Bitcoin, Ethereum & Cryptocurrency Key Points:

- Spot Bitcoin ETF flows show a net inflow of $31 million following 7 days of outflows.

- BTC/USD rises around 7% from weekly low yet remains on course for a lackluster month of June.

- Mt. Gox may repay up to $8.5 billion worth of crypto starting next month.

- SEC Chair Gary Gensler hints at Ethereum (ETH) ETF approval soon.

Most Read: Gold prices under pressure as the Dollar Index (DXY), US Yields Rise

Bitcoin (BTC/USD) rebounded from its weekly low yesterday, climbing approximately 7% to trade just below the 62,500 mark. However, this morning has witnessed a resurgence of sellers, causing Bitcoin to pull back from the 62,500 resistance zone, with attention now focused on the psychological support level at 60,000.

The selloff on Monday was in part facilitated by supply concerns. Rumors began to swirl that Mt Gox (the Tokyo based exchange) which ran into financial difficulty in 2014 may be about to return some $8.5 billion in crypto starting next month. This will be a relief for clients of the exchange but could add another layer of uncertainty to crypto prices. The increase in supply should Mt Gox follow through could also hamper Bitcoin prices moving forward.

Bitcoin ETF flows showed a shift yesterday after seven consecutive days of outflows. On June 25, the Bitcoin ETF experienced net inflows of approximately $31 million. Despite this recent positive movement, the past week has seen total outflows of around $1.1 billion from spot Bitcoin ETFs. Since the launch of 11 spot Bitcoin funds in January, total net inflows have reached $14.42 billion. The recent inflows may indicate that some market participants believe the recent price drop is over and expect a rally, while others may be averaging in for the long term. Regardless, if inflows continue to rise, this could help support BTC/USD.

Ethereum has had a slightly better month than Bitcoin, likely due to the excitement surrounding the approval of the ETH ETF. There’s increasing speculation among crypto enthusiasts that the ETH ETF could be more significant than the Bitcoin ETF for major players like BlackRock. Ethereum’s advantages include the ability to stake and earn revenue, as well as higher fees, which makes this assumption plausible. In a significant endorsement of the ETH ETF, SEC Chair Gary Gensler indicated that approval is likely imminent, promising a welcome boost for the industry and Ethereum itself. Despite being down 10% over the past 30 days, Ethereum remains up approximately 48% year-to-date

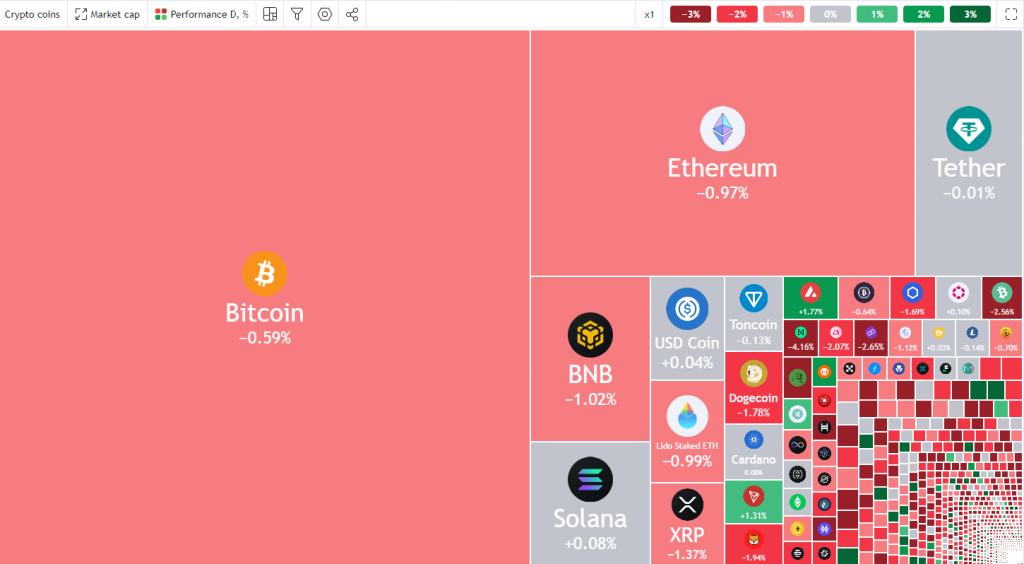

Crypto Heatmap – A breakdown of the performance of individual crypto coins, June 26, 2024

Source: TradingView.com (click to enlarge)

In other significant news within the crypto space, Bybit, a prominent crypto exchange based in Singapore, has surpassed San Francisco-based Coinbase in trading volume, securing its position as the second-largest crypto exchange. The latest data places Bybit just behind Binance, following substantial growth and scaling efforts. The regulatory issues clouding Binance since late 2022 have no doubt had an impact on Bybits rise to prominence. However, there concerns that Bybit could come under similar scrutiny as Binance. Less than a month ago the Bybit exchange was blocked by the French Financial Market Authority (AMF) for operating without proper authorization. Is this going to be a blip in the road or the start of a testing road for the new ‘big boy on the block’? Time will tell.

Technical Analysis on Bitcoin (BTC/USD)

Looking at BTC/USD from a technical perspective, the Daily chart below shows a long-term ascending trendline which continues to hold and keep me optimistic that a deeper retracement may remain elusive. Mondays selloff brought BTC/USD within a whisker of the 200-day MA and into the support area around the 60000 mark. An aggressive bounce yesterday has failed to find follow through today as the resistance around the 61750 holds firm.

The 50 and 100-day MAs looks to be setting up for a death cross pattern which would hint at bearish continuation. However, it is important to remember that the MAs are lagging indicators, as we saw last week when we had a golden cross pattern which was followed by a selloff. In other words, this is just a guide but it is not always accurate. If the bears take control support around 59000-60000 mark needs to be overcome before the 200-day MA resting at 57736 comes into focus and then of course the long-term ascending trendline. A break below the trendline and swing low support at 56560 could see an accelerate push toward the 52500 support area.

Alternatively, a recover from the current price will require BTC/USD to break above the 61750 daily resistance area before navigating its way back above the 50 and 100-day MAs currently resting just above the psychological 65000 handle. FYI, volatility in markets could increase on Friday during the US PCE data release and could provide a push for BTC/USD as well.

Bitcoin (BTC/USD) Daily Chart, June 26, 2024

Source: TradingView.com (click to enlarge)

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.