- Weak China retail sales, Q2 GDP & the potential return of Trumponomics sparked today’s sell-off seen on the Hang Seng Index.

- The Hang Seng Index is still trading above its 17,110 key medium-term support.

- Direct fiscal stimulus measures to jumpstart consumer spending in China if announced in the Third Plenum may trigger another round of short-term upmove on the Hang Seng Index.

- Watch the 18,530 key intermediate resistance on the Hang Seng Index.

This is a follow-up analysis of our prior report, “Hang Seng Index: Near-term weakness prevails over trade war jitters and soft yuan” dated 21 June 2024. Click here for a recap.

Since our last publication, the Hang Seng Index has dropped lower in the next three weeks and almost hit the highlighted 17,110 key medium-term support.

Hang Seng Index’s short-term outperformance

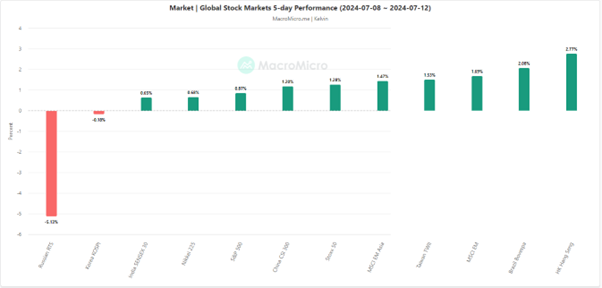

Fig 1: Hang Seng Index 5-day performance with other global stock indices as of 12 Jul 2024 (Source: MacroMicro, click to enlarge chart)

Last week, Hong Kong’s Hang Seng Index which is considered a higher beta play toward the Chinese stock market managed to outperform its global peers with a weekly return of 2.77% versus the S&P 500 (0.87%), Nikkei 225 (0.68%) and Stoxx 50 (1.28%) (see Fig 1).

Two primary drivers for last week’s stellar performance in the Hang Seng Index. Firstly, there has been a further improvement in China’s producers’ prices where the PPI for June decelerated at a slower pace at -0.8% y/y for the third consecutive month from -1.4% in April and in line with expectations. A further uptick in factory gate prices in China may spark a further rebound in consumer price inflation in the months ahead; where June’s CPI came in at a lacklustre rate of 0.2% y/y, below the consensus of 0.4% which suggests that deflationary risk still lurks around the corner.

Secondly, key US economic data has started to show signs of softness which supports the current data-dependent US Federal Reserve to quicken the start of its monetary policy easing for the first Fed funds rate cut to come in the September FOMC meeting with high odds of another 25 basis points cut in December based on the latest data from CME FedWatch Tool at this time of writing.

A potential imminent change in tune to dovish from “higher interest rates for a longer period” by the Fed has led to US dollar weakness in the past two weeks which in turn benefited China and Hong Kong stock markets where China’s central bank. PBOC is likely to have more leeway to enact more monetary easing policies with lesser fears of capital outflows due to a potentially weaker US dollar environment in the near term.

The return of Trumponomics

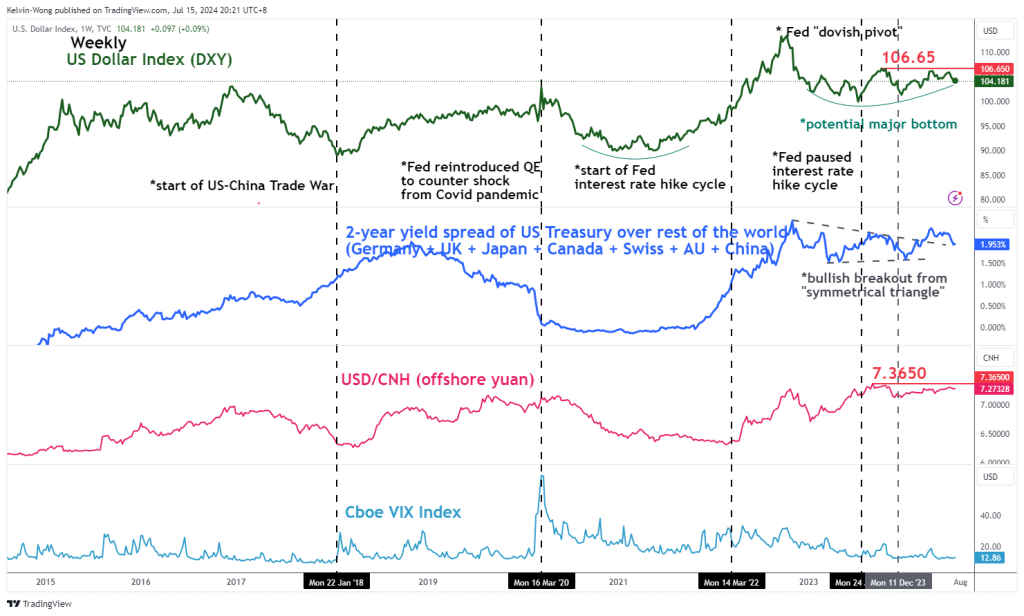

Fig 2: US Dollar Index major trend as of 15 Jul 2024 (Source: MacroMicro, click to enlarge chart)

The weekend assassination attempt on former US President Trump at a Republican rally in Pennsylvania is likely to tilt the current divisive political landscape in the US to Trump’s favour where sympathy votes from the middle ground may swing towards Trump during the November elections.

The betting market has seen a jump in the probability of Trump’s victory in the November elections from around 58% to as high as 68% after the assignation attempt as reported by Bloomberg News on Sunday, 14 July.

The possible return of Donald Trump to the White House has market participants digging out the playbook of “Trumponomics” where lower tax cuts and trade protectionism policies were advocated, which in turn led to a resilient US dollar strength environment; the US Dollar Index rose by 11% from the start of the US-China Trade War in late January 2018 to February 2020 before the onset of the Covid-19 pandemic (see Fig 2).

The US dollar ticked up higher in today’s Asian session open triggering a negative feedback loop into the Hang Seng Index where it ended Monday session, 15 July with a loss of 1.5%.

China’s industrialization policy has failed to jumpstart consumer spending

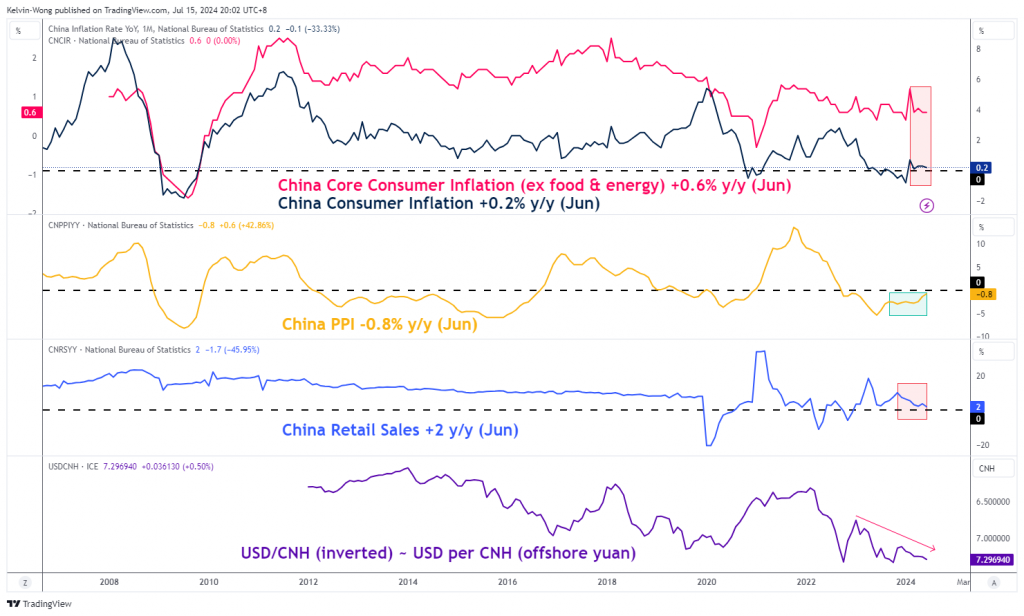

Fig 3: China’s retail sales, inflation data & USD/CNH trends as of Jun 2024 (Source: MacroMicro, click to enlarge chart)

The current key economic agenda craved out by China’s top policymakers has been the promotion of state-led investments in “quality” & “productive” growth initiatives for a high-tech driven industrialization policy of growing its semiconductor chip-marking capabilities for artificial intelligence (AI) products and services, biomedical and clean energy.

Current piecemeal stimulus measures to halt the slide of its depressed property market have failed to see a meaningful reversal in home prices and take-up rate of unsold homes, and the growth seen in industrial production has failed to trigger a positive spillover effect to retail spending as property still forms a significant portion of wealth allocation in China’s consumers’ portfolio.

China’s retail sales in June have slipped to 2% y/y from 3.7% in May, in line with another month of deceleration in housing prices; the new home price index in 70 cities declined by 4.5% y/y in June from a 3.9% fall recorded in May, its 12th consecutive month of decrease and the fastest pace since June 2015 (see Fig 3).

Depressed home prices led to weak consumer sentiment, in turn, showed up in disappointing retail sales data. The lack of a sizable uptick in internal domestic demand has caused China’s Q2 GDP growth to slip to 4.7% y/y from 5.3% in Q1 which is below the 2024 annualized target of around 5% set by the policymakers at the start of this year.

Fears of an entrenched deflationary spiral in China have spooked short-term players again which in turn explains today’s Hang Seng Index weakness throughout the session since the opening bell.

China’s Third Plenum may offer some hope

China’s top policy-making body, the Politburo will approve the country’s economic agenda and strategy for the next five to 10 years after the conclusion of the four-day Third Plenum meeting that starts from today till Thursday, 18 July.

Given that property policies are one of the key areas of focus in the meeting, the ongoing downturn remains the biggest threat to the economy given its significant wealth effect. Policymakers are now walking on a tightrope to defuse the risk inherent in the property market due to the past decade of unproductive investment initiatives in property development to jumpstart economic growth but are also mindful that a further slowdown in real estate prices may lead to a deflationary spiral.

So far, the $41 billion programme announced in May to help state-owned firms buy unsold housing stock from property developers has done little to boost sentiment in the property market as housing prices continue to slide in June.

The next approach policy markets may consider during the Third Plenum given the urgency of reviving the current lacklustre state of domestic demand is to implement more pronounced fiscal stimulus initiatives that can have a direct impact on consumer spending such as spending vouchers or further tax rebates without embarking on quantitative easing measures to add further liquidity into the market that can lead to yuan depreciation and in turn, capital outflows.

If such a form of direct fiscal stimulus measures is announced, the China and Hong Kong stock markets may get a short-term sentiment boost.

Watch the 18,530 key intermediate resistance on the Hang Seng Index

Fig 4: Hang Seng Index medium-term trend as of 15 Jul 2024 (Source: TradingView, click to enlarge chart)

The prior eight-week of decline seen in the Hang Seng Index has managed to stabilize right above its 200-day moving average which confluences with the 17,110 key medium-term pivotal support as it printed an intraday low of 17,376 last Tuesday, 9 July.

The daily RSI momentum indicator has flashed out a positive momentum condition as it staged a bullish breakout last week. Clearance above the 18,530 intermediate resistance may increase the odds of another leg of the short-term recovery sequence for a retest on the 20 May swing high area of 19,700 in the first step before the next medium-term resistance comes in at 20,400 (also the upper boundary of a medium-term ascending channel from 22 January 2024 low) (see Fig 4).

On the other hand, a break below 17,830 negates the bullish tone revival for a potential revisit on the 17,110 key medium-term support.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.