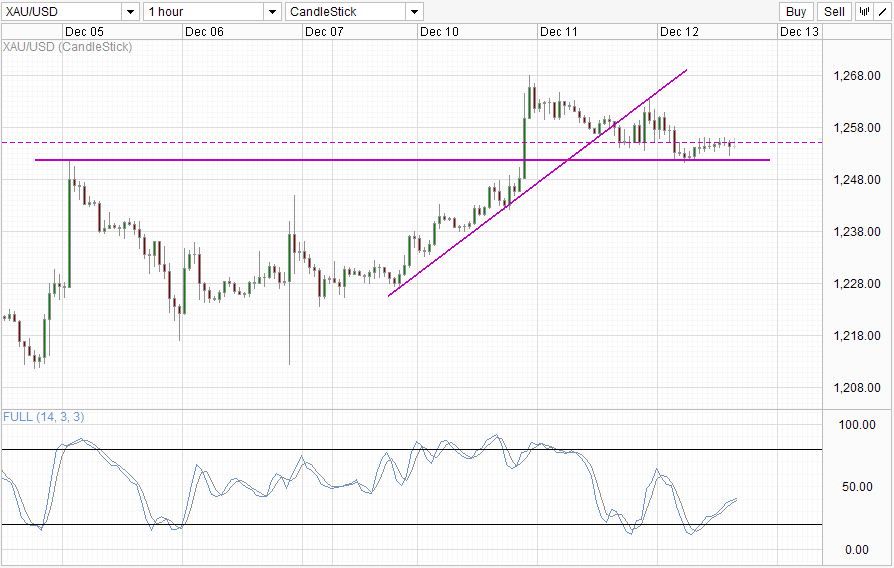

Hourly Chart

Not much movement seen in Gold following Tuesday’s sharp rally. Prices have been slowly trickling lower as expected as the bullish move wasn’t supported by fundamentals nor adequately explained by technicals. Currently price is below 1,255 – the resistance that was in play 2 weeks ago and 1,251.5 – the ceiling 2 weeks ago and the support just a few hours ago. Stochastic indicator favor a rebound from 1,251.5 with a bullish cycle currently in play, but the in ability to break 1,255 will continue to weigh and open up a retest of 1,251.5 and potentially a bearish breakout with 1,212 as ultimate bearish target. Traders should not be surprise at such a possibility as Stoch curve has yet to clear the “consolidation zone” between 42.0 – 64.0, where current bullish cycle could be cut short just like the one seen half a day ago.

Daily Chart

Daily Chart favors bearish scenarios moving forward as well as prices is pulling lower after hitting the 1,270 resistance. Stochastic indicator concurs with Stoch curve already entering the Overbought region. However, a bearish cycle is not yet indicated as Stoch curve is still pointing higher and above the 80.0 mark. Similarly, price will need to breach below 1,251 and preferably below 1,235 in order for stronger bearish conviction to emerge and Channel Bottom to become a viable bearish target.

More Links:

WTI Crude – Decline In Inventory Not Quite All That Jazz

AUD/USD – Bearish Despite Stronger Employment Numbers

NZD/USD – Higher On RBNZ Guidance But No Home Run For Bulls

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.