- Canada’s upcoming new tariffs on Chinese EVs have sparked a potential trade war between G-7 and China.

- A weaker yuan to indirectly offset the negative impact of trade tariffs on China’s exports may spark a currency war.

- Fears of a currency war emerging may see lesser capital inflows into Asian stock markets.

This is a follow-up analysis of our prior report, “Hang Seng Index: Improvement in market breadth and southbound flows, the bull run may not be over” dated 5 June 2024. Click here for a recap.

The benchmark Hang Seng indices together with China’s CSI 300 have failed to ignite a continuation of bullish feedback loops in their respective price actions despite the several positive elements; an upbeat China Caixin Serves PMI for May, and net funds inflows highlighted in our previous article.

China’s stock market dropped to a 4-week low

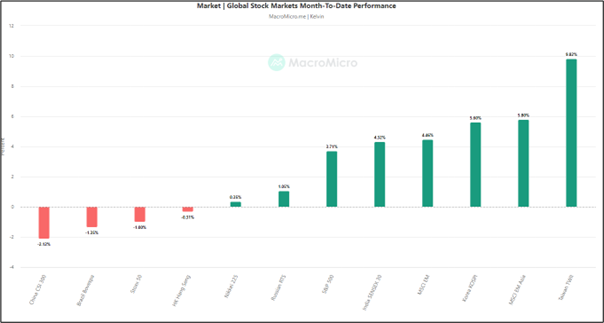

Fig 1: Global stock indices month-to-date performances as of 21 Jun 2024 (Source: MacroMicro, click to enlarge chart)

So far for the month-to-date performance as of 21 June, China’s CSI 300 is set to be the worst performer among the global stock indices with a running monthly loss of -2.1% while the Hang Seng Index stood at -0.3% (see Fig 1).

Trade tensions over China’s EVs exports

The “protectionism fire” towards China’s low-cost manufactured electric vehicles has now spread to Canada after US President Biden’s administration announced a trade tariff plan to impose a 100% levy on Chinese-manufactured EVs together with the European Union’s plan of imposing 48% levies on some models of Chinese EVs.

Prime Minister Trudeau’s government is now preparing potential new tariffs that may amount to 100% to align Canada with the US, and European Union trade policies towards China to protect their respective local car manufacturing industries.

The Chinese yuan took an indirect downside hit

Fig 2: USD/CNH major & medium-term trend as of 21 Jun 2024 (Source: TradingView, click to enlarge chart)

China’s central bank PBOC has set the daily fixing of the central parity rate of the onshore yuan (USD/CNY) on a weaker footing in the past three weeks. Since 7 June, the CNY’s central parity rate per US dollar has depreciated from 7.1106 to 7.1196 as of Friday, 21 June based on data obtained from the China Foreign Exchange Trade System.

The recent weaker fixings on the USD/CNY’s central parity rate have implied that China’s top policymakers may be using a weaker yuan to counter those upcoming trade tariffs imposed on Chinese-manufacture EVs to maintain the quantum of exports growth to drive China’s 5% GDP growth target for 2024 in the absence of internal demand-led growth engines.

The current movements of the offshore yuan (USD/CNH) have started to reflect a bearish sentiment toward the yuan where it broke above a key medium-term resistance of 7.2770

In the aspect of technical analysis, it suggests the potential continuation of the medium-term impulsive bullish upmove sequence of the major uptrend phase in place since 16 January 2023 for the major resistance zone to come in at 7.3750/4120 (see Fig 2).

The fears of a currency war have emerged again

A further bout of potential weakness in the Chinese yuan coupled with the Japanese yen that is looking to retest its 34-year low against the US dollar after today’s release of Japan’s core-core inflation that continued to decelerate in May has sparked fears of a currency war.

In a currency war environment, Asian export-oriented economies are likely to devalue their respective currencies to maintain export competitiveness for economic growth especially if the US Federal Reserve continues to push back its interest rate cut cycle.

In turn, weaker domestic currencies in Asia are likely to see fewer capital inflows which can translate to negative animal spirits towards the Asian region stock markets.

Hang Seng Index at risk of a further drop to test its 200-day moving average

Fig 3: Hang Seng Index medium-term trend as of 21 Jun 2024 (Source: TradingView, click to enlarge chart)

The failure to have a positive follow-through after a retest on its 50-day moving average on Monday, 17 June has formed a bearish momentum condition on the Hang Seng Index via the latest observations seen on the daily RSI momentum indicator (see Fig 3).

If the intermediate resistance of 18,610 is not surpassed to the upside, and a break below the 17,850 near-term support may see the Index resume its corrective decline sequence from its current year-to-date high of 19,706 printed on 20 May to expose the key medium-term support of 17,110 (also the 200-day moving average).

Only a clearance above 18,610 negates the bearish tone for the bulls to kickstart another potential impulsive upmove sequence.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.