- USD/CAD found support ahead of Canadian employment data release.

- Positive US jobless claims data boosted sentiment and USD.

- Bank of Canada hopes for moderation in unemployment rate following 50 basis points of cuts.

Most Read: Japanese Yen (JPY) Price Action: Following Dovish BoJ Comments, What Does Price Action Tell Us?

USD/CAD seems to have found support ahead of crucial employment data set for release tomorrow.

The Canadian economy, particularly its job market, has struggled more than its counterparts, prompting the Bank of Canada (BoC) to lead in the rate cut cycle.

This week, the Canadian Dollar has benefited from a weaker US Dollar and a rebound in oil prices. Additionally, a surprisingly positive trade balance report, which comfortably beat estimates, has provided a further boost.

The Bank of Canada is facing more challenges than many of its peers. The economy’s performance has been lackluster, and with increasing discussions about a global recession, the Central Bank’s task becomes even more complex.

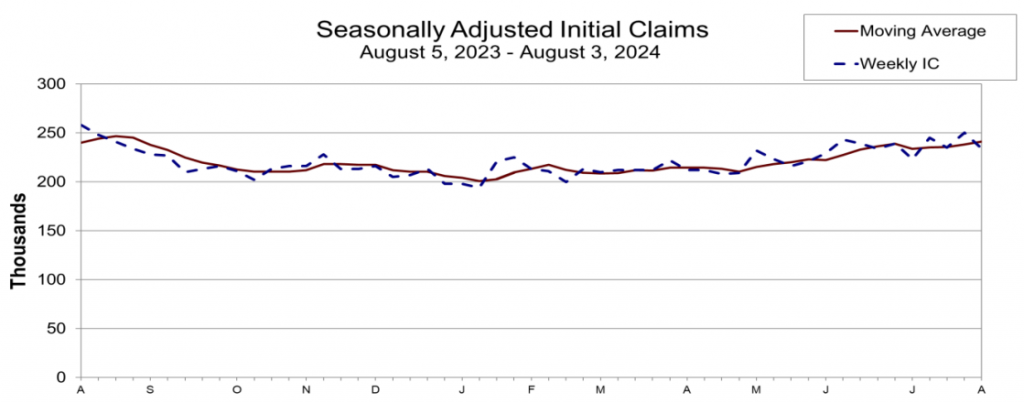

There was a positive today in terms of recessionary fears as US jobless claims came in better than expected. The number of unemployment benefit claims in the US dropped by 17,000 to 230,000 for the period ending August 3rd, falling short of market expectations of 240,000. Despite this decrease, the claim count remains significantly above this year’s average, suggesting that while the US labor market is still historically tight, it has softened from its post-pandemic peak.

Source: US Department of Labor

The data boosted sentiment, leading to a rise in US equities and an overall improvement in market outlook. The US Dollar index also gained traction and continues its upward trend following the selloff driven by recession fears on Friday and Monday.

Canadian Employment Data Ahead

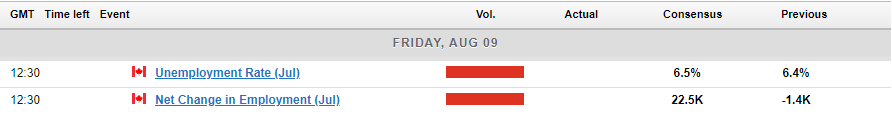

Tomorrow will see the release of Canadian unemployment and employment change statistics. Since January, the unemployment rate has been declining, with a brief pause at 6.1% in March and April, before rising to 6.4% in June.

The Bank of Canada will be hoping for a moderation in the unemployment rate following the 50 basis points of cuts already implemented. A positive outcome might be what USD/CAD needs to break the key support level at 1.3736.

Source: For all market-moving economic releases and events, see the MarketPulse Economic Calendar. (click to enlarge)

Technical Analysis

From a technical perspective, USD/CAD is positioned just above a critical support level at the 1.3736 mark. After failing to sustain levels above 1.3900, my earlier article this week mentioned the 1.3740-30 range as a potential area of interest for a retest.

Analyzing price action and today’s daily candle close could be pivotal. The positive jobs data print helped lift USD/CAD from its support, with the daily candle oscillating between a doji and a hammer pattern. Nevertheless, this could change by the end of the day.

Immediate support is at 1.3736, and a drop below this could lead to a retest of the 1.3690 area, which is also aligned with the 100-day moving average. On the upside, immediate resistance is at 1.3800, followed by levels at 1.3850 and 1.3900.

USD/CAD Chart, August 8, 2024

Source: TradingView (click to enlarge)

Support

- 1.3736

- 1.3690

- 1.3650

Resistance

- 1.3800

- 1.3855

- 1.3900

Follow Zain on Twitter/X for Additional Market News and Insights @zvawda

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.