AUD/USD continued the channel bearish breakout following RBA Rate Decision this morning. Prices tanked not because the tone of RBA was dovish – wording and phrases used this time round is similar to last, with RBA reiterating that previous rate cuts are still “coming through, and will be for a while yet”. Furthermore, Governor Stevens said that there are signs of increased demand for housing financing, suggesting that the lower rates are working and implies a lower need for decreasing the policy rate further.

The reason for the extreme bearishness of AUD that followed was not due to rate expectations, which remains neutral, but purely due to a new side of RBA – one that has surprisingly focused on the AUD exchange rate this time round. Stevens said in the statement that a weaker AUD is “likely to be needed to achieve balanced growth in the economy”. This is a much more active statement compared to previous month’s which simply stated that a lower AUD would “assist in re-balancing growth in the economy”.

It seems that RBA may actually actively intervene in the currency market to drive AUD lower. How they intend to do it remains unknown, but for now market is taking the threat seriously, driving AUD/USD below 0.947 following the announcement.

Hourly Chart

Bears remained in charge for a full additional hour following the announcement, a good sign that the decline wasn’t just a knee-jerk reaction. Nonetheless, 0.947 may prove to be a strong adversary, with prices appearing to be pulling back from here. What we need to do now is to ascertain whether this pullback will have enough traction to move back higher towards 0.952 and rising Channel Bottom or is merely a technical pullback. Stochastic curve does not really tell us much other than that momentum is Oversold, and due for a pullback.

Considering that RBA does not really suggest any proper mechanism to push AUD lower without invoking lower rates (which they are hesitant to lower), there isn’t any proper fundamental justification for AUD/USD to be trading much lower from here. Any push lower will be pure sentiment related which is speculative, and considering that sentiment was bullish from Monday, one wonders when market will stop giving RBA a bearish premium when they have basically provided louder bark than bite this time round.

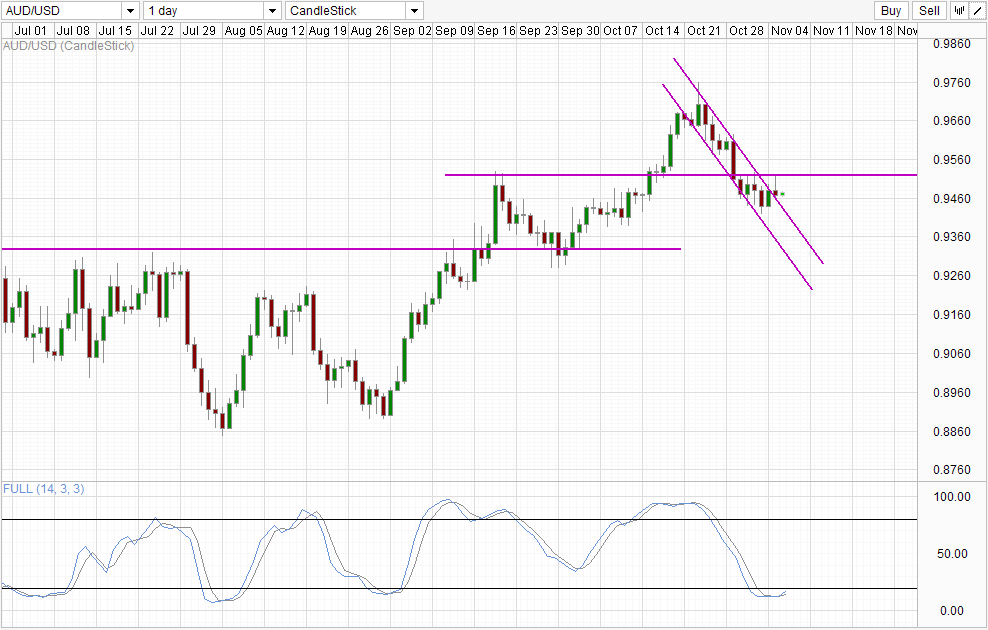

Daily Chart

Daily Chart is mildly bullish, with prices pushing above the descending channel even though it is still kept below the 0.952 ceiling. However, the rally from September remains intact, and with stochastic curve currently pointing higher, it is likely that prices may rally higher especially if a proper bullish signal is formed in conjunction with 0.952 ceiling broken.

However, that will actually be against long-term fundamentals that favors a lower AUD/USD on the basis that US economy is slated to improve further from here while Australia still does not have a recovery plan in mind (or at least it has not been communicated to the market). With so many conflicting factors, traders will need to be extra careful and hold for further confirmation on direction.

More Links:

EUR/USD Technicals – 1.35 Support Band Holding

GBP/USD – Pound Gains Ground As Construction PMI Sparkles

USD/CAD – Canadian Dollar Continues Pressure on Greenback

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.