- Japan’s core-core CPI for January 2024 is expected to come in soft at 3.2% y/y versus 3.7% y/y in December 2023.

- Leading economic indicators, Japan’s Consumer Confidence, and Average Cash Earnings of employees suggest a more potentially upbeat core-core inflation rate for January 2024.

- Watch the 150.70 key short-term resistance of USD/JPY with near-term support at 149.60.

This is a follow-up analysis of our prior report, “USD/JPY: Lingering below 151.40/95 major resistance zone” published on 15 February 2024. Click here for a recap.

In the past month, the movement of the USD/JPY has inched higher by +364 pips (+2.48%) on a month-to-date basis as of today, 26 February 2024 at this time of the writing.

The recent strength of the USD/JPY printed an intraday high of 150.88 on 13 February (ex-post hotter than expected US CPI print for January 2024) has prompted key Japanese officials from the Ministry of Finance (MoF) to issue a slew of verbal interventions to talk down the US dollar strength against the JPY as the USD/JPY has been trading a few whiskers away from a key technical resistance level of 151.95 where prior bulls have been rejected on 1 and 13 November 2023 that led to a sell-off of -7.7% to print an intraday low of 140.25 on 28 December 2023.

In addition, market participants are likely to have a “fearful” recency bias at around the 151.95 level of the USD/JPY where the Bank of Japan (BoJ) under the instructions of MoF intervened in the foreign exchange market “vigorously” via the sale of US dollars on 21 October 2022 after the USD/JPY hit an intraday high of 151.95.

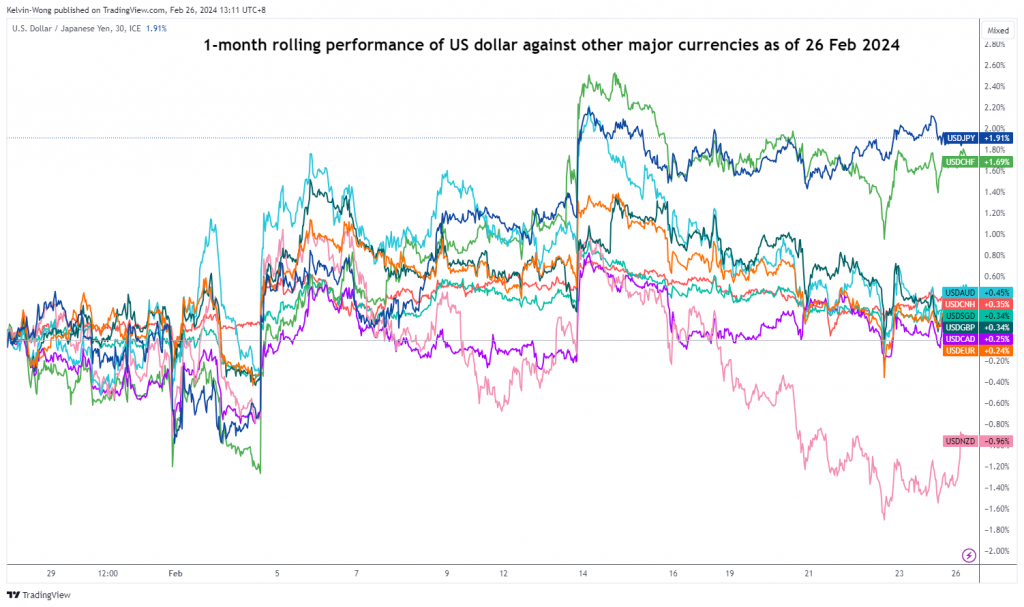

USD/JPY came in top on a one-month rolling performance

Fig 1: 1-month rolling performance of USD against other major currencies as of 26 Feb 2024 (Source: TradingView, click to enlarge chart)

So far, the US dollar has been the top performer against the JPY on a one-month rolling basis where the USD/JPY recorded a gain of +1.9% versus other major currencies (see Fig 1). The primary focus now will be on the release of Japan’s nationwide inflation data for January 2024 especially on the demand-pull sensitive core-core inflation rate (excluding fresh food and energy) that BoJ monitors to gauge whether Japan has exited from its persistent 25-year long of deflationary environment.

Japan’s core-core inflation (y/y) growth has remained above BoJ’s inflation target of 2% since November 2022 and printed a 42-year high of 4.3% y/y in September 2023. It has started to soften to 3.7% y/y in December, and the forecast by Trading Economics expects another soft print of 3.2% y/y in January 2024.

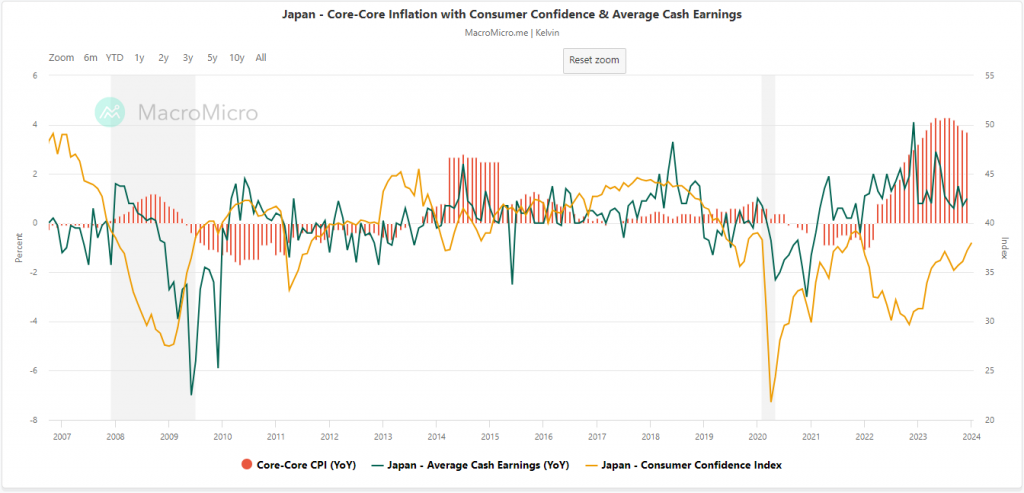

Consumer Confidence & Average Cash Earnings may point to a more upbeat core-core CPI growth rate

Fig 2: Japan’s core-core CPI with Consumer Confidence & Average Cash Earnings as of Jan 2024 (Source: MacroMicro , click to enlarge chart)

Since core-core inflation is more driven by demand-pull factors such as consumer spending, thus we can monitor and track the movement of the 2 key leading economic indicators that are related directly to consumer spending; consumer confidence and average cash earnings of Japanese employees (y/y)

By overlaying Japan’s consumer confidence and the average cash earnings of Japanese employees with Japan’s core-core inflation (CPI), we can see that their long-term trends are moving in synch with consumer confidence and average cash earnings leading over core-core inflation when they grew (for example during the periods of April 2011 to September 2013, and most recently from February 2022 to February 2023) (see Fig 2).

The latest data on consumer confidence for January has remained resilient as it staged a further advance to 38 from 37.2 in December 2023, its highest reading since December 2023.

In addition, the recent soft patch seen in the growth rate of average cash earnings started to stabilize in January where it increased slightly to 1% y/y from 0.7% y/y in December 2023.

Hence, January’s core-core inflation print for Japan may come in better than expected and is likely to keep the potential imminent removal of short-term negative interest rates narrative in Japan on track during the next BoJ’s monetary policy on 26 April which in turn may put a cap on the recent US dollar strength against the JPY.

150.70 key short-term resistance to watch on USD/JPY

Fig 3: USD/JPY medium-term trend as of 26 Feb 2024 (Source: TradingView, click to enlarge chart

Fig 4: USD/JPY short-term trend as of 26 Feb 2024 (Source: TradingView, click to enlarge chart)

The recent short-term rally from the 2 February low of 145.90 seems to have stalled as the price actions of USD/JPY have failed to make any tailwinds above 150.70 since 16 February.

The short-term hourly RSI momentum indicator has recently broken down below its parallel former ascending support last Friday, 23 February which indicated a potential resurgence of short-term bearish momentum.

Watch the 150.70 key short-term pivotal resistance of USD/JPY and a break below 149.60 exposes the next intermediate support zone of 148.80/40.

On the other hand, a clearance above 150.70 invalidates the bearish tone for a squeeze-up to see the major resistance zone coming in at 151.40/95.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.